Ethereum (ETH), which is considered an ultra-sound currency due to its deflationary supply method, now appears to be facing new challenges that have prompted some analysts to question whether that narrative still holds.

Prominent cryptocurrency analyst Thor Hartvigsen recently highlighted this issue in an in-depth article on X, where he discussed the current state of Ethereum’s fee generation and supply dynamics.

Is ETH no longer an ultrasound currency?

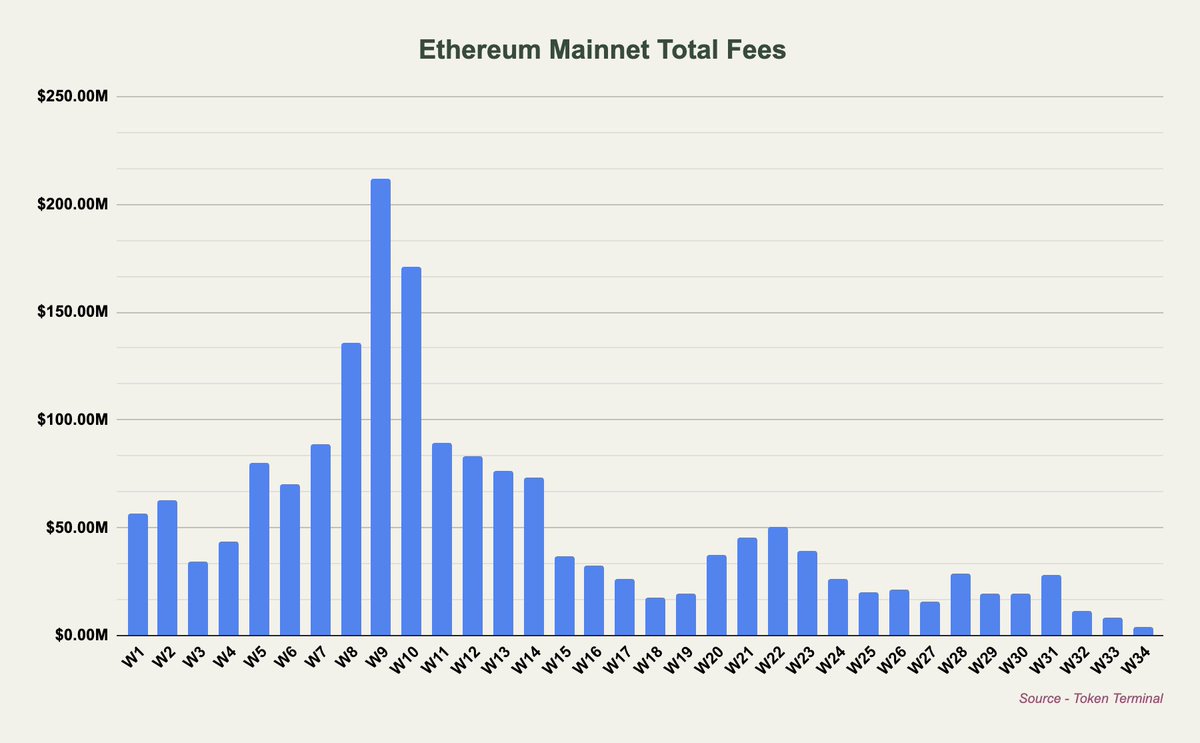

Hartvigsen noted that August 2024 is “on track to be the worst month for fees generated on the Ethereum mainnet since early 2020.” This decline is largely attributed to the introduction of blobs in March, which allowed Layer 2 (L2) solutions to bypass paying large fees to Ethereum and ETH holders.

As a result, much of the activity has shifted from the mainnet to these layer two (L2) solutions, with most of the value being captured at the execution layer by the L2s themselves.

As a result, Ethereum has become net inflationary, with an annual inflation rate of around 0.7%, meaning that the issuance of new ETH currently exceeds the amount burned by transaction fees.

