October 10 will go down in crypto history as a day when traders were devastated. This was more than a Black Swan event. It was an apocalypse, a day when even the best altcoins melted, some falling all the way to $0. Although HYPE price predictions, for example, are optimistic, the crypto market is still reeling from the sell-off. Some blame Donald Trump and White House insiders for accelerating this decline, while others place the blame squarely on Binance, the world’s largest exchange, for all their woes and selloffs.

In the midst of all this, Hyperliquid, the decentralized perpetual exchange that is rapidly accumulating volume and taking on the big guys, is also in the middle of the storm. As a transparent exchange where every position can be monitored, Hyperliquid is the platform of choice where a mega short position was placed by a well-placed and knowledgeable crypto whale minutes before the big drop.

A whale opened a $750 million loan, with 10x leverage $BTC short position. It is already in deficit of $3.7 million and will be liquidated if $BTC climbs above $130,800.

What do they know?

pic.twitter.com/GbJwoXw54e

– Bitcoin Titan (@BitcoinTitann) October 10, 2025

Because of this connection, there are now questions about whether the White House, Donald Trump, and rogue White House insiders were deliberately inclined to liquidate traders or whether there is a plan to directly increase Hyperliquid’s visibility.

DISCOVER: Best Meme Coin ICOs to invest in 2025

Donald Trump, China, Garret Jinn and the October 10 crypto collapse: the link

To determine whether this is true or not, we must look at the sequence of events before the October 10 crisis.

China started the day early by announcing new rules regarding the export of rare earth metals.

Less than 24 hours later, Donald Trump responded by posting on Truth Social that the United States would impose a +100% tariff on China, citing escalating trade tensions.

This “Trump shock” quickly triggered an immediate panic in the market, which saw Bitcoin and some of the best crypto to buy sliding from over $120,000 to around $102,000 before rebounding. As a result, over $19 billion (probably underestimated) was closed quickly and forcefully across multiple perpetual exchanges.

