On-chain data shows that the most massive Ethereum whales control most of the supply, and their holdings are only growing.

Ethereum mega-whales own over 57% of all tokens in existence

In a new article on X, on-chain analytics firm Santiment explained what the supply of ETH held by different segments of the user base has looked like recently.

The relevant metric here is “supply distribution,” which tracks the percentage of Ethereum’s circulating supply that a given wallet group currently holds.

Addresses or investors are divided into these cohorts based on the number of coins they have in their balance. For example, the 1-10 coin group includes all wallets with between 1 and 10 ETH.

In the context of the current topic, three broad ranges containing multiple cohorts are of interest: 0 to 100 coins, 100 to 100,000 coins, and more than 100,000 coins. The first includes small hands in the market, such as individual investors.

These holders don’t hold a lot of assets in the grand scheme of things, so they individually don’t matter in the market. In the second cohort, the 100-100,000 coin cohort, wallets start to get a bit large, but only towards the end of the range.

The lineup includes two of the industry’s leading investor groups, sharks and whales. Whales are significantly more massive than sharks, so they are the largest cohort out there.

Finally, the largest addresses on the network hold over 100,000 ETH. At current prices, this amount is approaching $400 million, so investors in this group would be quite massive. Perhaps an appropriate name for them would be “mega-whales”.

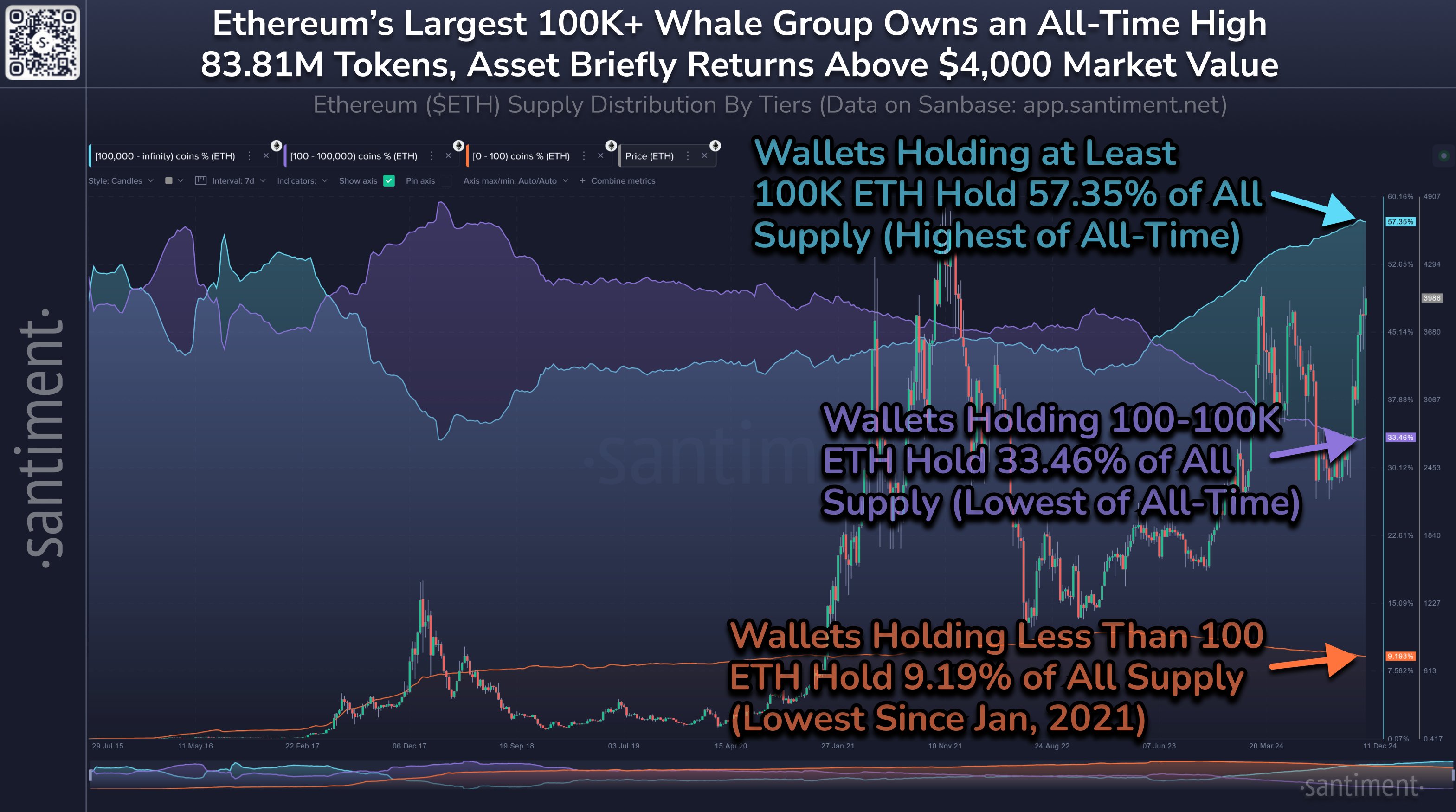

Now here is the chart shared by the analytics company that shows the supply distribution trend for these three Ethereum wallet lines over the past decade:

The value of the metric appears to have been on the rise for the mega whales in recent months | Source: Santiment on X

As the chart above shows, the percentage of Ethereum supply held by mega-whales has increased over the past two years. At the same time, the two smaller portfolio ranges have lost their dominance, with Sharks and Whales in particular seeing a fairly sharp decline.

The mega-whales, made up of just 104 members, now own 57.35% of the ETH supply, a new all-time high. Meanwhile, shark and whale holdings sit at an all-time low of 33.46%.

In general, centralization of supply is not positive for any cryptocurrency. Yet, this is particularly important for Ethereum, as the network operates on a Proof-of-Stake (PoS)-based consensus mechanism. This means that if one entity or group of entities controls 51% of the supply, they can take over the network.

That said, many mega-whales would not be “real” investors but wallets owned by staking pools and other platforms, which simply hold the coins in one place on behalf of many investors.

ETH Price

Ethereum saw a pullback over the past day, with its price now at $3,930.

Looks like the price of the coin has overall been moving sideways recently | Source: ETHUSDT on TradingView

Featured image of Dall-E, Santiment.net, chart from TradingView.com