- Options market data indicated that the price of ETH may have stabilized.

- However, market sentiment remained negative due to tensions in the Middle East.

Ethereum (ETH) the price appeared to stabilize after recent volatility following geopolitical escalations in the Middle East that spooked crypto markets.

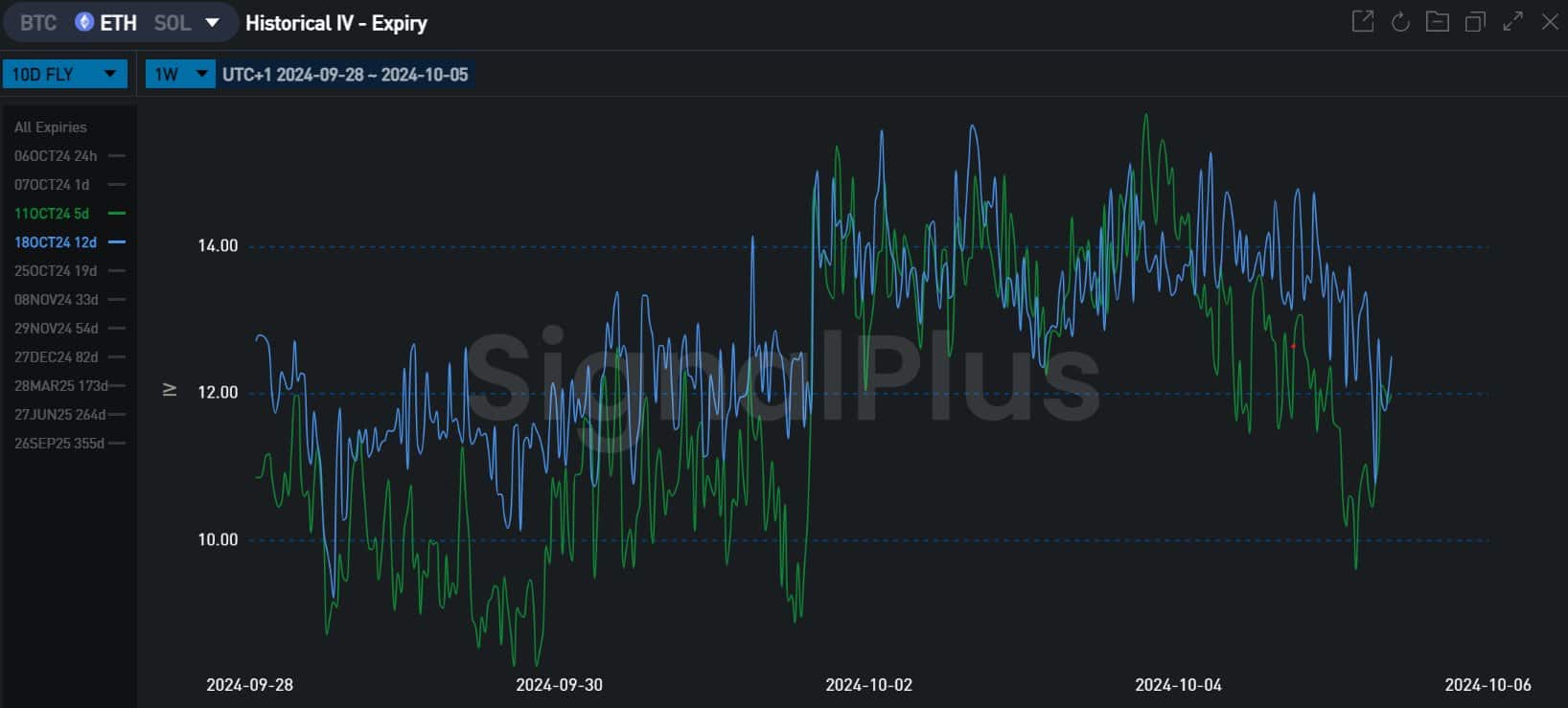

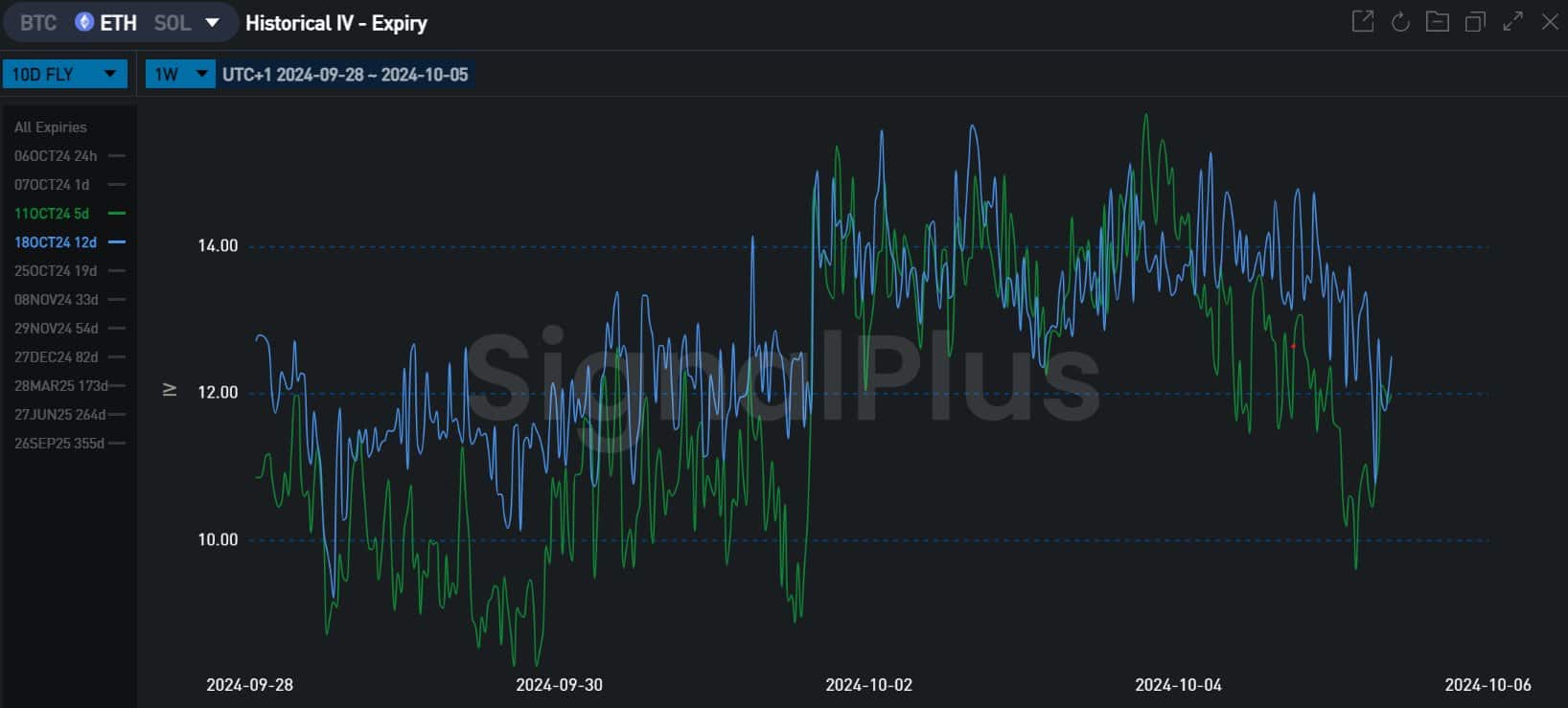

According to Jake Ostrovskis, a crypto trader at Wintermute, options market data suggests that a local bottom could be reached for the largest altcoin. He note,

“Starting Tuesday (October 1), the largest covering flow was seen in #ETH in shorter-term contracts, and these flows are now unwinding as the market looks to firm up.”

Source: SignalPlus

Is the ETH local bottom reached?

As a reminder, the increase in hedging flows in short-term ETH contracts over the past few days has led traders to take hedging positions to protect against price fluctuations, especially in the context of escalations between Israel and Iran.

To achieve this, they used short-term options.

However, there was a notable unwinding of hedging flows and a decline in implied volatility for these short-term options over the weekend.

This suggested that traders were becoming confident in the stability of the ETH market and that hedging was not necessary.

In other words, ETH’s local bottom may soon be reached, especially since Israel did not retaliate against the recent Iranian attack.

