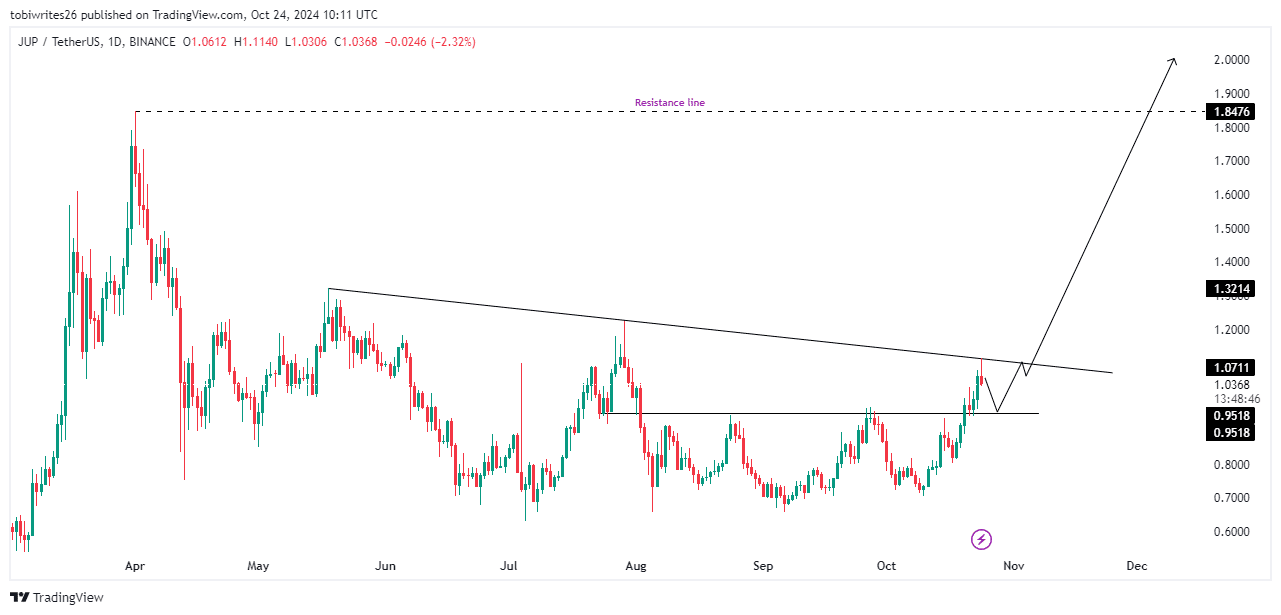

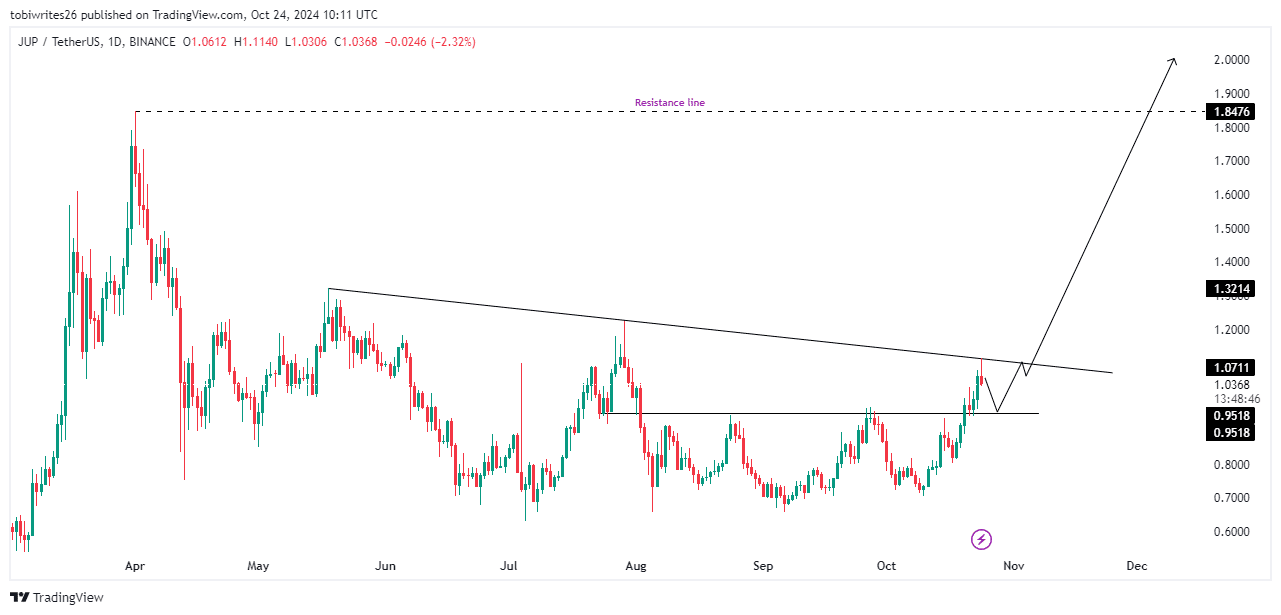

- The main challenge for JUP is a descending trendline that has triggered three consecutive pullbacks.

- However, after an expected brief decline, JUP could see a 100% rise, targeting the $2 level.

Over the past month, Jupiter (JUP) has gained 31.72% and its daily chart shows continued strength with a further increase of 11.30%, paving the way for a potential breakout.

AMBCrypto’s analysis suggests that JUP’s momentum could extend further, provided it maintains key support levels and market metrics continue to favorably align with its uptrend.

JUP market dynamics: decline then rise

According to JUP’s daily chart, the asset is well positioned for a potential rally, although it recently encountered resistance during its third unsuccessful breakout attempt, resulting in only a minor decline.

However, this slowdown is likely to persist for some time, as increased selling pressure could push JUP even lower towards the support level at 0.9158, where large buy orders are likely positioned.

If JUP reaches this support level, it could trigger a rebound, allowing the asset to first overcome the descending trendline resistance.

This could be followed by further resistance at 1.847 before making a potential move towards the $2 target.

Source: TradingView

AMBCrypto analyzed technical indicators to determine the likelihood of this projected scenario coming true.

