- WIF has weathered high volatility, hitting a notable milestone along the way

- And yet, downward pressure remains high, posing ongoing challenges

With an impressive jump of over 10% in just 24 hours, dogwifhat (WIF) emerged as the top gainer. placeleaving over 100 major cryptocurrencies in its dust. WIF was trading at $2.51 at press time. In doing so, the coin rebounded from a rough start to October, which saw it close near $2.30.

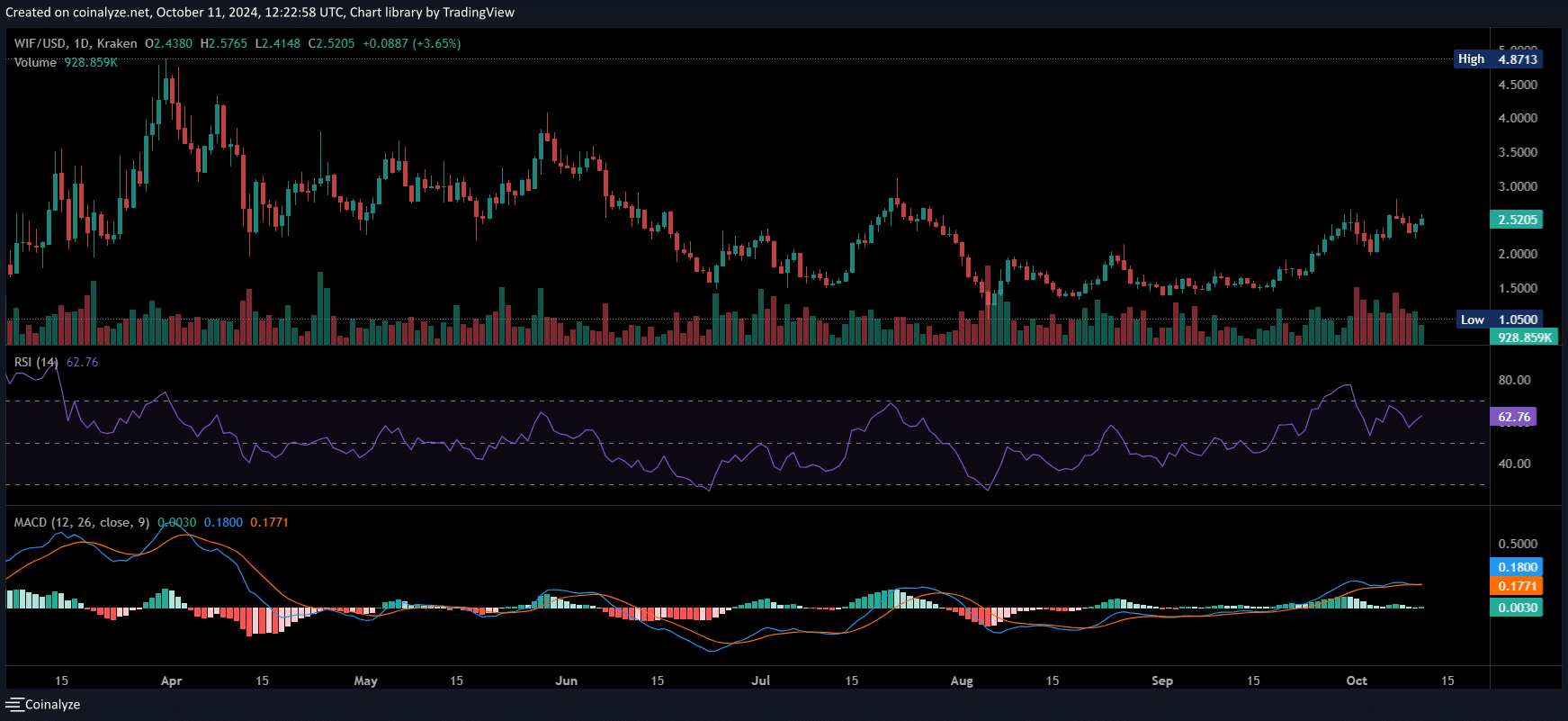

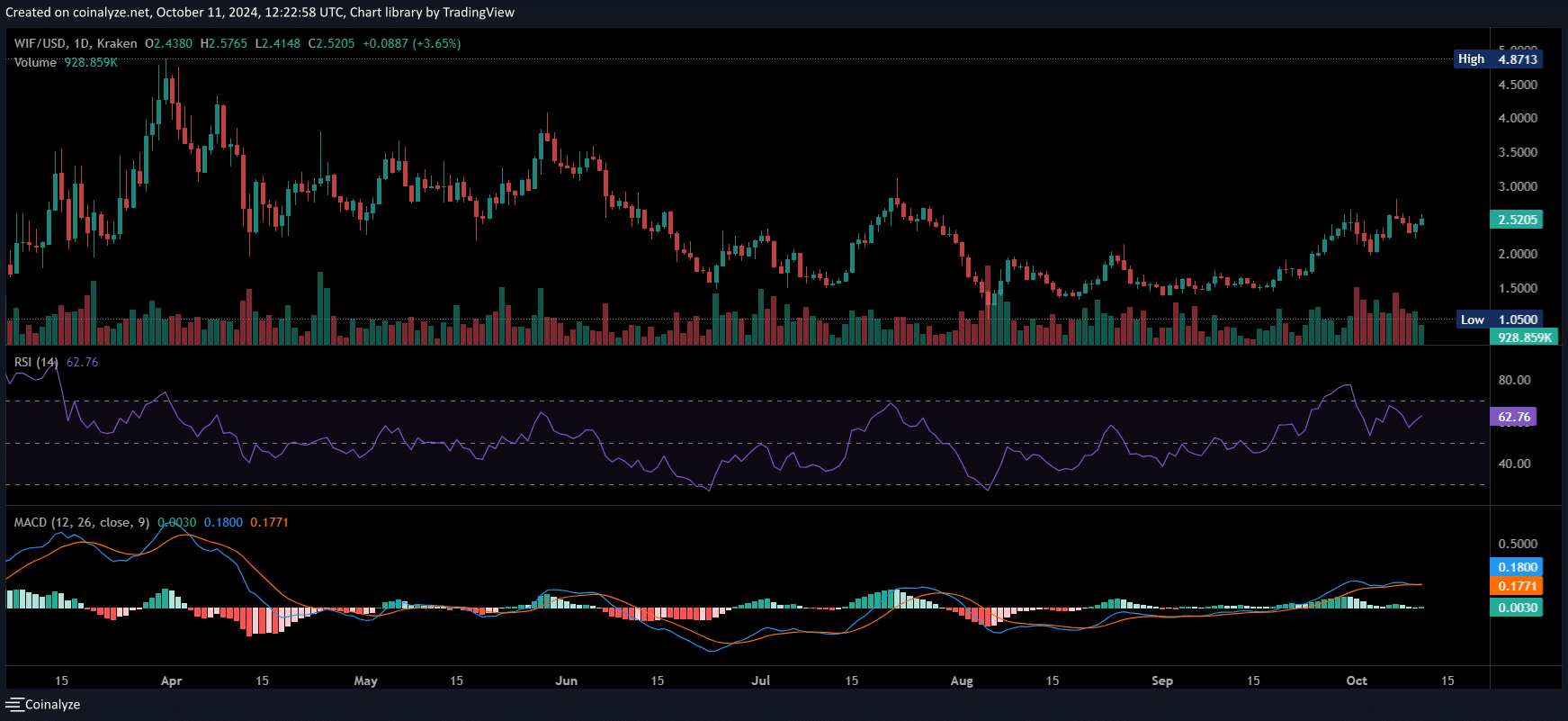

However, for a parabolic rally to $3, it is crucial to turn its current resistance into support. Right awayresilient RSI supports this potential. Especially since the suggested that the buying force is not yet exhausted. Which begs the question: will other conditions also align?