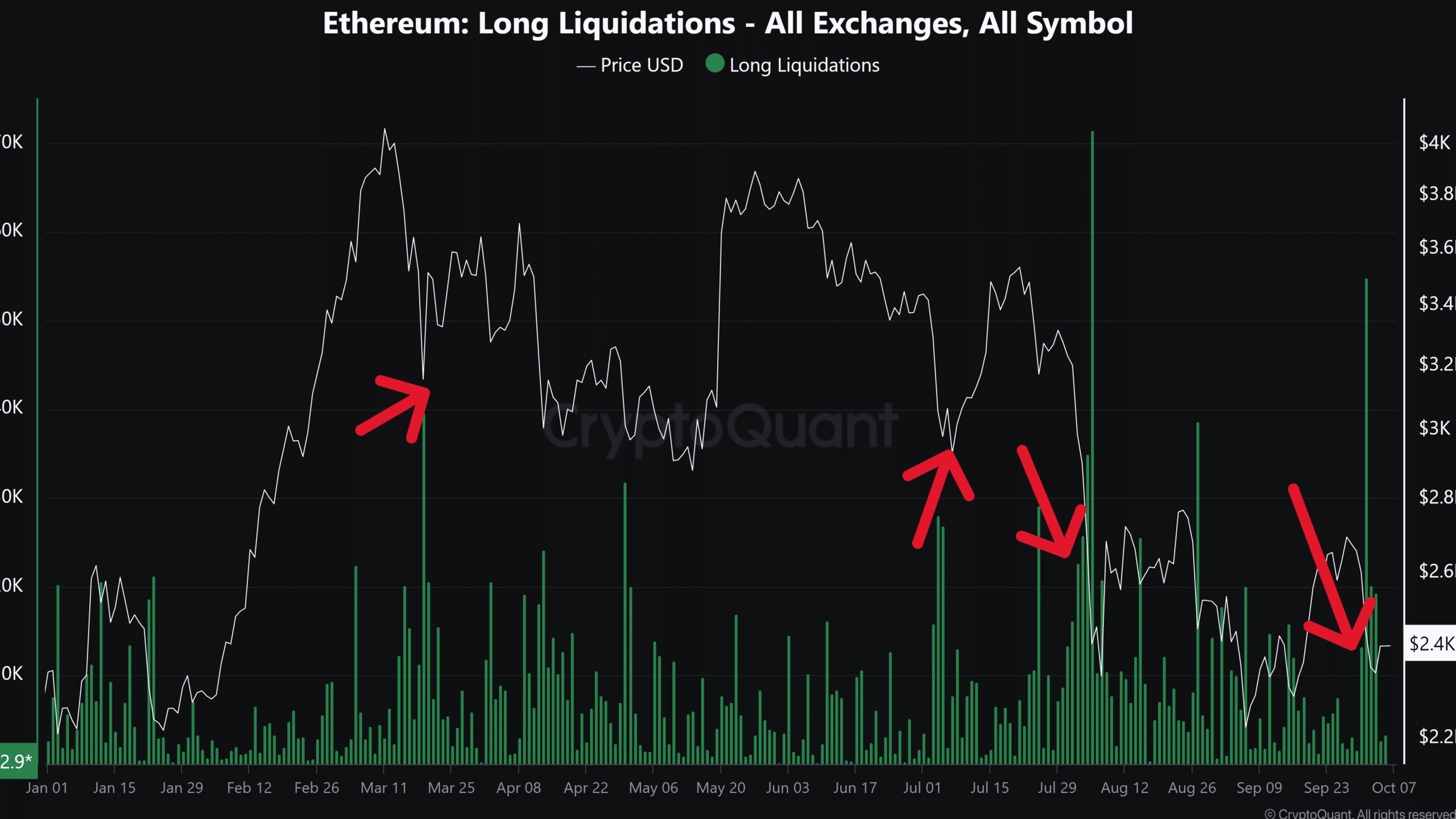

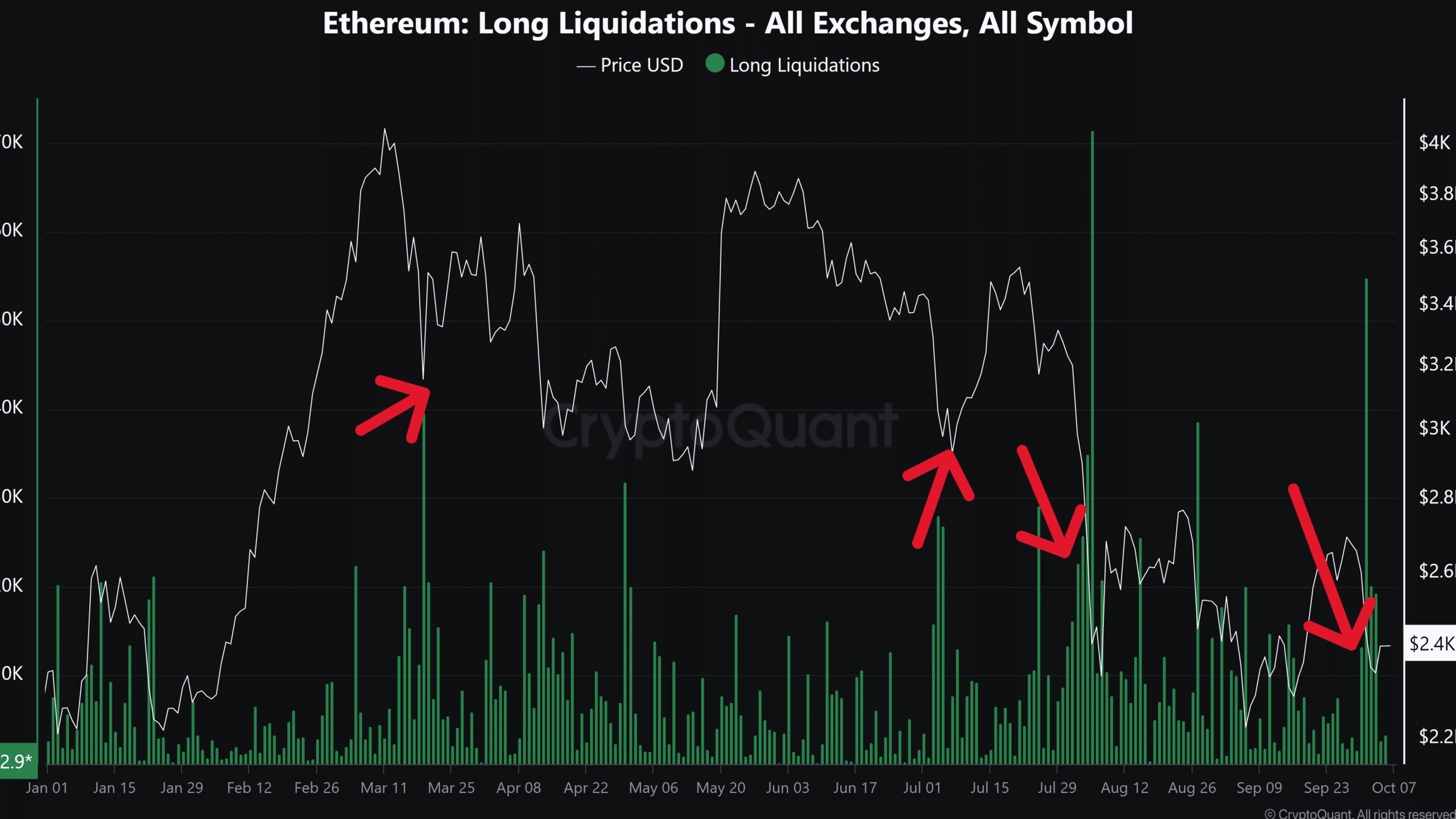

Source: CryptoQuant

Another set of data suggesting that ETH may have bottomed is the increase in long liquidations. The recent drop liquidated over $50 million in long ETH positions.

In most past trends, an increase in ETH long liquidations has coincided with local lows. This trend was observed in March, July and August.

