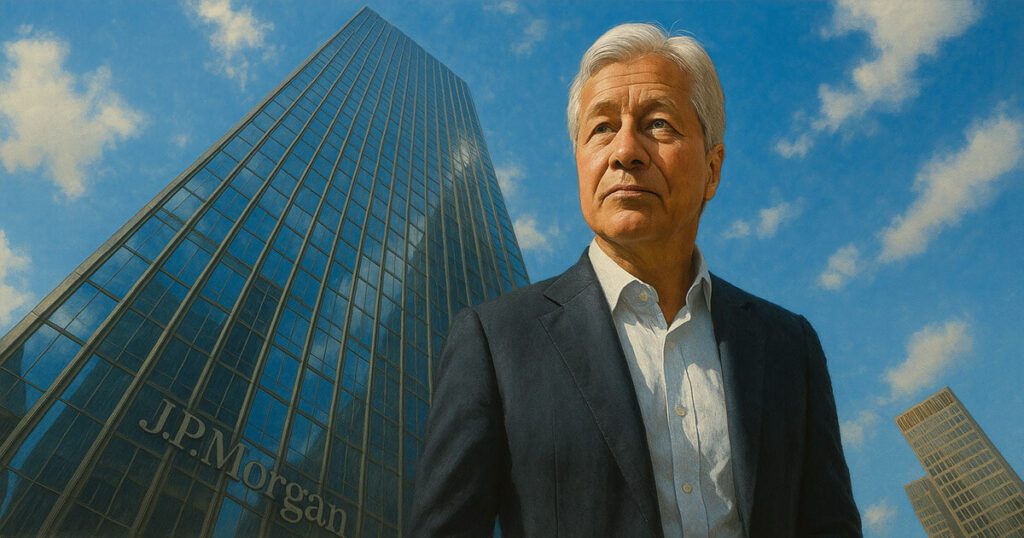

JPMorgan CEO Jamie Dimon said that Wall Street lender planned to offer Bitcoin (BTC) to his customers in a brutal passage from his historic position to digital assets.

During JPMorgan investors day, Dimon reiterated that he was “not a fan” of Bitcoin, but recognized that customers will continue to ask for access.

He said:

“I don’t think you should smoke, but I defend your right to smoke. I defend your right to buy bitcoin. “

He also said that the bank does not plan to offer childcare services.

Dimon maintains skepticism

Dimon’s criticism with regard to the crypto conforms to past remarks. In a January interview, he called Bitcoin “without value”. He linked it to criminal activities, repeating the concerns raised in his testimony from the Senate in 2023, in which he pleaded to close the industry.

At the World Economic Forum of 2024 in Davos, it described the bitcoin “pets for pets”, While in April of the same year, Dimon Called Crypto a “Ponzi diagram”.

In his remarks of May 19, he also said that “the blockchain does not matter as much” as people think. However, JPMorgan continued to build infrastructure around Blockchain technology for institutional use.

Earlier this month, Kinexys finished a test transaction that has laid its private network to a layer 1 public blockchain, using token short-term treasury assets and real-time settlement protocols. ChainLink and Ondo Finance participated in this pilot.

In addition, Kinexys treats more than $ 2 billion in transactions daily and plans to extend the regulations in Euro dollar-European using JPM Coin, the JPMorgan owner token.

JPMorgan increases exposure to cryptography

In the middle of the remarks on the Bitcoin offer, Jpmorgan’s 13F deposited With the Securities and Exchange Commission (SEC) of the United States for the first quarter of 2025 showed a spectacular increase in exposure to cryptography through negotiated funds on the stock market (ETF).

As of March 31, the company brought in $ 16.3 million in assets related to the crypto, from $ 1 million at the end of 2024. Exposure to lender’s cryptography is mainly done via instruments related to Bitcoin and Ethereum.

As of March 31, JPMorgan held just over 263,000 shares by Ishares Bitcoin Trust (IBIT) of BlackRock and around 3,000 shares Bitwise Spot Bitcoin Etf (BitB).

The lender also owned the Bitcoin Trust (GBTC) actions of Graycale (GBTC) and Mini Trust ETF, from Wise Origin Bitcoin Fund (FBTC) from Fidelity, and new Allocations to Bitwise and Franklin Templeton Ethereum.

The assets linked to the company’s crypto are only a small fraction of its $ 4.4 billions of assets under management at the end of the first quarter.

It is not known to what extent the portfolio reflects the owner positioning in relation to the facilitation of customer demand. The bank previously clarified that the holding of certain FNB allowances could be part of its marketing services.