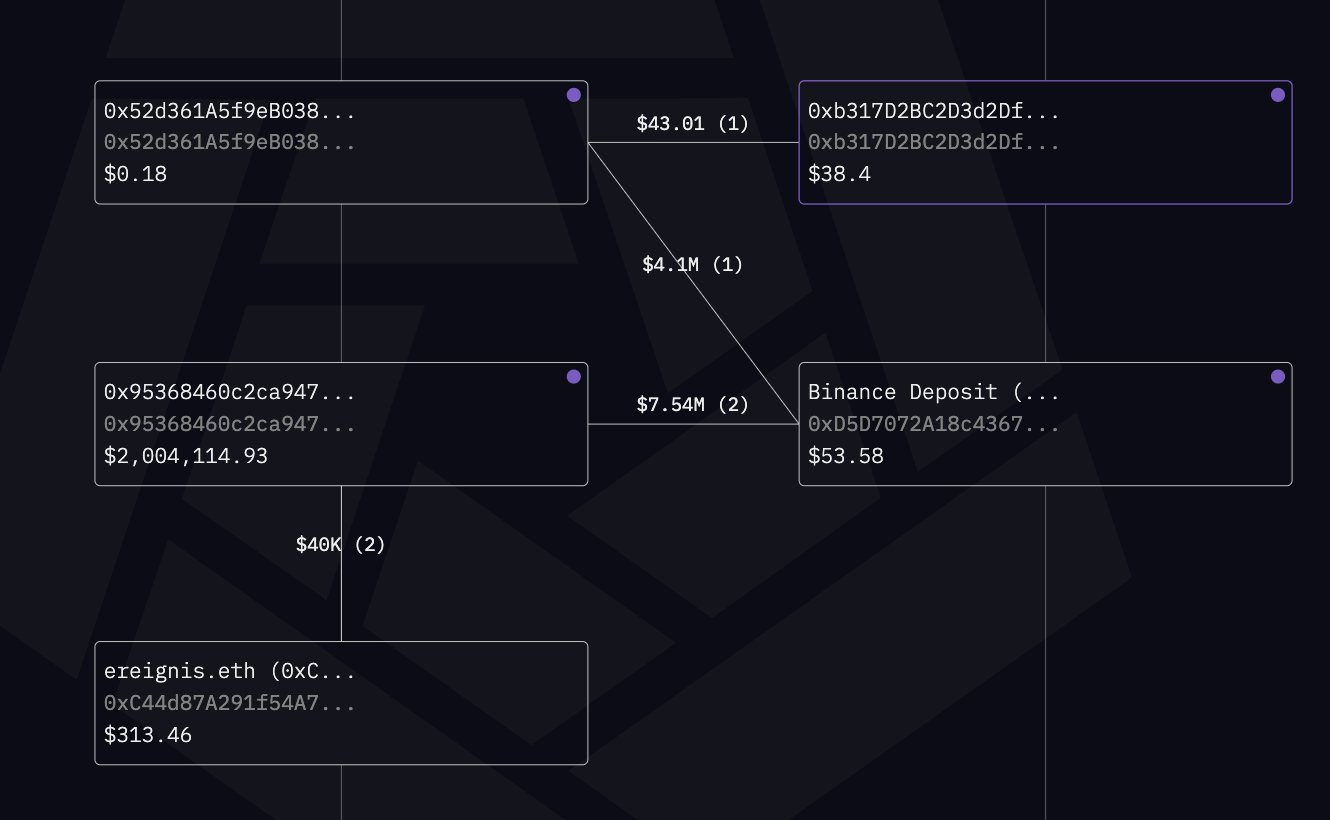

The problem is that analysts noted something interesting just before Trump issued new tariffs on China: a whale linked to Garret Jinn, the former CEO of the defunct exchange BitForex, had opened a $735 million short position in BTC through Hyperliquid about an hour before the news.

(Source: eyeonchains, X)

By the time BTC USD fell to $102,000, the wallet was in full profit, with Jinn going on to make over $142 million in realized BTC profits.