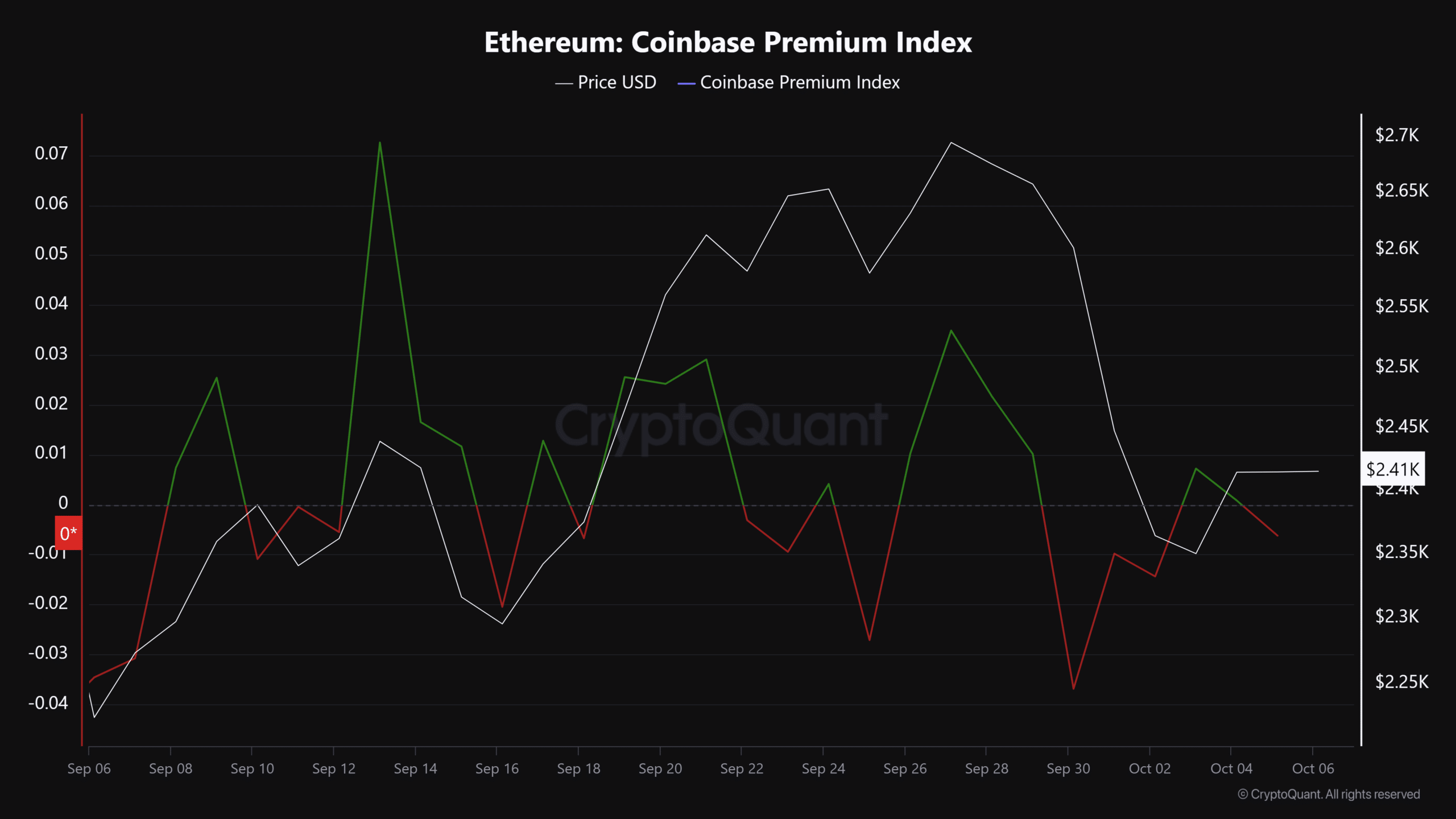

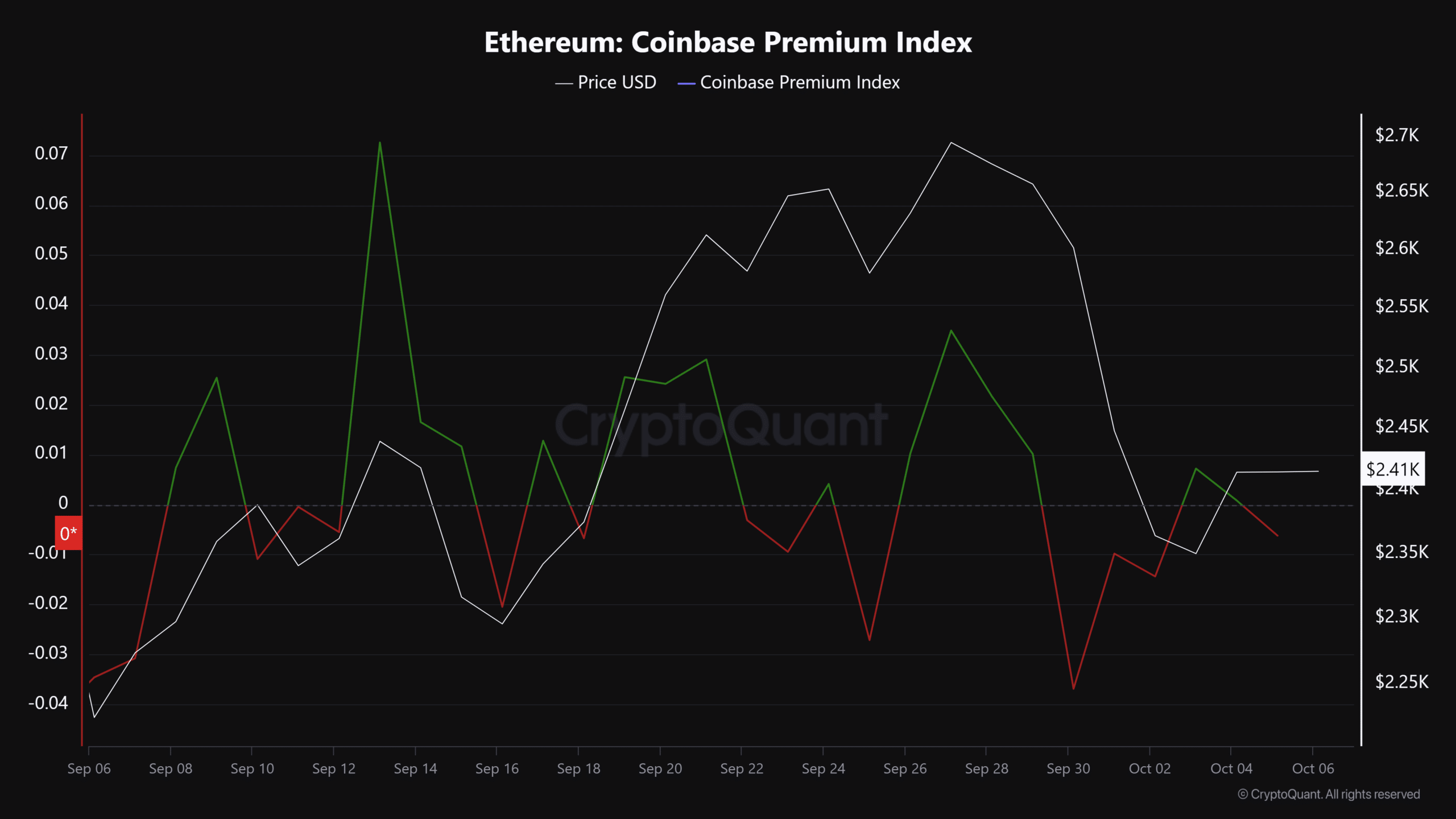

That said, there has been no significant demand from US investors, as demonstrated by a negative reading on the Coinbase Premium Index. More often than not, increases in the Coinbase Premium Index correlate with a strong rally in ETH.

Source: CryptoQuant

Ergo, despite the potential stability of the ETH market, monitoring US investor demand could indicate whether the bottom is reached and whether a relief rally could follow.

