Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

The rapid bursting of the bullish momentum on the cryptography market in the last weeks of April has seen the Ethereum price closed the month above $ 1,800. However, Altcoin did not finish the month of profit, making April its fourth consecutive month with negative performance. According to the latest data on the chain, the Ethereum price seems to be above a crucial level of support, which could determine the trajectory of Altcoin in the coming weeks.

ETH price at the risk of falling at $ 1,772

In an article of May 3 on the X platform, the eminent cryptography analyst Ali Martinez revealed that the Ethereum Prize could be at a critical moment which could decide on his future in the short term. Based on the latest chain data, Altcoin may fall to $ 1,500 if it lost this level of support in the coming days.

This Ethereum price chain assessment revolves around the average cost of several Ethereum investors. In crypto trading, cost analysis of the cost determines the capacity of a price level to be used as support or resistance according to the volume of parts acquired for the last time by investors in the region.

Related reading

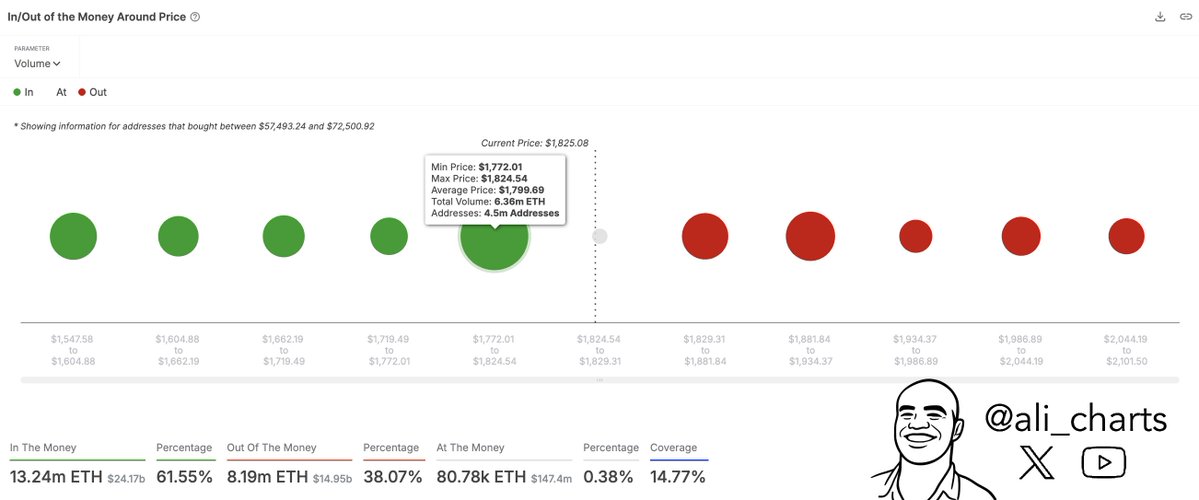

As shown in the graph above, the size of the point (green and red) represents and corresponds directly to the number of ether chips purchased in a price region. The larger the circle, the more the quantity of tokens bought in and around the price zone, and the higher the level of resistance or support.

According to intotheblock data, more than 6.36 million ETH tokens were bought by 4.5 million addresses in the price range of $ 1,772 and $ 1,824 (at an average price of $ 1,799). As explained previously, the high purchase activity in this price zone led to the formation of a major level of support just under the current price.

The Ethereum price should bounce back when it falls at this level. The justification for this expectation is that when the price of the ETH amounts to around $ 1,772, investors with their cost bases in and around this level are likely to defend their positions by buying more tokens, by helping the price to remain afraid of the support region.

However, the graphic highlighted shows that price levels under the level of support of $ 1,772 have much less investor activity. This suggests that the Ethereum price could fall at around $ 1,500 without taking a break if $ 1,772 is violated. On the other hand, the price of the ETH could go to $ 2100 if this level of support remains non -brilliant, because no significant resistance is in advance.

Ethereum Prize at a glance

To date, the ETH token is estimated at around $ 1,830, reflecting an increase of almost 1% in the last 24 hours.

Related reading

Istock star image, tradingview graphic

(tagstotranslate) ETH

Source link