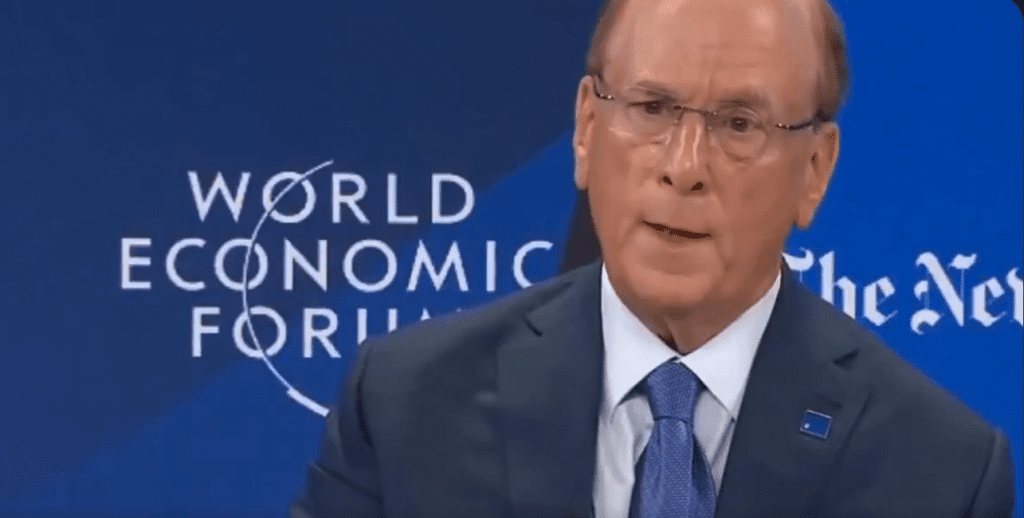

BlackRock CEO Larry Fink took the World Economic Forum stage to argue that tokenization needs to move from pilot programs to market plumbing and suggested that a shared blockchain standard could reduce costs and even “reduce corruption,” a framework that immediately reignited the question “which chain?” debate on cryptography and in particular within the Ethereum community.

Fink did not name a network. But the combination of BlackRock’s onchain product footprint and its own research positioning makes Ethereum the most natural candidate for the “common blockchain” he alluded to, even if he kept it implicit.

Fink’s remarks, delivered in the language of infrastructure rather than crypto evangelism, leaned heavily on the operational case for digitized assets and interoperable settlement rails.

“I think the movement towards tokenization and decimalization is necessary. It is ironic to see two emerging countries leading the world in tokenization and digitalization of their currencies, namely Brazil and India. I think we need to act very quickly to achieve this.”

He then pushed the argument beyond payments and into capital markets: “We would reduce fees, we would do more democratization by reducing fees more if we had all the investments on a tokenized platform that can go from a tokenized money market fund to stocks and bonds and back and forth.” »

The most provocative line was his call for normalization and the compromise it implied. “(If) we had a common blockchain, we could reduce corruption. So I would say, yes, we may have more dependencies on a blockchain, which we could all talk about, but that being said, activities are probably processed and more secure than ever.”

BlackRock CEO Larry Fink told the World Economic Forum that he believes the move toward tokenization and digitalization is necessary. We need to act very quickly to achieve this. With a common blockchain we can reduce corruption.

The “common blockchain” that Larry Fink referred to… pic.twitter.com/VhRvuwCx00

– Ethereum Daily (@ETH_Daily) January 22, 2026

Why Ethereum is coming

In the abstract, “a common blockchain” could be interpreted as a generic call for shared rails. In practice, BlackRock’s public market cryptocurrency portfolio and tokenization work has centered around Bitcoin and Ethereum.

On the ETF side, BlackRock’s flagship US spot products follow bitcoin and ether – iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA) – with ETHA launching in 2024 and now being the focus of the company’s public exposure to Ethereum.

On the tokenization side, BlackRock’s first tokenized fund, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), debuted on Ethereum via Securitize in March 2024, making Ethereum the original issuance network for what has become one of the most closely watched institutional RWAs on the market.

While BUIDL has expanded across multiple networks over time, the key point of Fink’s “common blockchain” framework is that Ethereum has been BlackRock’s default starting point for public chain issuance, a significant signal in a market where “norms” tend to follow whoever already has the most liquidity, the widest integration surface, and the most conservative counterparties.

The strongest message this week came from BlackRock research rather than Davos sound bites. In its thematic outlook for 2026, BlackRock explicitly discusses the idea of Ethereum as an infrastructure layer that collects “toll” as tokenization evolves. One slide asks: “Could Ethereum represent the “toll road” to tokenization? and adds that stablecoin adoption could be an early indicator of tokenization “in action,” with “blockchains like Ethereum” positioned to benefit.

In the same section, BlackRock cites RWA data “as of 01/05/2026” and notes that “over 65% of tokenized assets are on Ethereum,” highlighting the network’s lead in today’s tokenized asset stack.

At press time, ETH was trading at $3,005.

Featured image created with DALL.E, chart from TradingView.com

Editorial process as Bitcoinist focuses on providing thoroughly researched, accurate and unbiased content. We follow strict sourcing standards and every page undergoes careful review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance and value of our content to our readers.