- The price of ETH has typed its price made, which increases hopes of a potential background.

- The low demand for FNB and growth of flat networks could derail such a result

Ethereum (ETH) The price is in the news after having marked a key level which reported the stockings in the previous long term market, which increases the hopes of potential reversal for Altcoin.

According to cryptocurrency analyst Kritolik, ETH fell below its “price made”, the basis of the average cost for most buyers. This level often marks a potential market change. THE analyst claimed,,

“These periods have always been followed by strong recovery – which makes them strategic accumulation points for long -term investors.”

Source: cryptocurrency

The attached graph also revealed that the price made of the market decreases in 2018-2020.

However, the level could also act as short -term resistance when the price of ETH drops below. In such a case, the analyst warned that an increase in the sale of ETH panic could probably be in the short term.

What is the next step for ETH?

Despite this, American actions and crypto, including ETH, have reacted as risky assets to Trump’s pricing updates. As such, a probable background could only be accelerated by a positive macro lag.

In fact, even institutional investors have left Altcoin for six consecutive weeks, as the coherent outings of ETH Spot ETH show.

Source: Soso value

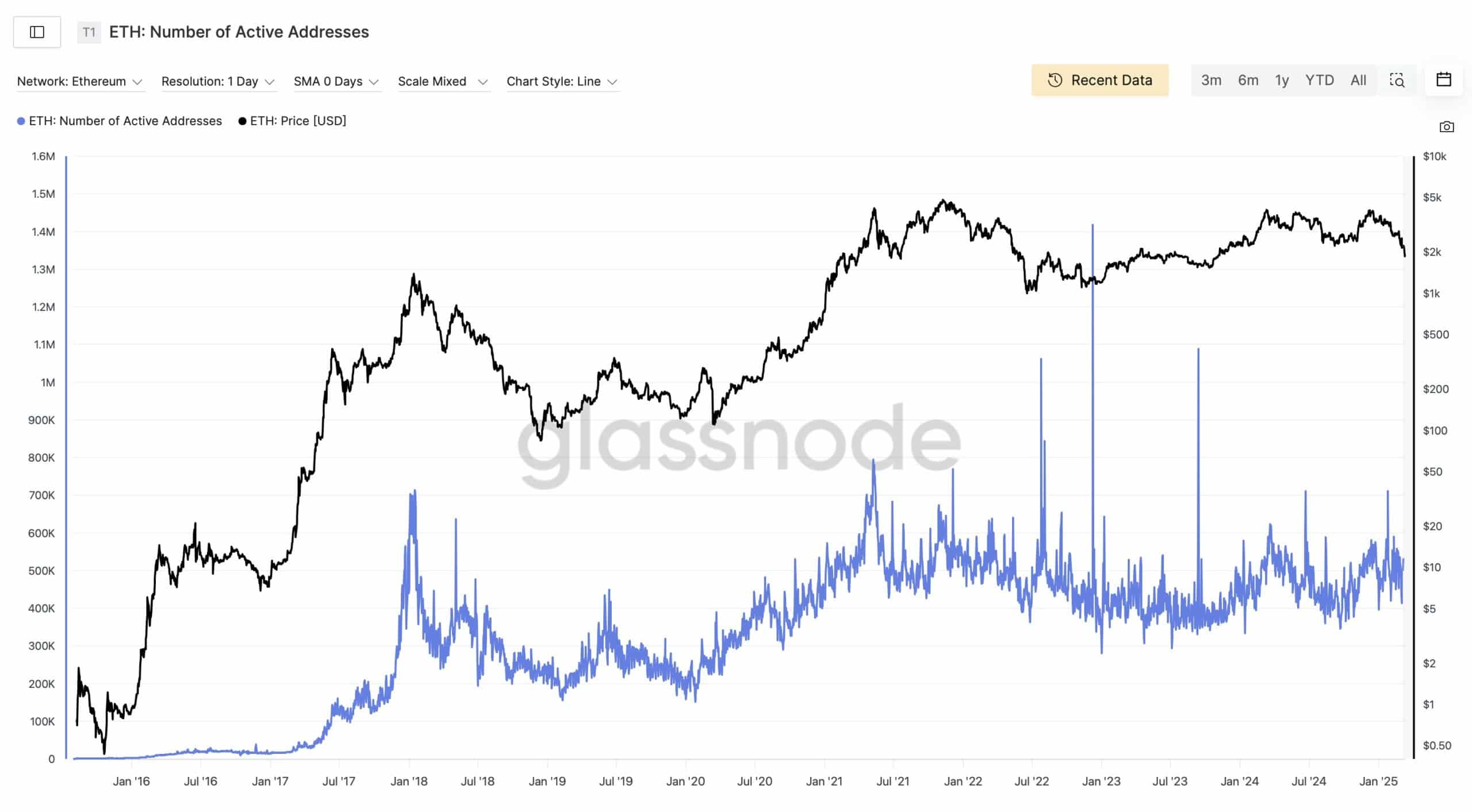

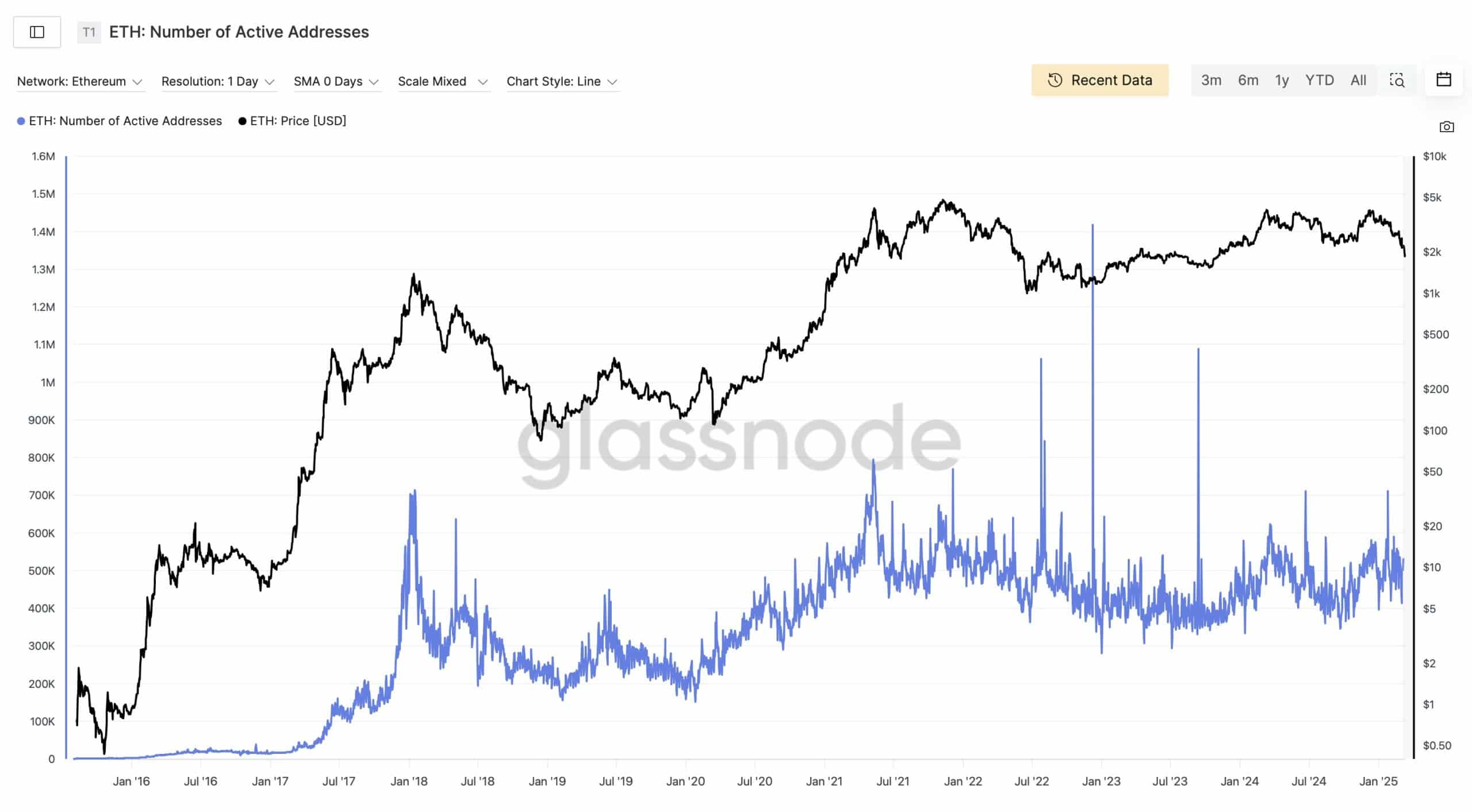

Another cautious data The point, according to the analyst, Stacy Muur, is active stagnant users. She noted that Ethereum active addresses have been flat for four years.

