Jupiter (JUP), the first decentralized scholarship aggregator based on Solana (DEX), experienced a devastating market crash because investors’ confidence seems to have completely evaporated.

After its last company greater than $ 1 in February, the JUP token maintained a relentless downward trajectory, losing more than 33% in the last month and falling from 82.73% compared to its $ 2.04 post-launch peak.

Currently, the token is estimated at $ 0.3629. Holders who left the posts before this catastrophic decline are fortunate to have done it before the massive accident.

The founder of Jupiter suspends Dao’s vote in a desperate decision to save Jup Token

A merchant who liquidated his substantial assets around $ 0.70 expressed his disbelief, declaring that as Solana’s most recognizable token, nobody provided for JUP’s descent to “uselessness”.

This investor awarded the deterioration of JUP to the absence of a real utility token and large versions of token of the development team.

On June 19, the head of the exploitation of Jupiter Exchange, Kash Dhanda, tried to fight against the frustrations of the growing community concerning the lack of strategic planning to improve the usefulness of the Jupiter’s tokens.

Kash announced that the Jupiter foundation suspend its DAO voting mechanism to concentrate efforts on the strengthening of Jupiter and Jupavers’ ecosystems.

He stressed that the Jupiter exchange is currently at a key moment, requiring immediate action to shape the future of DEFI, because this window of opportunity will not remain available indefinitely.

A Solana maximalist approved this decision, describing the abolition of the DAO vote as a major step towards the rehabilitation of the JUP trajectory.

He suggested that elimination of “30 -day debit requirements” should be the next priority. Its point of view is focused on “allowing stakers while avoiding deterrent of potential investors”.

Massacre of token unlocking: why JUP has become the biggest disappointment in Solana

Another supporter of cryptocurrency shared comparable opinions, expressing the hope that Jup Dao would permanently abandon the voting mechanism.

“”What an absurd energy drain for such a talented team to continuously debate controversies of the trivial working group“He said.

He noted that billions of stock market capitalizations JUP disappeared during five -digit financing decisions.

He proposed alternative value creation models, such as buyout programs that benefit holders and improve the price performance of JUP tokens.

Despite the deterioration of prices ‘action and the decrease in investors’ trust, the Jupiter Foundation continues to deliver new products and carry out major milestones.

On June 22, Jupiter Exchange announced that the aggregator DEX had exceeded 1 billion of dollars in cumulative negotiation volume, dealing with more than 1.7 billion exchanges of 49 million unique merchants.

This achievement represents the highest volume among all decentralized exchanges based on Solana.

The platform also introduced what it called “the first Solana trading portfolio”, the JUP mobile application, which allows users to transfer funds and monitor their DEFI portfolio positions transparent.

In the past 24 hours only, Jupiter has accumulated more than $ 3.8 million in transaction costs, even exceeding Uniswap, the largest Dex de Ethereum.

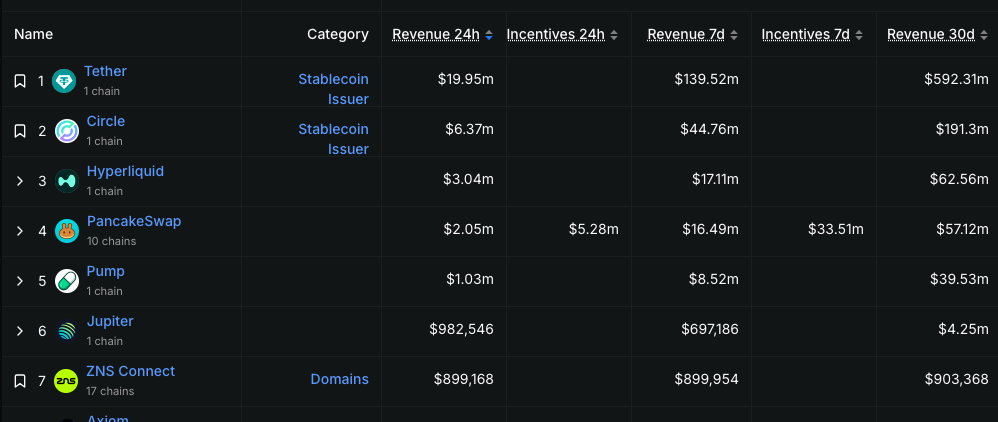

The platform also recorded more than $ 982,000 in daily income, ranking behind Pump.fun, Pancakeswap, Hyperliquid and Major Stablecoin Providers (Tether and Circle).

Bitcoin trader prominent “Bitcoin consensus“Think that these impressive metrics will eventually be reflected in the evaluation of JUP while the token has signs of a significant reversal thanks to a classic double -bottomed training on daily graphics.

It provides for a model rupture targeting $ 0.96, which represents a potential increase of 174% compared to current price levels.

Jupiter RSI at 33: Is JUP’s rebound about to explode?

The daily analysis JUP / USDT reveals the price by maintaining a socket on the key support at $ 0.3371, which the bulls must successfully defend to avoid additional declines.

After testing this support area, the asset showed modest recovery at around $ 0.3594, indicating a renewal of purchase interest.

However, the overall technical structure remains lower following a prolonged downward trend and recent rejection near the resistance level of $ 0.50.

The simple 9 -day mobile average is negotiated below current price levels, suggesting a short -term recovery momentum potential.

Meanwhile, the RSI oscillates around 33.54, reflecting the conditions of the market occurring and involving a possible technical rebound.

If the level of support of $ 0.3,371 was maintained, the price movement to $ 0.3889 and potentially 0.4981 could materialize.

However, a violation below this key support threshold would expose new decrease targets and perpetuate the bearish pressure. The bulls must resume the level of $ 0.3889 to validate any sustainable recovery trajectory.

Post JUP holders sell after 80% crash – dead or purchase? appeared first on Cryptonews.

,,

,,  ) (@Jupiterexchange)

) (@Jupiterexchange)  Double bottom alert on

Double bottom alert on