Safemoon leaders billed investors to defraud. While the former CEO John Karony faces a trial, will the victims of the collapse of 2021 find justice? SFM tokens are now worthless.

“I am innocent and I did not commit fraud,” said John Karony, co-founder of Safemoon, a DEFI project that collapsed in December 2023 in the midst of charges of investors who drew from the carpet.

The story of Safemoon is that of hope and betrayal. After its launch with a fanfare in March 2021, Safemoon quickly became a darling of crypto fans, many of which expected a bithot, especially since some of the Best coins to buy soared.

Discover: 9+ Best risk at high risk and high reward to buy in May 2025

The rise and the fall of Safemoon

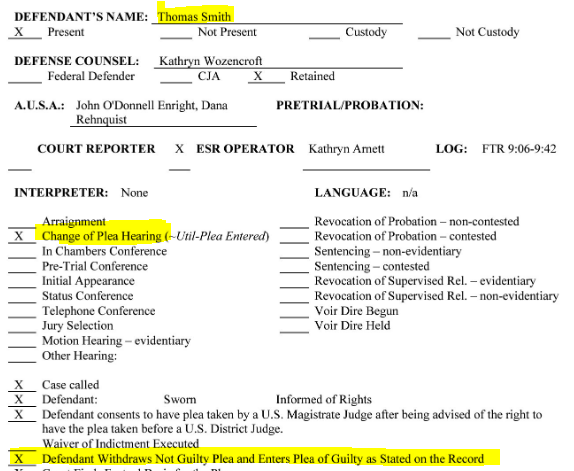

At its peak, Safemoon order A market capitalization of more than a billion dollars. SFM, the native token, was among the best artists.

(Source)

What attracted investors is the promise of a passive income thanks to its unique Tokenomics model.

SAFEMOON token holders have received transaction costs awards, an attractive offer that has led thousands of investors, some spilling their life savings, to seize the opportunity to generate free money.

About four years after its launch, Safemoon is a shell of its old self. The native token, SFM, is worth a fraction of a hundred, having slipped more than 97% of its top of all time. In this state, he strongly underforms part of the Best parts of meme Solana. Safemoon lies in the ruins after having deposited a bankruptcy of chapter 7 in December 2023.

Karony’s trial

Now, investors have left the assets worthless, seek justice and demand that the authorities hold Karony, the CEO, responsible. The fraud trial is underway in the Oriental District of New York.

Federal prosecutors allege that Karony, Kyle Nagy, who remains as a whole after fled to Russia, and former CTO Thomas Smith has frauded investors, siphoning more than $ 200 million in “locked” pools between 2021 and 2022.

The United States Ministry of Justice (DOJ) and Securities and Exchange Commission (SEC) charge The three leaders with a fraud in securities, wire fraud and a silver laundering plot in November 2023, a month before Safemoon filed for bankruptcy.

The authorities claim that the funded funds have been spent on luxury cars, residences and a private jet, while misleading investors on the financial health of the protocol.

“As the alleged, Safemoon managers have increased their business value to more than $ 8 billion, but instead of rewarding their customers as promised, their insatiable greed led them to spend millions of dollars on their own sumptuous desires. Today, no luxury vehicle or a range of real estate can protect them from the consequences of these crimes, “said Ivan J. Arvelo, special agent in charge of intestinal safety, New York. “HSI New York will relentlessly continue people who seek to exploit investors and the American financial system for their own gain.”

Discover: Top 20 crypto to buy in May 2025

Will the victims get justice?

In the current case, Karony pleaded not guilty to all accusations and was released on bail of $ 3 million in January 2024.

He maintains his innocence, saying that the truth will emerge in court. The first day of his trial on May 6, 2025, journalists noted that the defense team appeared “Surprisingly strong.”

Defense lawyers argue that their customer was not personally responsible for diverting funds. They also argue that changes in American crypto regulations following the election of Donald Trump weaken the case of the dry. The legal team says that the SFM was not clearly defined as security at the time of alleged misconduct, a position reinforced by recent regulatory changes.

Meanwhile, federal prosecutors argue that Karony and his co-founders have deliberately deceived investors, and regardless of regulatory nuances, they have to deal with consequences.