Although some criticisms argued that users have migrated to L2S, the growth of the stagnant network could cap ETH’s recovery prospects.

Source: Glass nose

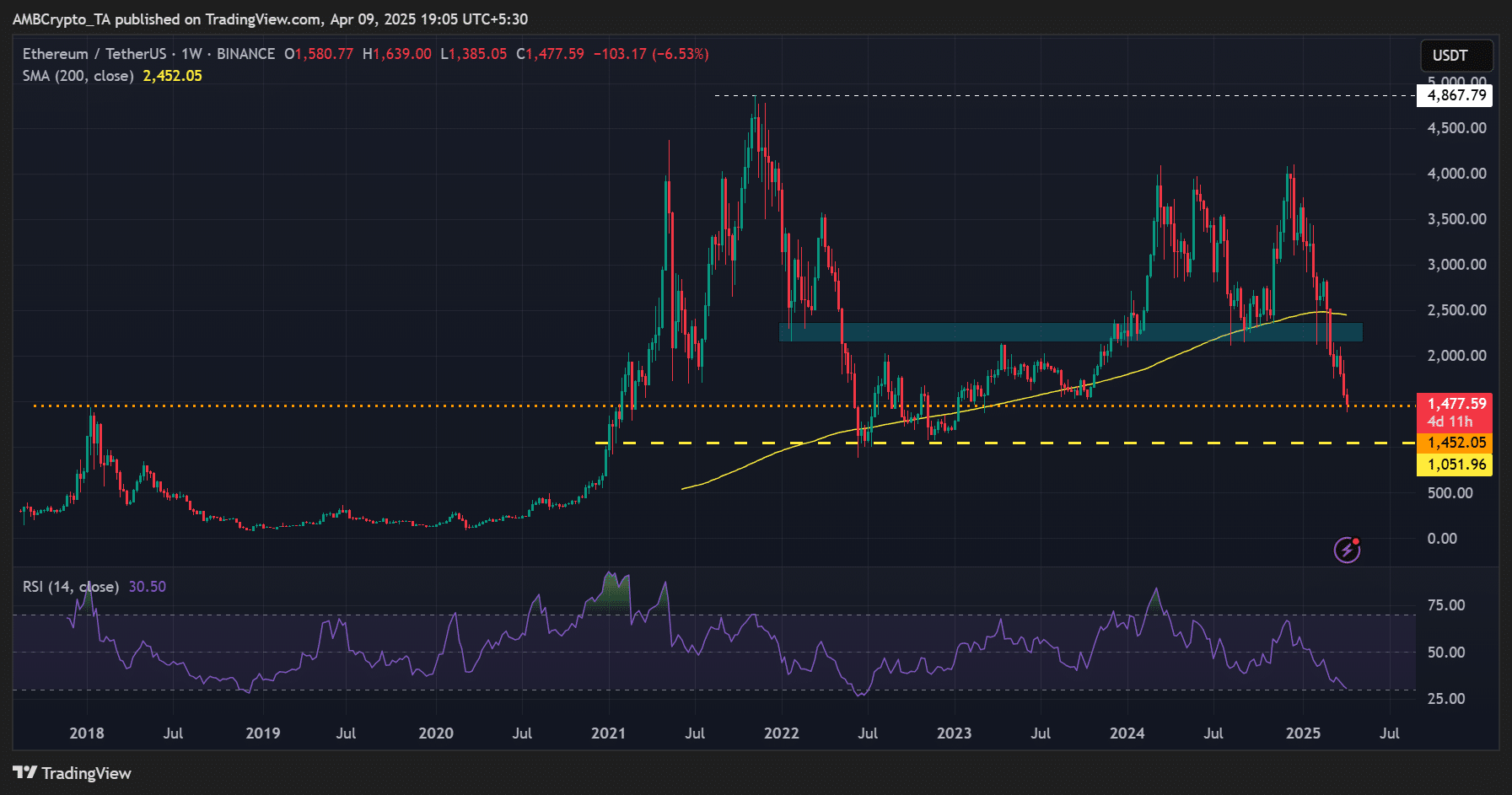

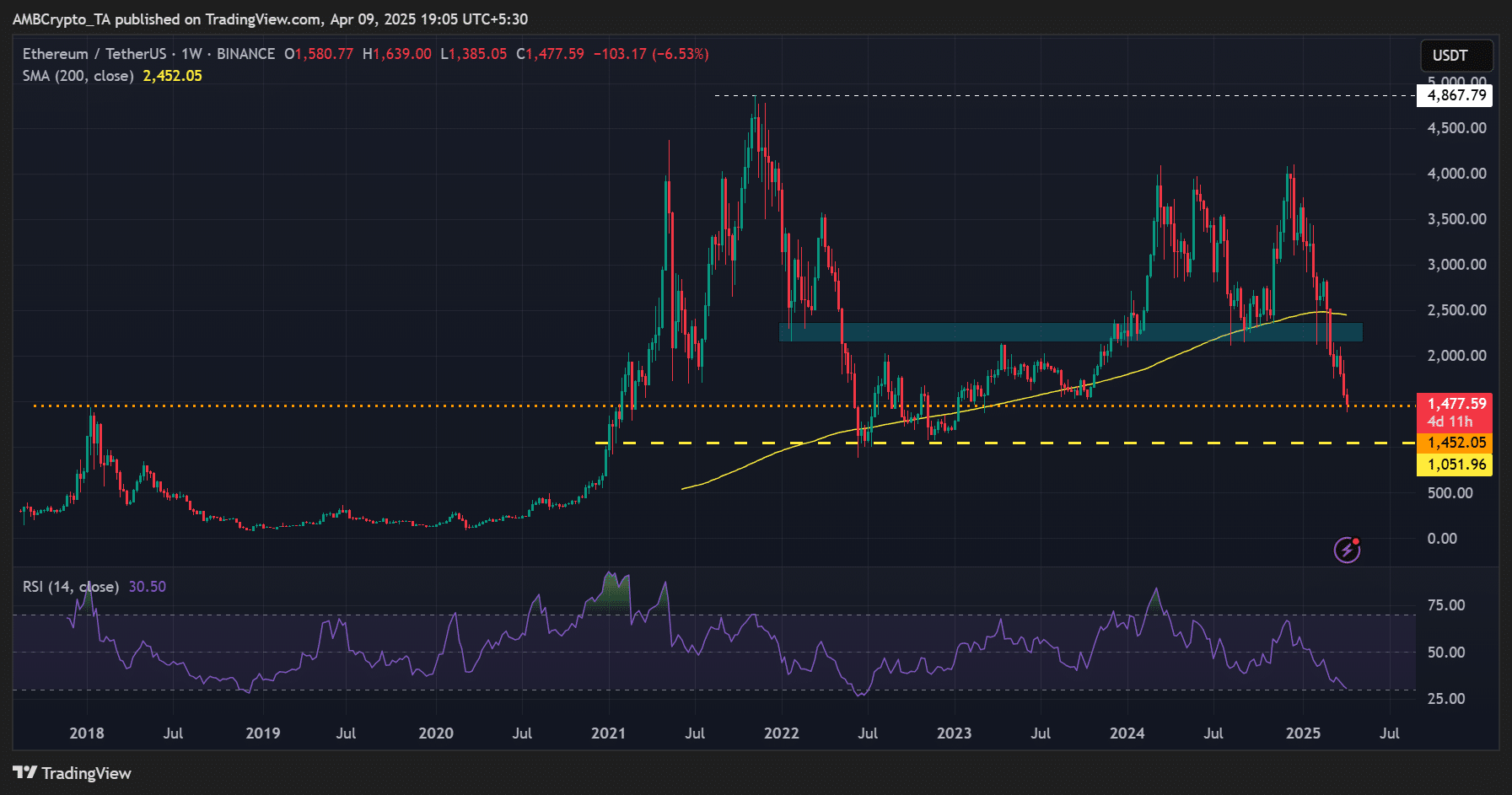

From a price point of view, ETH fell to a hollow of two years below $ 1.5,000. In fact, it was down 64% compared to its peak in the press time cycle of $ 4,000.

With an in progress macro uncertainty, a prolonged drop to $ 1,000 cannot be canceled in the short term.

Source: ETH / USDT, tradingView

In other words, Altcoin has struck a central point, in particular when followed from a price perspective made.

However, the macro front is currently dominating market orientation and could delay a potential ethn rebound if uncertainty persists in the short term. In addition, as revealed by a sequence of 7 weeks of ETH outputs, the low demand has not painted a strong perspective of recovery.