- The October Rally of Pepe remains one of its most notable price movements, representing an increase of 227% price

- To determine if Pepe is positioned for a similar rally, its current technical configuration deserves to be analyzed

In a recent comment on the market, analysts alluded to the possibility of an increase of 100% in Pepe (PEPE), establishing parallels with its October rupture model.

In particular, 2024 marked a year of escape for the same, after having displayed remarkable gains of 1,435% in earnings on the other – on its new year opening price of $ 0.0000013. In doing so, he closed the year with exponential yields.

At the time of the press, however, Pepe was negotiated 61% below its opening of the first quarter of 2025, reflecting wider market corrections. However, its current graphic structure at 1 day closely reflects the consolidation beach at the end of October, characterized by a compressed price action.

Historically, this diagram preceded a clear break, with the same thing that sees Pepe soar 227%, culminating at $ 0.00002597 on November 14.

Consequently, speculation swirls if the same could be ready for a short -term escape. A repeated rally, maybe?

Source: TradingView (PEPE / USDT)

Underflow of the fundamental configuration of Pepe

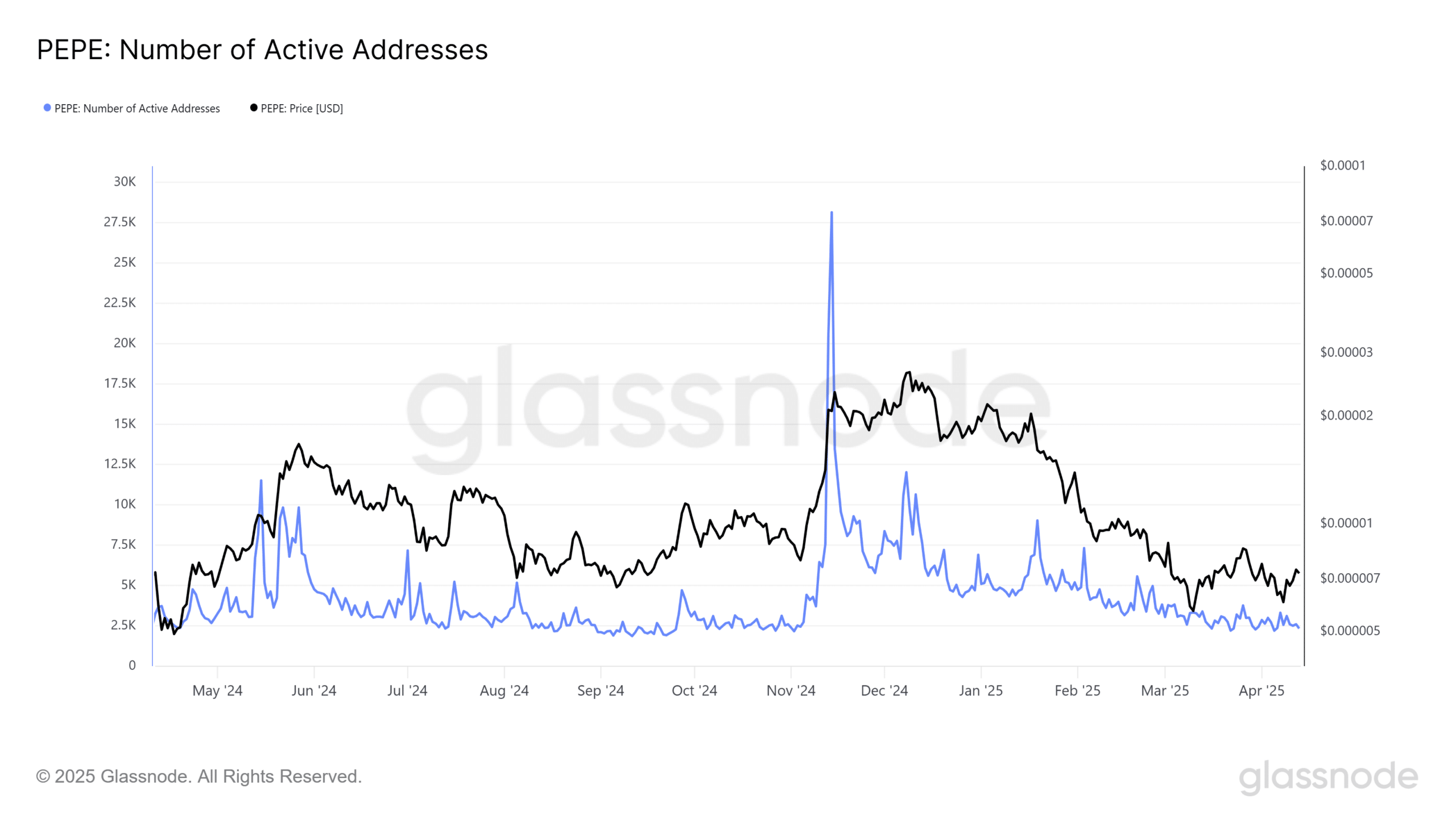

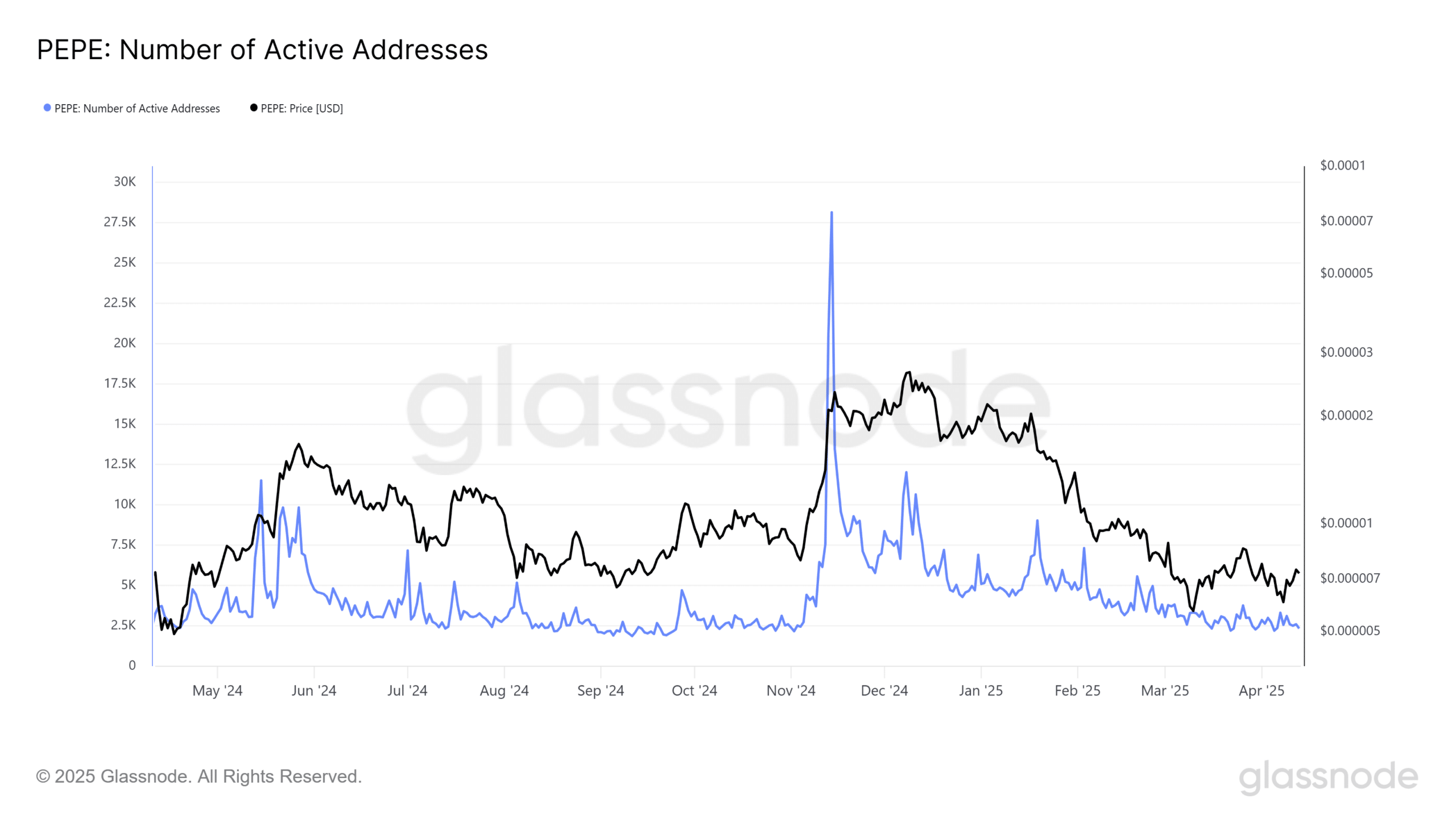

Interestingly, the addresses active on the PEPE network were on average 2,500 before a significant increase of 20,500 in mid-November, aligning with the movement of the parabolic price of the token.

Historically, such an increase in chain activity has been an indicator of the bullish momentum.

However, current network metrics remain relatively stable, with addresses active at 2,587 – reflecting the previous consolidation phases before the breakup events.

In other words, this could mean a similar accumulation model which previously preceded a significant price change. .

Source: Glassnode

Despite the lack of confirmation of concrete, Pepe’s speculative rally potential could be a double -edged sword. In particular when you consider the derived market data.

For example – Coinglass data indicated that despite activity on the deaf chain and a lack of clear accumulation signals in the cash market volume, the open interest (OI) on the PEPE term contracts has increased sharply.

In fact, it exceeded the levels of November with an increase of almost 5%, the same armé at 301.48 million dollars at the time of the press.

Consequently, weekly gains of 20% PEPE can be at risk of triggering liquidation cascades, in particular on long positions, due to the lack of support for the purchase of diving. This would put the sellers uncovered in control, emphasizing the need for prudent risk management.

While historical models seemed to refer to a potential break, the cryptography market is based on difficult data, not coincidences. Pepe gains were motivated by liquidity with leverage rather than biological purchases, making this rally vulnerable to a lively overthrow.