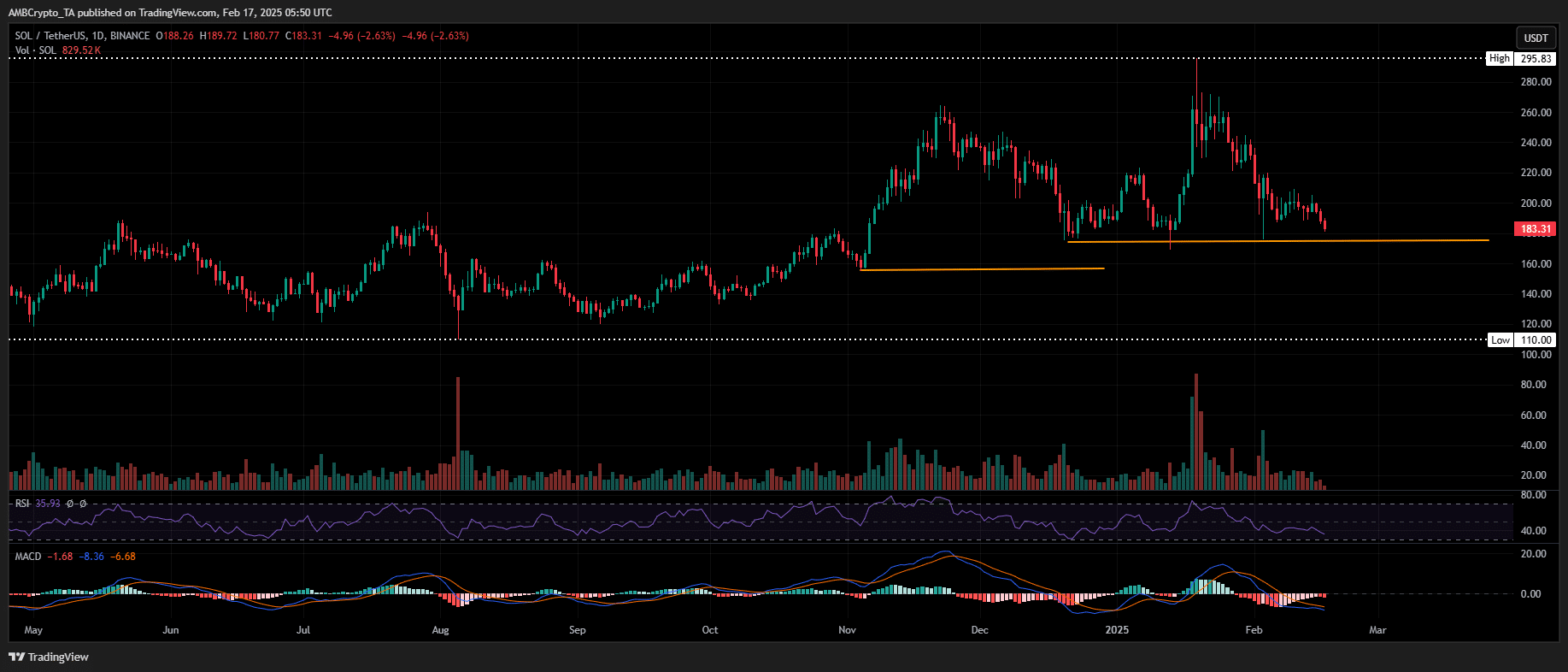

- Solana is negotiated below a crucial support zone, and from here, its price could evolve in both directions.

- Given the context of the market, is a deeper decline then, or will the bulls seize the dip?

After losing 5% of its market value, Solana (ground) hovers near a critical support zone – an area which has historically fueled strong rebounds towards the range of $ 250 to $ 260 – an increase of 35% compared to its current price.

Source: TRADINGVIEVE (Sol / USDT)

Historically, this support area has triggered solid rebounds, and with a volume of 65%, now exceeding $ 2 billion, traders can expect a rehearsal.

In addition, the ground / BTC pair reflects a similar model of the last cycle, when a Haussier reversal pushed Solana from 65% to $ 270 in just two weeks. But don’t forget – the media threshing of the launch of Trump Memecoin played a huge role, causing a 19% wave of a day in Solana.

Thus, while a 35% rebound could make sense with the consolidation of Bitcoin, the chatter of the Altcoin season and the strong volume supporting it. But let’s be real – it’s still too early to call.

It should be noted whether the market goes to a solid background before the capital of retail and speculative capital plunges its first head into the “DIP”.

