Chain data shows that the Ethereum MVRV report recently experienced a significant drop. Here is what it could mean for the price, according to history.

The Ethereum MVRV report fell to a relatively low level recently

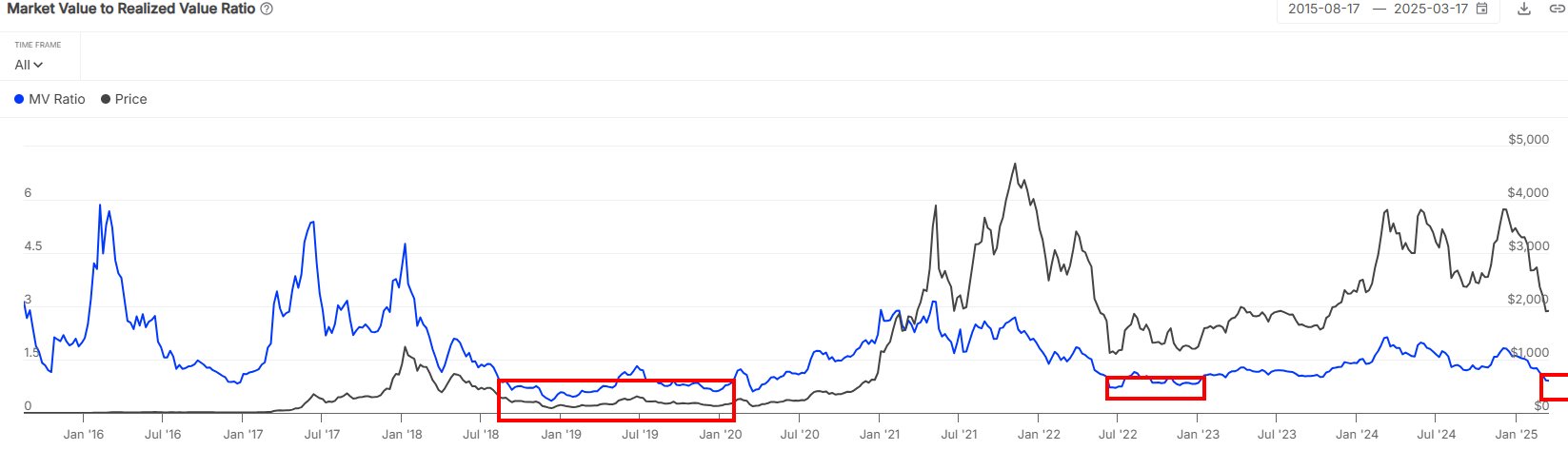

In a new article on X, the intelligence platform of the Intotheblock market discussed the latest trend in the Ethereum market value (MVRV). The MVRV ratio refers to a metric on a chain which measures the ratio between the market capitalization and the ceiling made of ETH.

In short, what this indicator tells us is how the value held by investors as a whole is compared to the investment they initially made to buy their parts.

When the MVRV report is greater than 1, this means that the average holder can be supposed to transport a net profit not made. On the other hand, the metric being below the threshold suggests that the overall market is underwater.

Now here is the table of the indicator shared by the analytical company, which shows the trend in its value for Ethereum in the last decade:

The value of the metric appears to have been sliding down in recent days | Source: IntoTheBlock on X

As is visible in the graph above, the Ethereum MVRV ratio recently dropped and crossed below brand 1, which implies that ETH investors are now in net loss. The reason for this change on the market naturally lies in the price crash that cryptocurrency was faced in the context of a slowdown in the sector.

Currently, the ETH MVRV report has a value of 0.9. Intotheblock noted that the indicator does not often reach this level, generally with only the bears markets being able to force it so low.

An interesting model emerges by looking at the trajectory of past prices which followed the periods of the indicator seated at these stockings. “Historically, MVRV ratios lower than 1 have coincided with favorable entry points for ETH,” explains the analysis company.

Something to note, however, is that if the MVRV report falling in this area has actually proved to be optimistic for Ethereum, the effect does not tend to be immediate, cryptocurrency generally having to stay for long periods in the region before a rebound.

In some other news, Intotheblock underlined in another post X post to what extent an important support block exists for ETH between the levels of $ 1,843 and $ 1,900.

The cost basis distribution across the various price levels | Source: IntoTheBlock on X

In the analysis on the chain, the strength of any level of support is measured on the basis of the offer bought for the last time by investors. The aforementioned price range is particularly dense in terms of supply, because 3.56 million assets were bought by 4.64 million addresses inside.

“This accumulation suggests solid support, but if ETH slides below this beach, the risk of capitulation increases, because demand seems lower beyond this level,” explains the analysis company.

Ethn price

Ethereum is currently releasing the support area on the channel, because its price is negotiated about $ 1,877.

Looks like the price of the coin has gone stale recently | Source: ETHUSDT on TradingView

Dall-E star image, intotheblock.com, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.