Editor’s note: Field notes is a series in which we report from the ground on important industry, research and other events. In this edition, we bring together quick observations from the team at Korean Blockchain Week (KBW) 2025which took place from September 22 to 28 in Seoul, Korea. The a16z crypto team was also present there last year, where founding general partner Chris Dixon spoke at the launch event and spear the Korean edition of Read Write Own (writing here by the Korean news agency Yonhap).

The big picture

Korea has massively modernized and expanded its economy over the previous decades, creating a consumer base that is digitally native and enthusiastic about adopting the latest technologies. The country is also currently home to one of the largest centralized cryptocurrency exchanges (UPBit) in the world. Koreans are currently not subject to capital gains taxes on crypto, which could encourage higher trading volumes and speculation there, especially since gambling is illegal for Korean citizens. (A team member reported that their Uber driver was swapping criminals while stopped at a traffic light during KBW2025.)

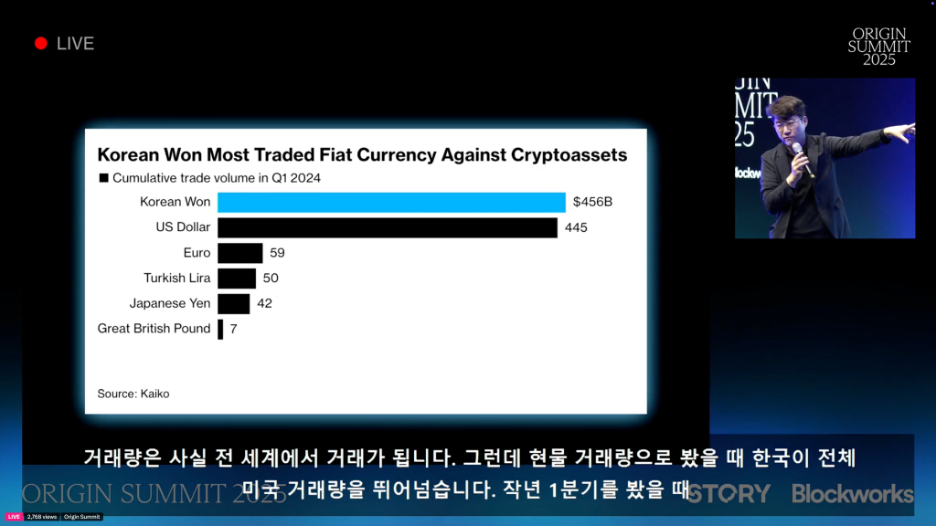

SY Lee 님, CEO and co-founder of Story Protocol, highlighted during the Origin Summit that, according to Kaiko, the Korean won trades against crypto more than any other currency, including the US dollar:

(There is even a phenomenon called “kimchi premium” which refers to tokens trading on Korean exchanges at a premium over other international exchanges due to the scale of demand.)

During KBW2025, Naver – South Korea’s largest internet portal – also announced its acquisition of UPbit (which was completed in a full share swap between NAVER Financial and Dunamu, the operator of Upbit, as confirmed by Blockworks). This is one of several steps the exchange has been involved in to become a superapp. They are also reportedly exploring a stablecoin in the local currency, KRW.

The opportunity

Not only does Korea have a young and extremely online consumer base that fuels the adoption of new technology products, but as SY summarizes in his presentation, Korea has the second highest paid ChatGPT subscription in the world behind the United States. And more broadly on a cultural level, the country has: the #1 YouTube video of all time, the #1 boyband, the #1 movie, the most viral soundtrack and the #1 show on Netflix.

The intersection between the crypto industry and broader culture was reflected during Korea Blockchain Week, with k-pop stars, athletes and others (including the directors of KPop Demon Hunters) participating in events. Compared to other conferences, there were also many local attendees – not just the traveling crypto community attending the conferences – at KBW2025.

Notes on placing on the market

Korea being very favorable to companies of Korean origin (see the omnipresence of Naver on Google Maps), have a presence on the ground and making an effort to align with the local ecosystem is important for success launch products there.

The founders must come in person in Korea for business development as well, given the emphasis on local culture and relationships. There is also less talk about the technology behind the underlying protocols – and more focus on the legitimacy coming from the underlying protocols. partnerships and local product launches.

It should also be noted that more traditional marketing is important in Korea because so few users are currently on-chain directly. There are clearly many Koreans interested in crypto, spanning all age groups and genders; but many women also control family finances and are not on Crypto Twitter.

On the marketing side, gifts — gifts, collectibles, tokens, etc. — are extremely popular in Korea. Each booth at KBW2025 was themed around a giveaway or raffle, and attendees were all patiently lining up to enter. Korean crypto users also expect airdrops.

The founders have a great opportunity to spend time in Korea, learn about the culture and consumers, and make their products available there. We also help our portfolio companies grow in Asia through regional partnerships and community development.

***

The opinions expressed herein are those of the individual staff of AH Capital Management, LLC (“a16z”) cited and are not those of a16z or its affiliates. Certain information contained herein has been obtained from third party sources, including from portfolio companies of funds managed by a16z. Although it is from sources believed to be reliable, a16z has not independently verified this information and makes no representations as to the current or continuing accuracy of this information or its suitability for any given situation. Additionally, this content may include third-party advertisements; a16z has not reviewed these advertisements and does not endorse any advertising content contained therein.

The opinions expressed herein are those of the individual staff of AH Capital Management, LLC (“a16z”) cited and are not those of a16z or its affiliates. Certain information contained herein has been obtained from third party sources, including from portfolio companies of funds managed by a16z. Although it is from sources believed to be reliable, a16z has not independently verified this information and makes no representations as to the current or continuing accuracy of this information or its suitability for any given situation. Additionally, this content may include third-party advertisements; a16z has not reviewed these advertisements and does not endorse any advertising content contained therein.

You should consult your own advisors on these matters. References to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. Furthermore, this content is neither intended nor intended for use by investors or potential investors, and cannot in any way be relied upon in making a decision to invest in any fund managed by a16z. (An offer to invest in any a16z fund will be made only by the private placement memorandum, subscription agreement and other relevant documents of such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, discussed or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar features or characteristics. results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not authorized a16z to publicly disclose as well as unannounced investments in publicly traded digital assets) is available at

The content is only valid as of the date indicated. Any projections, estimates, forecasts, objectives, outlooks and/or opinions expressed in these materials are subject to change without notice and may differ from or be contrary to the opinions expressed by others. Please consult for additional important information.