Solana in Crossroads: rebound or still decline?

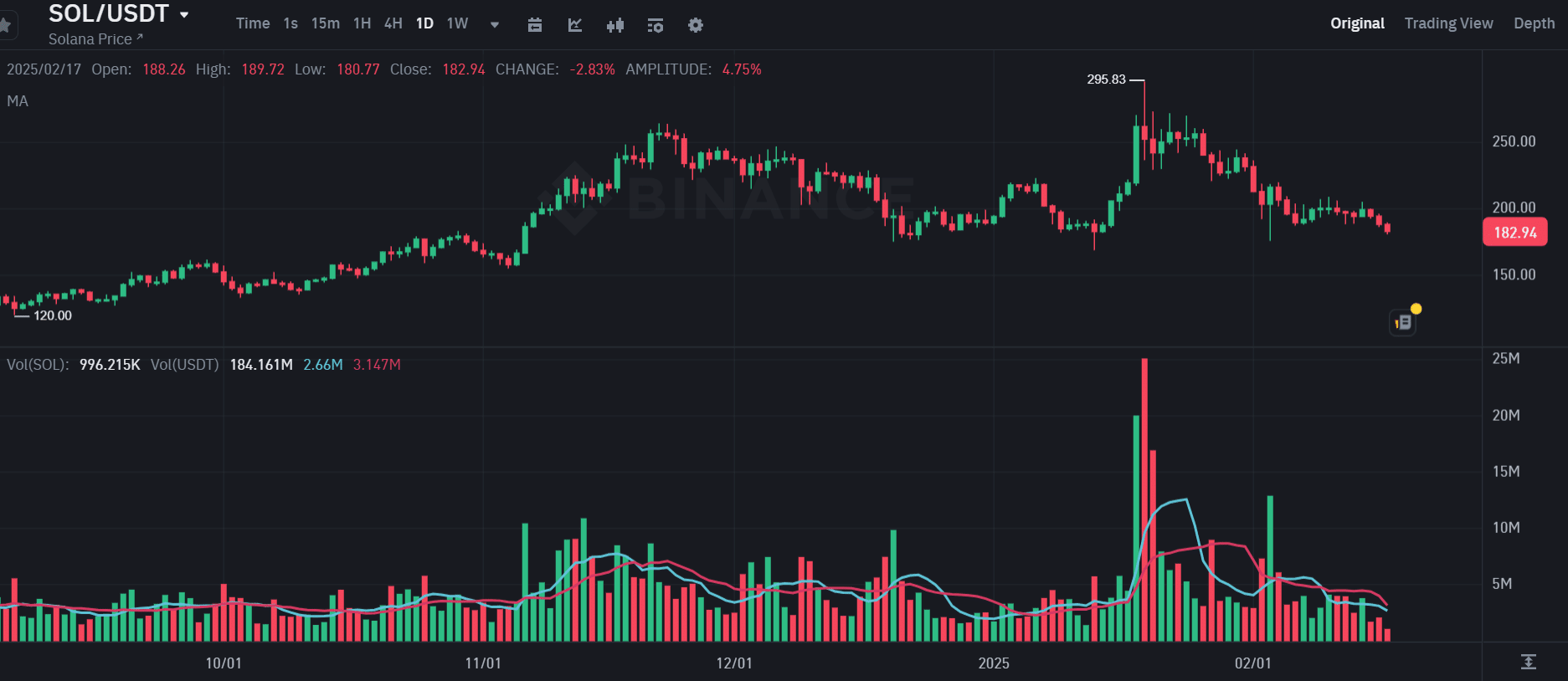

At the time of the drafting of this document, Solana saw a strong purchase interest in the long -term market, with open interest (OO) up 8.37% to $ 5.85 billion.

More than $ 14 million long was liquidated in 24 hours, aligning with the 2.65% soil drop. Despite the liquidations, Solana is far from relaxing. Merchants take high risks, betting on a potential rebound.

However, as Ambcrypto points out, this strategy could turn around if punctual trading does not increase. Binance data shows three consecutive days of order sales.

Unless that moves to green, a background of $ 180 could be difficult to strike. A decline at $ 160 is more likely if long compressions are not checked.

Source: Binance

With a high -risk feeling on the derivative market, prudence is crucial.

While the buzz on a rebound of 35% to $ 250 spreads on social networks, reality suggests more days of heavy liquidations.

Merchants risk losing millions, making a rebound for Solana still far.