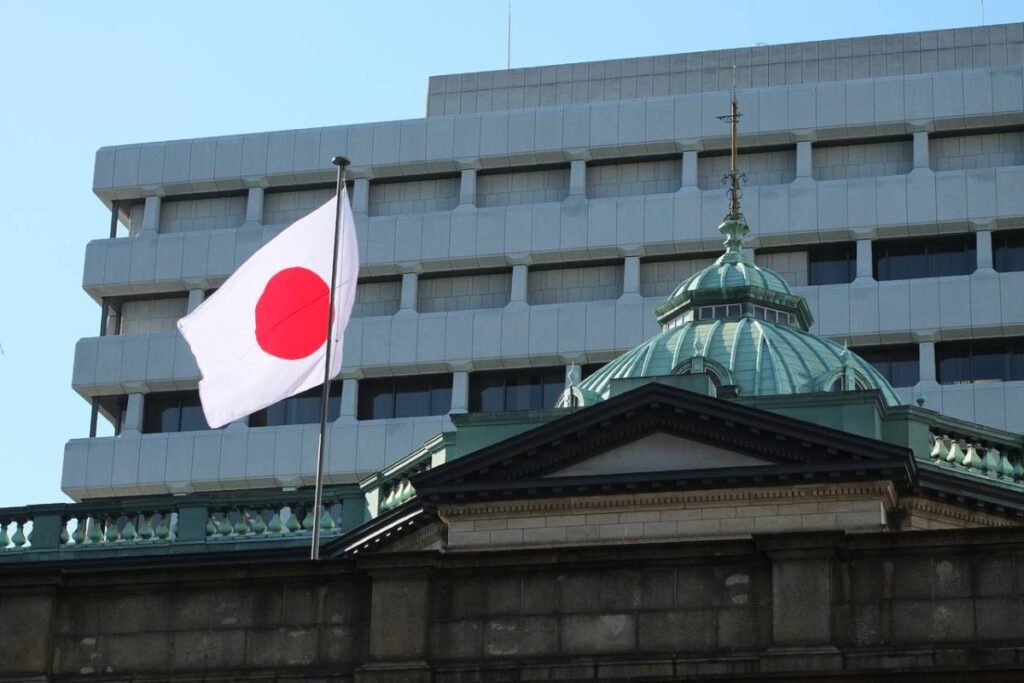

Japan is preparing to reshape its cryptographic regulations with a new proposal that would divide digital assets into two distinct categories – one for supported tokens of business and another for decentralized cryptocurrencies such as bitcoin.

The country’s financial services agency (FSA) released The project project this week, opening the door to public comments until May 10, 2025.

The new approach aims to clarify a fragmented regulatory environment. Under the plan, the tokens used for fundraising or issued by companies – often less known altcoins – are faced with stricter rules concerning transparency, investor protection and disclosure. Projects should describe how funds are used and disclose potential risks. If they reach a significant investor base, they can raise laws on security tokens.

On the other hand, largely decentralized decentralized tokens such as Bitcoin and Ethereum would not be regulated in terms of assets. Instead, crypto exchanges would be responsible for monitoring the market, in particular by reporting net price movements.

While the document avoids the thorny question of taxation, it laid the foundations for more formal recognition of the crypto in the financial system of Japan. The regulators also envisage wider changes in financial laws by 2026 which could redefine digital assets as investment products rather than simple payment tools.

The proposal reflects a change in tone of the traditionally prudent position of Japan. A possible lifting of the ban on Crypto ETF is also under discussion, indicating that Tokyo is increasingly open to the adoption of digital assets under more strict guarantees.