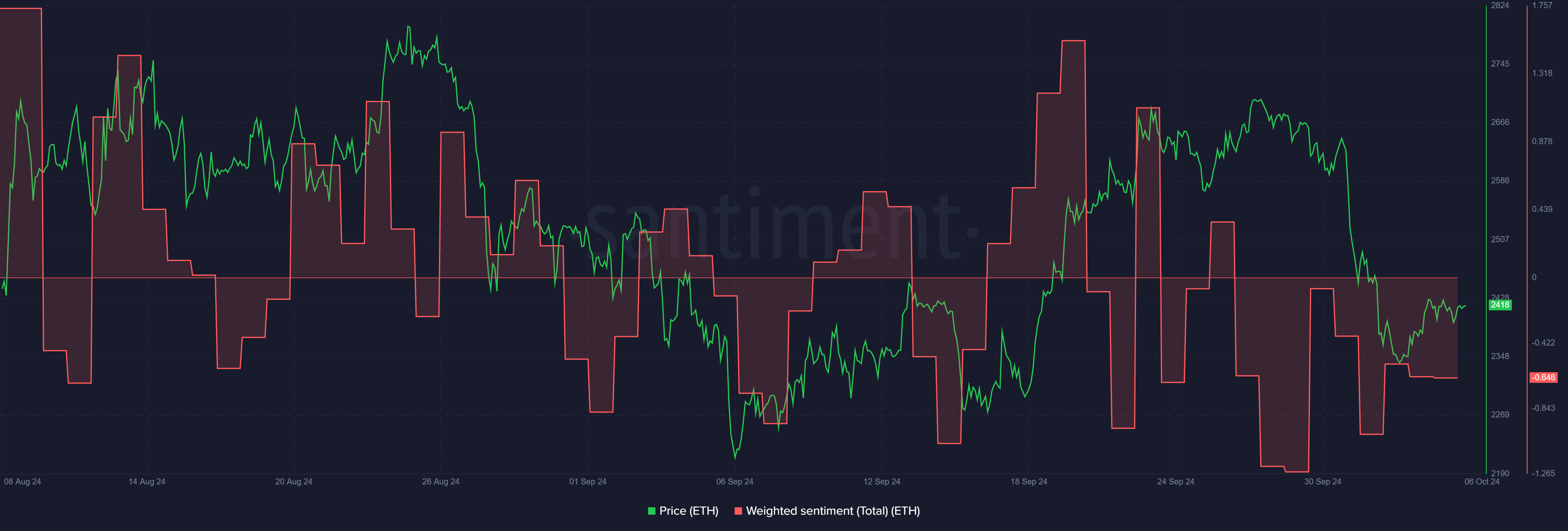

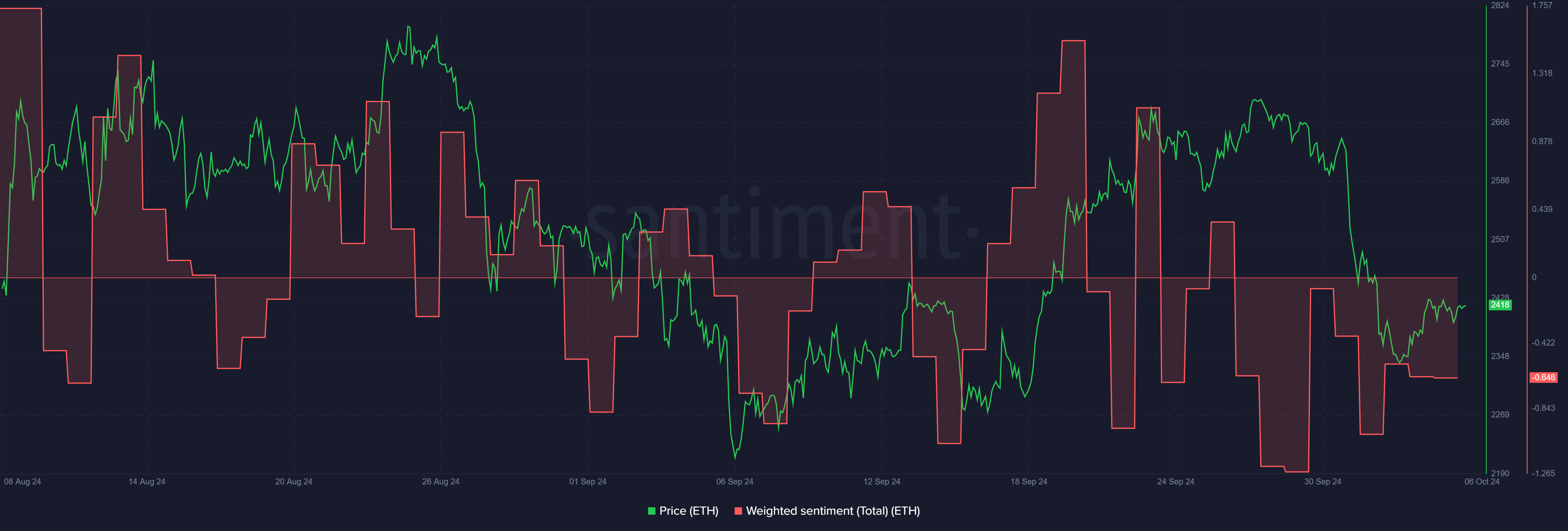

Additionally, a cautious outlook remained apparent, as evidenced by negative ETH market sentiment.

Source: Santiment

This showed that investors stayed on the sidelines, probably to wait for Israel’s reactions to last week’s Iranian decision. At press time, ETH was trading at $2.4k, down 8.4% over the past seven trading days.