Key takeaways

- Mark Cuban suggests Kamala Harris could remove Gary Gensler as SEC chairman if he is elected.

- Gensler has been criticized in Congress for unclear definitions and regulations on crypto assets.

Share this article

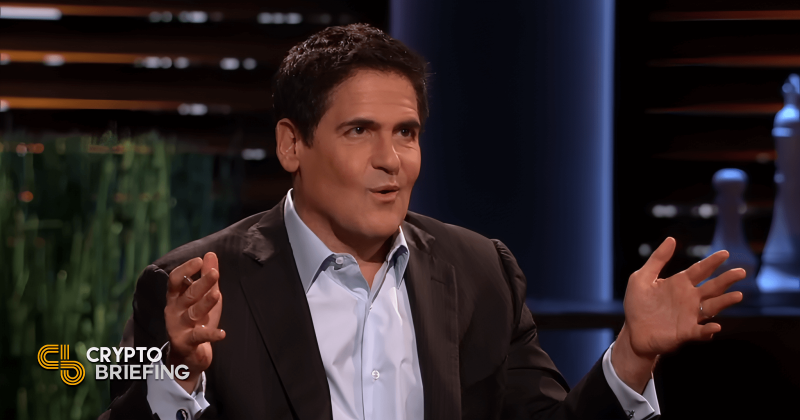

Billionaire Mark Cuban said Vice President Kamala Harris’ team opposes “regulation through litigation,” suggesting Gary Gensler could be removed as chairman of the Securities and Exchange Commission ( SEC) of the United States if Harris was elected.

Cuban noted that Harris’ team did not use any “uncertain terms” to express its lack of support for the SEC’s current approach to regulation. “ACY Gensler. Your departure is worth one point of GDP growth,” he added.

This comes amid Harris Remarks at a fundraiser on Wall Street in Manhattan on Sunday to encourage innovative technologies if elected, namely artificial intelligence and digital assets.

Furthermore, former US President Donald Trump sworn to fire Gensler if he is elected on his first day in the White House during his appearance at the Bitcoin conference held in Nashville this year.

Despite recent positive developments involving Kamala Harris and the crypto industry, her chances at Polymarket have remained steady at 50%, outpacing Trump’s chances by 1%.

Gensler under fire

Gary Gensler and SEC Commissioners Caroline A. Crenshaw, Hester Peirce, James Lizarraga and Mark Uyeda attended a congressional hearing yesterday to discuss the regulator’s efforts to oversee U.S. capital markets.

During the hearing, Gensler was criticized by House representatives who questioned him about the SEC’s various proposed definitions for crypto, the resulting lack of clarity, and which tokens can be considered cryptocurrencies. securities.

Congressman Ritchie Torres asked the SEC chairman about the difference between a ticket to a baseball game, which gives access to said game, and a non-fungible token (NFT) which gives access to a web series, like Stoner Cats.

Although Gensler confirmed that the ticket is not a security, he responded with his usual statement regarding the importance of the circumstances surrounding the offering and that a specific case cannot be used to measure what may be defined as a security token.

Notably, the entity behind the Stoner Cats collection received settled the SEC charges in September 2023, agreeing to a cease and desist order and payment of $1 million as a civil penalty.

Additionally, Congressman Tom Emmer claimed that Gensler abused the regulator’s enforcement tools and ignored crypto companies eager to comply with the regulator. Emmer added that the SE president created the term “crypto asset security” without providing clear lines on how to define it.

Share this article