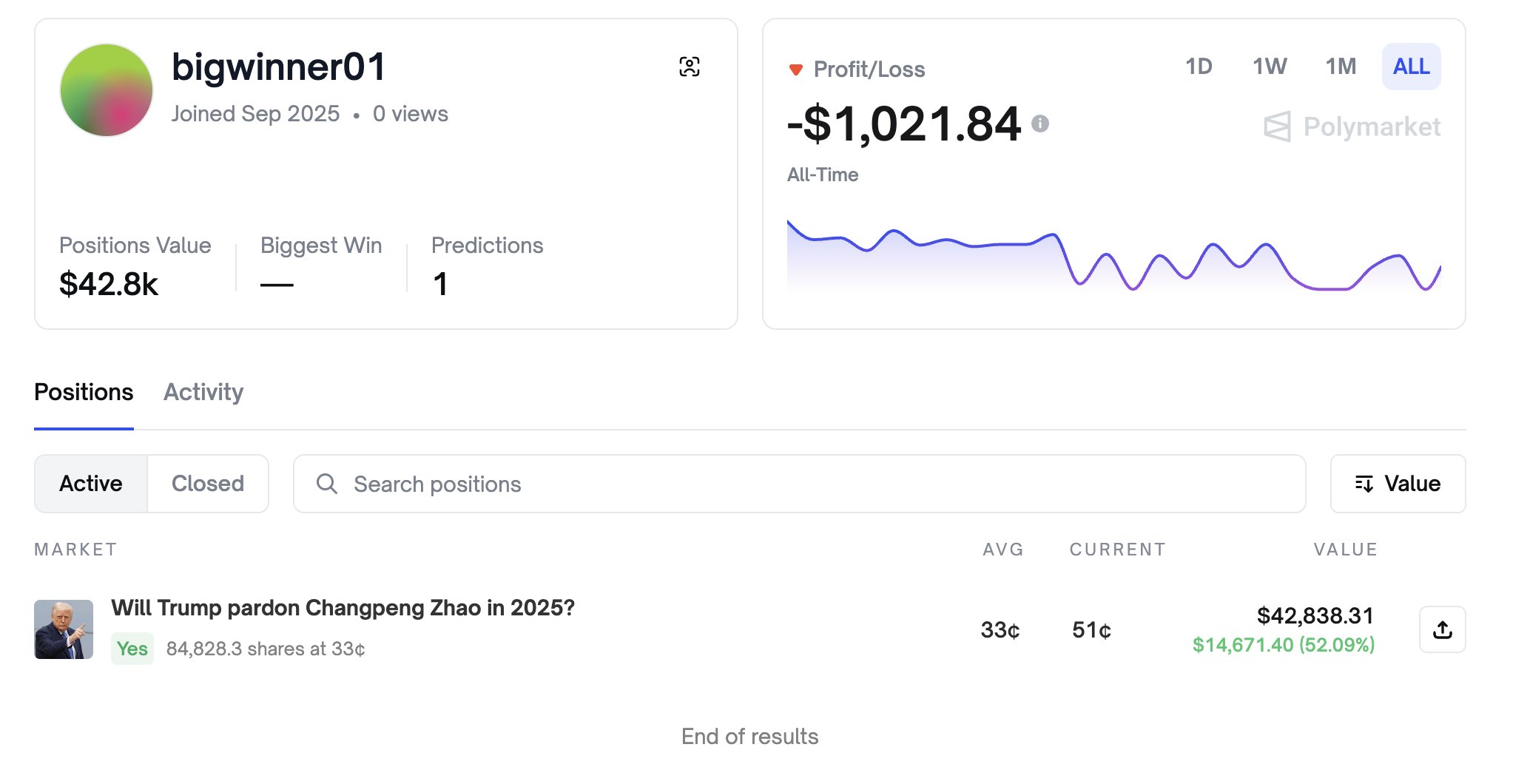

According to on-chain sleuths, Jinn prefers exchanges related to Trump and the White House. Analysts say he also holds a long position in “Will Trump pardon CZ in 2025? » on Polymarket, a bet that is gaining traction amid rumors that Trump is considering pardoning Changpeng Zhao.

(Source: emmettgallique,)

Analysts say it’s no coincidence that Jinn could have placed a mega short position on BTC minutes before Trump announced new tariffs on China and, at the same time, held a long position on another bet whose outcomes depend entirely on the White House. One believes he is just the leader of a larger insider trading ring leaking information about the White House.

Zhao Changpeng common analyzes linking Jinn to the October 10 turbulence on X. However, Jinn quickly responded: adage he had no ties to the Trump family or the president and that his actions did not constitute any form of insider trading.

The fund is not mine, but that of my clients. We run nodes and feed them internal information.

– Garrett (@GarrettBullish) October 13, 2025

DISCOVER: 9+ Best High Risk, High Reward Cryptocurrencies to Buy in 2025

Is the White House pumping hyperliquid? HYPE Price Prediction at $50?

Whether the funds belong to Jinn or his clients, as he claims, is irrelevant for now. Crypto traders were decimated on Friday, and it could be a few more weeks before BTC and best Solana coins are trading at new October 2025 highs.

The fact that Jinn shorted BTC on Hyperliquid is why there are allegations that the White House may support the perpetual exchange, indirectly increasing HYPE prices.

However, there is currently no credible evidence linking Donald Trump or the White House. Trader Jinn denied any connection to the First Family, adding that the funds belong to customers and not him.

However, the involvement of the White House, The Trump family and a highly controversial topic associated with high-level manipulation of cryptocurrency prices, the source of which is Hyperliquid, have brought more visibility to the perpetual exchange.

Crypto HYPE is in red at press time and has reversed sharply from the October 13 highs. If HYPE USDT finds support above $30, HYPE crypto prices could rally up to $50.

DISCOVER: 10+ Next Cryptos to 100X in 2025

Is the White House pumping hyperliquid? HYPE Price Prediction at $50?

- October 10 was Black Swan day, with more than $19 billion liquidated.

- Mega Whale opened a short position of almost $1 billion on Hyperliquide

- Crypto Prices Crash After Trump Announces New Tariffs on China

- HYPE Price Prediction: HYPE crypto at $50?

The post Is the White House pumping hyperliquid? Whale denies Trump insider trading as HYPE price prediction targets $50 appeared first on 99Bitcoins.