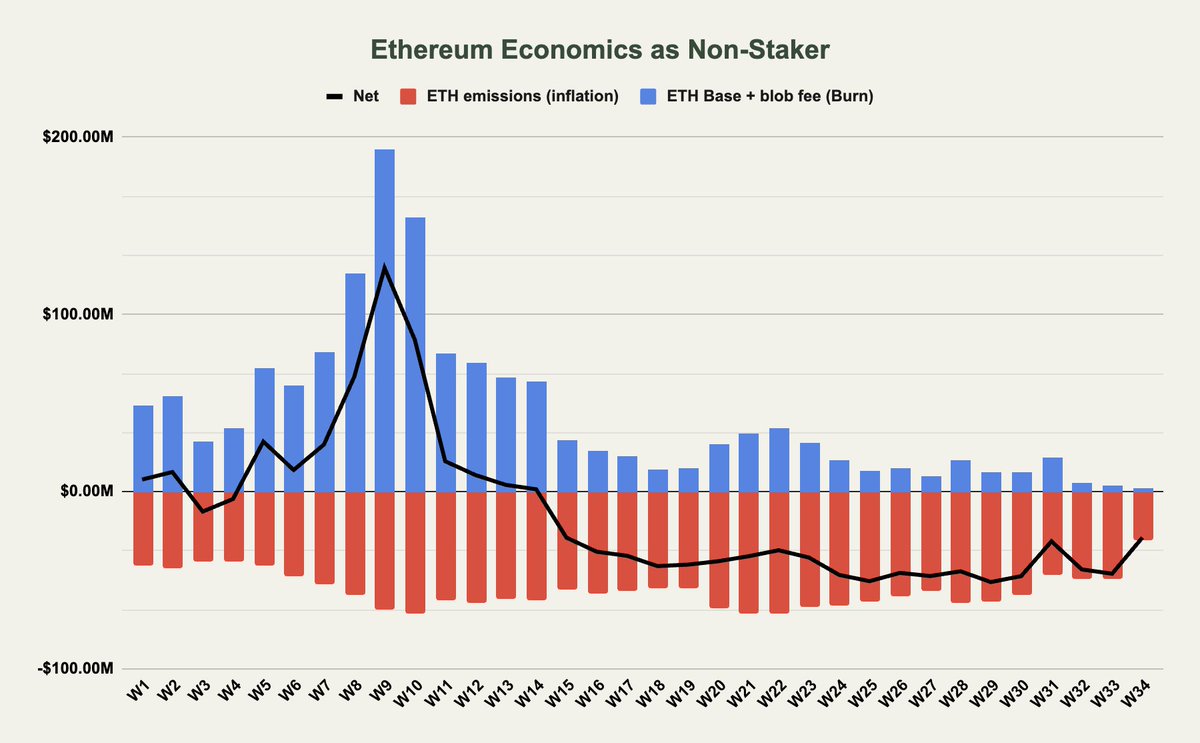

Hartvigsen revealed the impact of this on both non-stakers and stakers: According to the analyst, non-stakers mainly benefit from Ethereum’s burn mechanism, where base fees and blob fees are burned, reducing the overall supply of ETH.

However, with blob fees often being $0 and base fee generation decreasing, non-stakers see less benefit from these burns. At the same time, priority fees and miner extractable value (MEV), which are not burned but rather distributed to validators and stakers, do not directly benefit non-stakers.

Additionally, ETH emissions flowing to validators/stakers have an inflationary effect on supply, which negatively impacts non-stakers. As a result, the net flow to non-stakers has become inflationary, especially after the introduction of blobs.