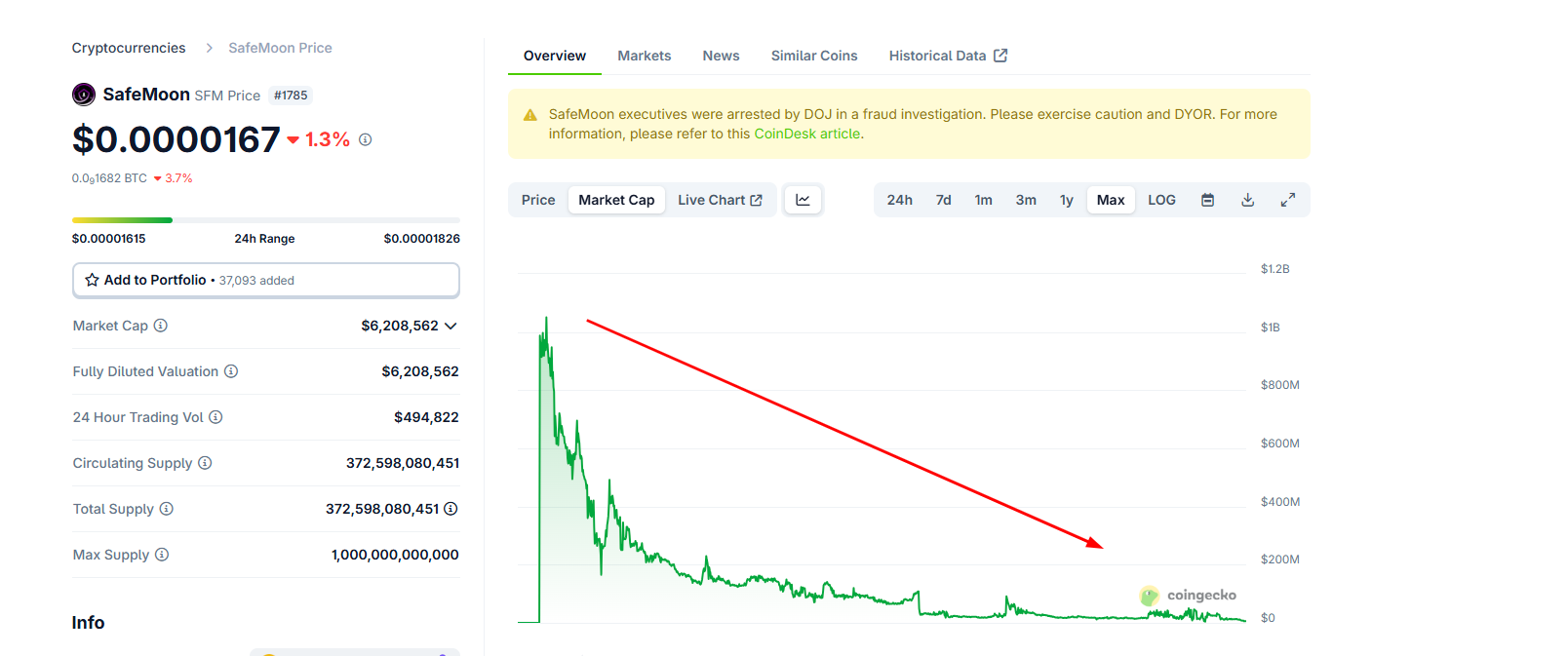

Former CTO Thomas Smith argued Guilty of the securities fraud in securities securities in securities in February 2025.

(Source))

Smith admitted to having deceived investors about the financial health of the protocol and testified against Karony, revealing overwhelming details on their internal operations. He’s now standing as a witness against Karony.

For the victims, the trial represents their last hope of responsibility. After the bankruptcy deposit, the remaining assets of Safemoon are minimal, little providing investors to recover. Even if the funds are recovered, it remains uncertain if the victims will receive adequate compensation.

DISCOVER: 12 Best Cryptographic Préventes to invest in May 2025 – Higher token presale

Safemoon Fraud Train: Is the former CEO innocent or guilty of the former CEO?

- Safemoon, once a Crypto of Defi Top with a market capitalization of $ 1 billion, collapsed after the accusations of fraud

- Karony’s fraud trial is underway in New York. He maintains his innocence

- Regulatory challenges strengthen the defense position

- Will federal prosecutors win and will victims find justice?

Is the post the old CEO of Safemoon really innocent? 2021 Investors require their back to back first on 99Bitcoins.