During the weekend, the cryptocurrency market made a strong dive, the main active ingredients undergoing significant losses. Although the slowdown has raised concerns, some cryptography experts think it could have an opportunity for potential future gains.

These prospects arise in the midst of generalized fears concerning a potential global recession and the climbing of commercial wars.

Will the market accident lead to a new class of cryptographic millionaires? Experts weigh

Beincrypto has today pointed out a spectacular dive on the cryptocurrency market. Total market capitalization has dropped $ 216 billion in the last 24 hours. Bitcoin (BTC) also experienced a significant drop, falling below the $ 75,000 mark.

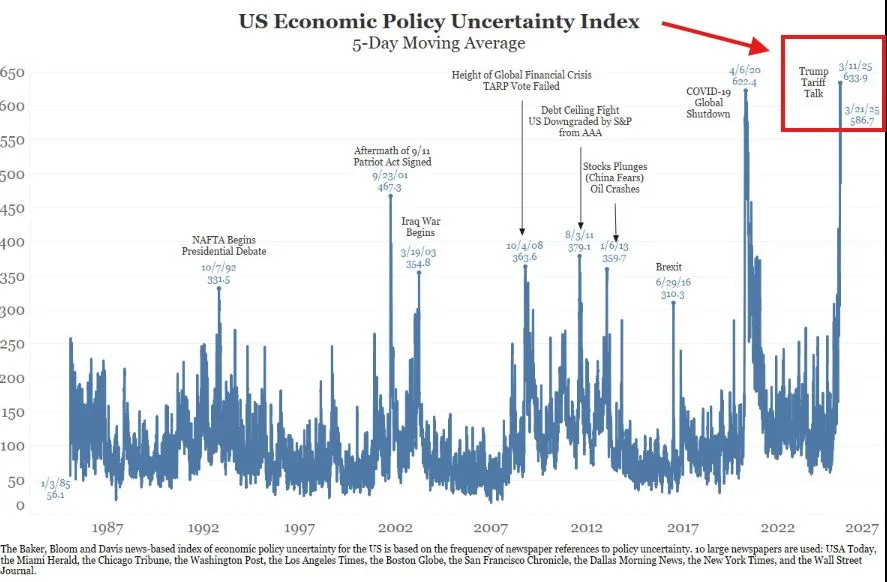

In the midst of this, an analyst stressed that the uncertainty index of American economic policy has reached an unprecedented summit. For the context, this index measures the level of uncertainty in the American economy linked to policy changes.

He combines newspaper mentions of economic uncertainty with data on tax policy and budgetary deficits. A higher index value indicates greater uncertainty, which can influence market volatility, investor behavior and economic decision -making.

In particular, it exceeded the levels observed during the 2008 financial crisis and the COVVI-19 market crash of 2020.

“The market has never been as uncertain as it is at the moment. It is worse than the great financial crisis and the Crash Covid,” he published.

The analyst said billions of dollars had been withdrawn from the stock market. However, he expressed his optimism that a large part of this capital will find his way in Bitcoin, presenting a potential opportunity for cryptocurrency.

Meanwhile, another analyst responded to concerns about a potential rehearsal of the 2008 financial crisis. He noted that such an event is very unlikely on the current market. Instead, he planned a similar recovery to the rapid rebound after the 2020 accident.

“The crash of the current market looks very much like March 2020. At the time, it was a generational entry point for the crypto, and the rare who remained patients left with millions,” he wrote.

By establishing parallels with the slowdown in the 2020 market, he stressed that the current market is probably halfway through its correction phase. The analyst also stressed that after the 2020 crash, central banks responded by reducing interest rates and injecting massive liquidity into the economy.

This increase in liquidity played a crucial role in the thrust of actions and risk assets to the new records of the following year.

“If we reflect the action of 2020 prices, which, I believe, is likely, you will meet generation opportunities in crypto. Be patient and start paying particular attention, the next few weeks and months will be decisive. Buy fear, but do not rush, there is a good chance that it is still early,” said the analyst.

However, he stressed that several uncertainties remain, including the duration and impact of prices, the responses from other countries and if Bitcoin can be decoupled from the S&P 500 as a recession coverage.

This perspective aligns with another expert, who suggested that current disorders could pave the way for a new generation of cryptographic millionaires to emerge.

“Remember the crash coche in 2020. The BTC was $ 3,850, ETH was $ 100, XRP was $ 0.11. And all these projects continued to create millionaires in the coming years!” He said.

While the markets are struggling with unprecedented uncertainty, the coming months will probably determine whether this period marks a turning point for a new wave of wealth creation or a deeper economic slowdown.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.