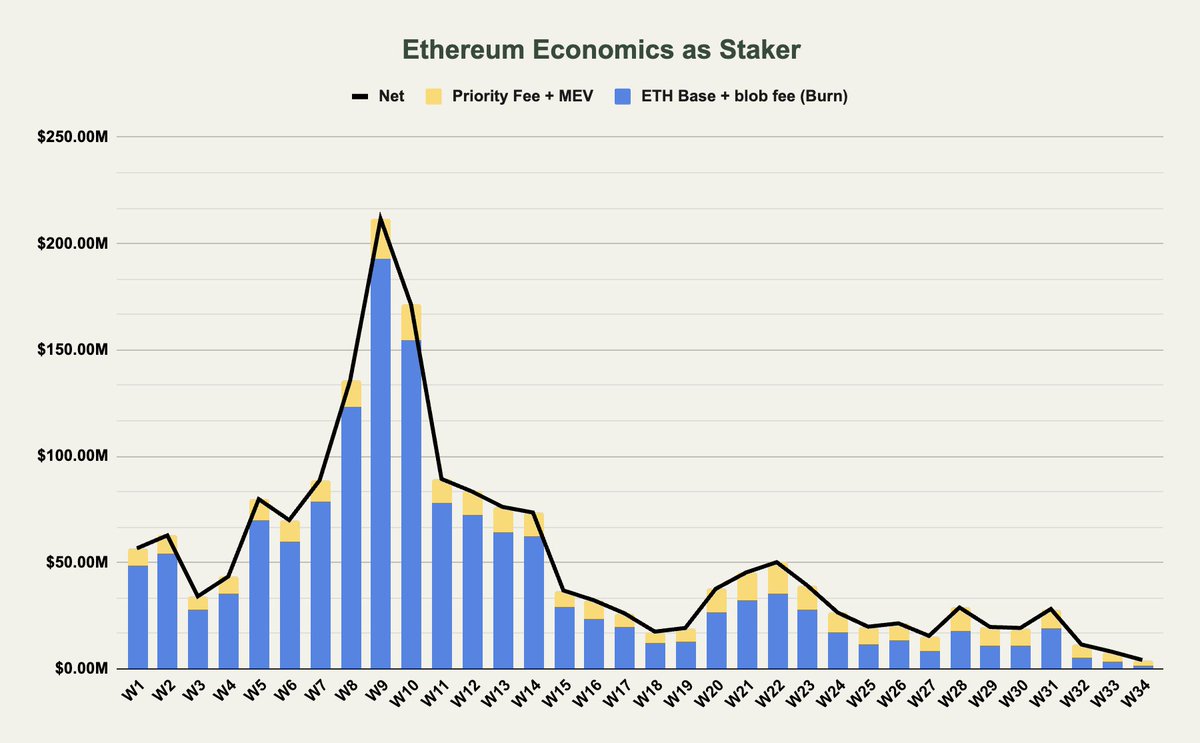

For stakers, the situation is somewhat different. Hartvigsen revealed that stakers capture all fees, either through burn or through staking yield, meaning that the net impact of ETH emissions is neutralized for them.

However, despite this benefit, stakers have also seen a significant drop in the fees paid to them, down over 90% since the start of the year.

This decline raises questions about the sustainability of the ultra-sonic money narrative for Ethereum. To answer this, Hartvigsen said

Ethereum no longer carries the narrative of ultra-sound money, which is probably for the best.

What’s next for Ethereum?

So far, it is quite evident from current trends that Ethereum’s ultra-sonic money narrative may not be as compelling as it once was.

With fees falling and inflation slightly outpacing burn, Ethereum is now more comparable to other layer 1 (L1) blockchains like Solana and Avalanche, which also face similar inflationary pressures, Hartvigsen says.

Hartvigsen notes that while Ethereum’s current net inflation rate of 0.7% per year is still significantly lower than other L1s, the diminishing profitability of infrastructure layers like Ethereum may require a new approach to maintain the network’s value proposition.

One potential solution the analyst discussed is to increase the fees L2s pay to Ethereum, although this could pose competition issues. Concluding the article, Hartvigsen noted:

Taking a step back, infrastructure layers are generally not profitable (look at Celestia which generates ~$100 in daily revenue), especially if you consider inflation as a cost. Ethereum is no longer an exception with a deflationary net supply and, like other infrastructure layers, requires another way to be valued.

Featured image created with DALL-E, chart by TradingView