WIF reaches an important milestone

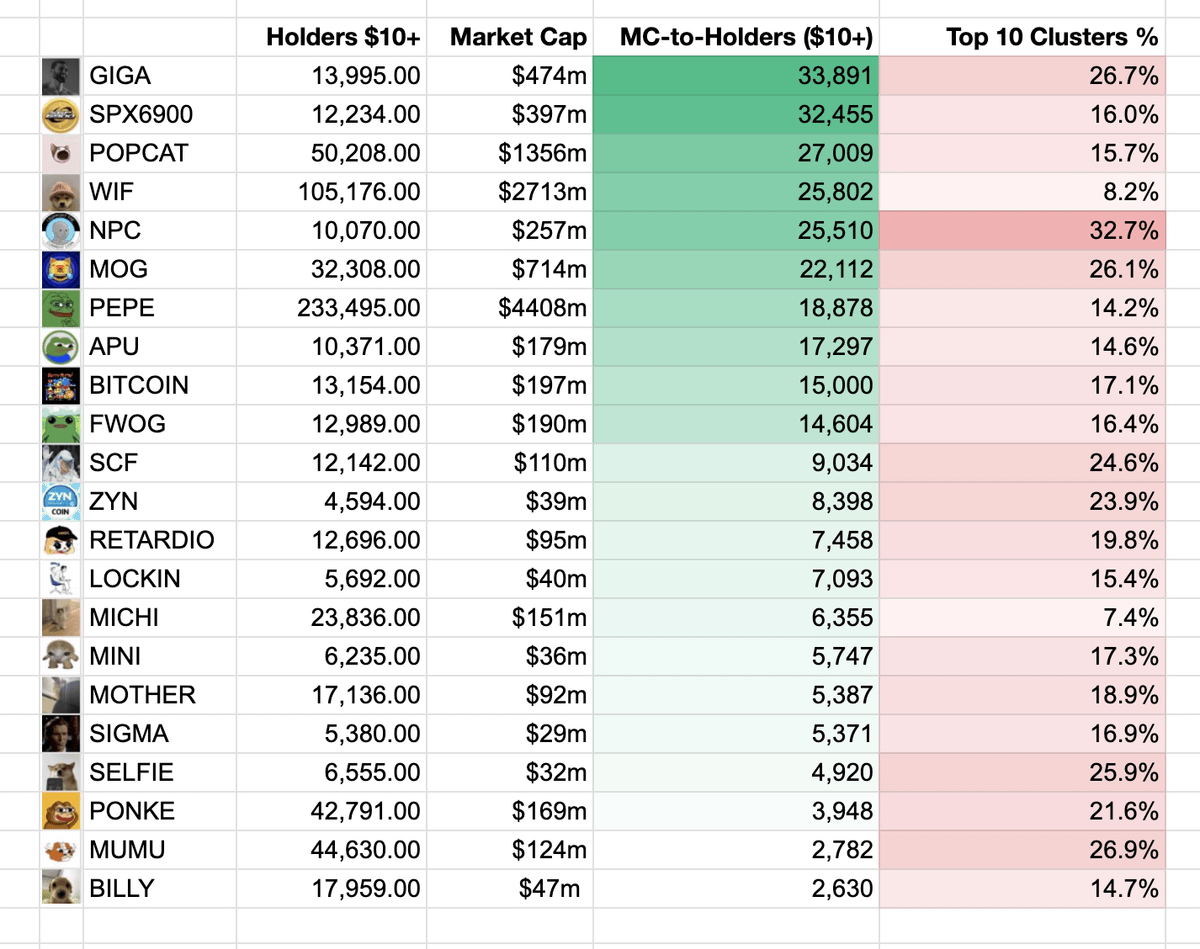

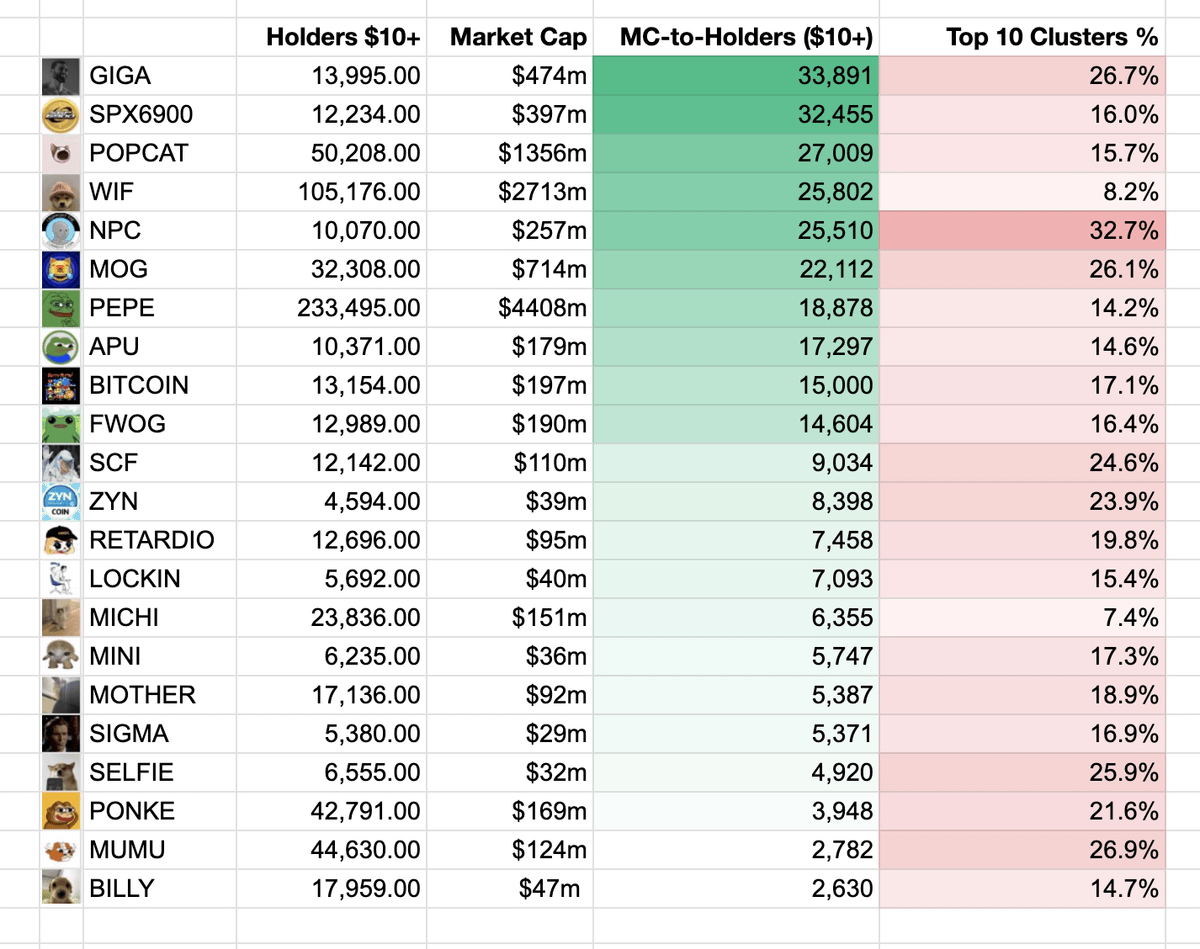

Selective memecoins have built a strong base of holders over the years, despite their inherent risks. This change shows that investors are increasingly attracted to volatile tokens to earn outsized returns in a short period of time.

WIF, with a holder count of 186,393, illustrates this trend. Only 8.2% of its tokens are distributed among the top 10 holders.

Source:

Although a more concentrated token may increase the potential for coordinated selling pressure, WIF’s increasing decentralization mitigates the risks of a sudden price swing. This dynamic becomes even more significant as the market anticipates a memecoin super cycle by the end of the fourth quarter.

WIF could emerge as a favorite, as a strong parabolic rally generally requires less buy-sell imbalance.

Thus, a more significant increase in the value of the WIF could highlight trust among stakeholders. However, this does not make the WIF immune to bearish pullbacks. This significantly reduces the potential for extreme volatility.

A crucial path to follow

As WIF approaches its previous rejection level at $2.59, it has more than made up for lost gains during its retracement to the $2.30 level. This means that most holders are now in a net profit position.

Although this is a bullish signal, WIF could still see a short-term price correction as traders turn to collection on their earnings.

However, this trend could reverse if the selling pressure is neutralized and traders view $2.30 as a strong support level. This will likely create ideal opportunities to buy the dip.

Source: Coinalyse

The bulls need to hold the $2.50 price firmly. A significant MACD convergence is imminent, leaning towards a bearish outlook.

Historically, these crossovers have played an important role in identifying potential market tops. If this trend continues, the next price correction could take WIF back below $2.30.

Moreover, with increasing selling pressure after last week’s rally, WIF became the fifth gainer, short positions could gain. control.

Is your wallet green? Check the dogwifhat profit calculator

If this trend continues, a parabolic rally to $3 may require another cycle. Especially since forced closures of long positions could lead to a sharp drop in the price of WIF.

Thus, WIF needs intervention to absorb this pressure and establish $2.30 as a support level. Otherwise, a retracement seems more likely.