Market Greed Suggests Potential JUP Drop

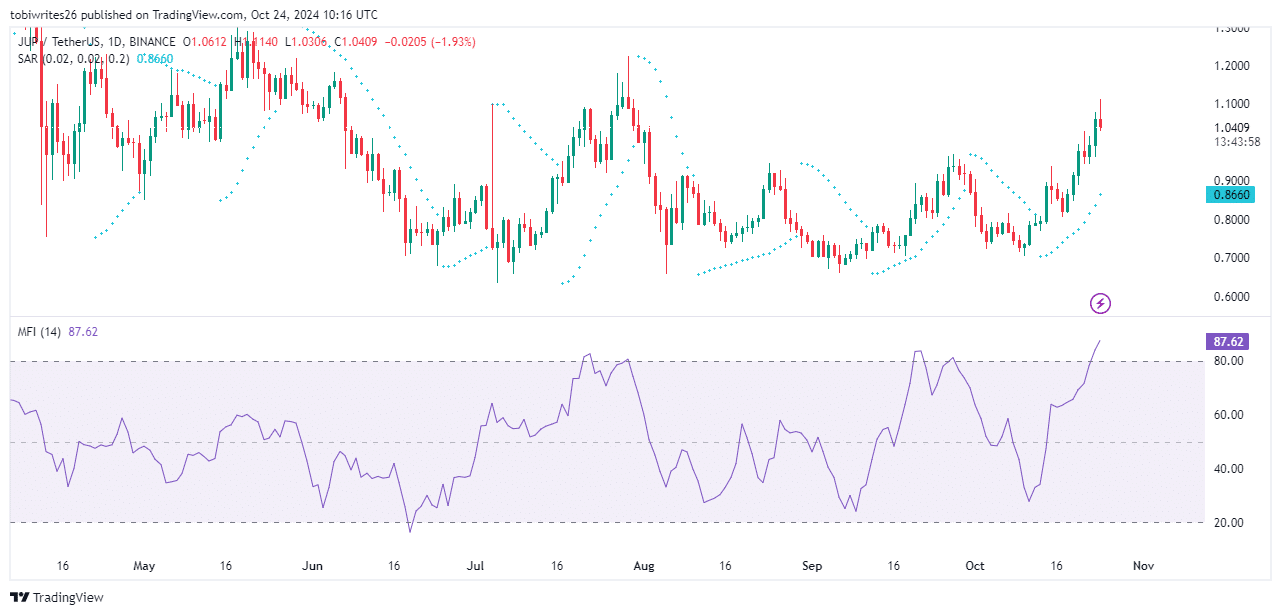

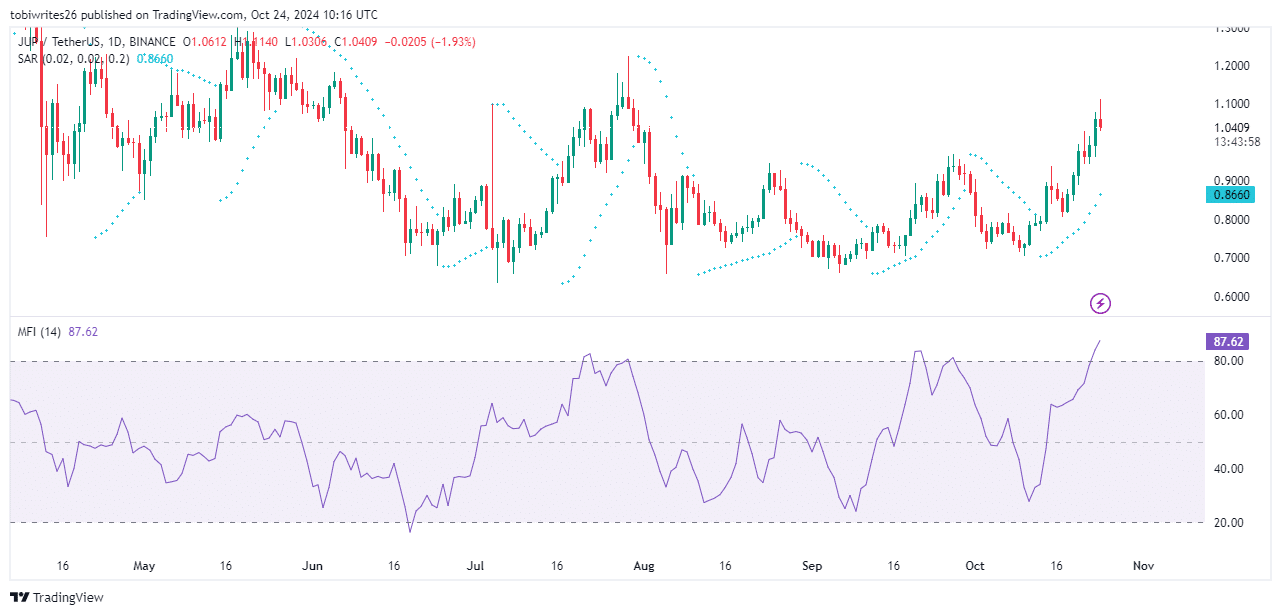

According to the Money Flow Index (MFI), which measures liquidity flows into and out of assets to gauge the behavior of market participants, JUP is likely to experience a decline in the short term.

The IMF has entered the overbought zone, surpassing the 80 mark, indicating extreme greed in the market. This means that a corrective decline is necessary to balance the price action.

This decline is expected to fade at the previously mentioned support level or lead to some price revaluation before the next upward move.

Although this slowdown may trigger some panic, the Parabolic SAR (Stop and Reverse) indicator signals that market sentiment remains bullish, with a series of points forming below the JUP price.

In summary, the expected decline will likely be short-lived before an upward movement resumes.

Source: Commercial View

Open interest in JUP continues to rise

Data from Coinglass shows that open interest for Jupiter (JUP) increased by 13.89%, bringing its total value to $126.25 million.

Realistic or not, here is the market capitalization of JUP according to SOL terms

Open Interest reflects the actions of market participants and, in this case, indicates an increase in long contracts and the maintenance of existing long positions.

This suggests that the market is maintaining its overall bullish sentiment.