Kraken reportedly aims to list its shares on a US exchange as early as the first quarter of 2026, joining Coinbase, Gemini and Bullish on the public markets. As Bitcoin and major altcoins trade sideways, money continues to flow into crypto stocks and mergers, with $8.6 billion in crypto M&A deals recorded in 2025. This shift suggests that even as token prices cool, the business side of crypto is heating up again.

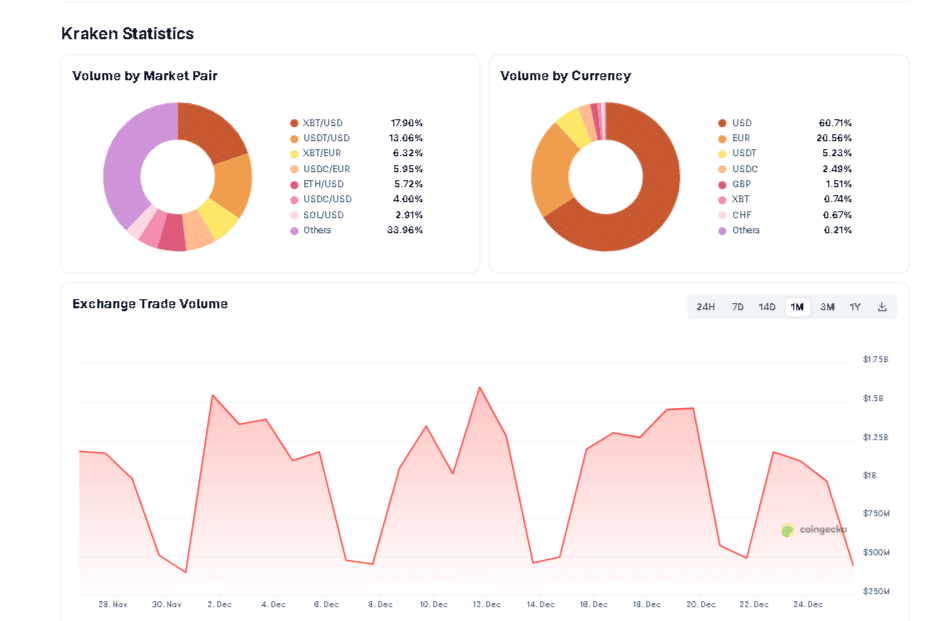

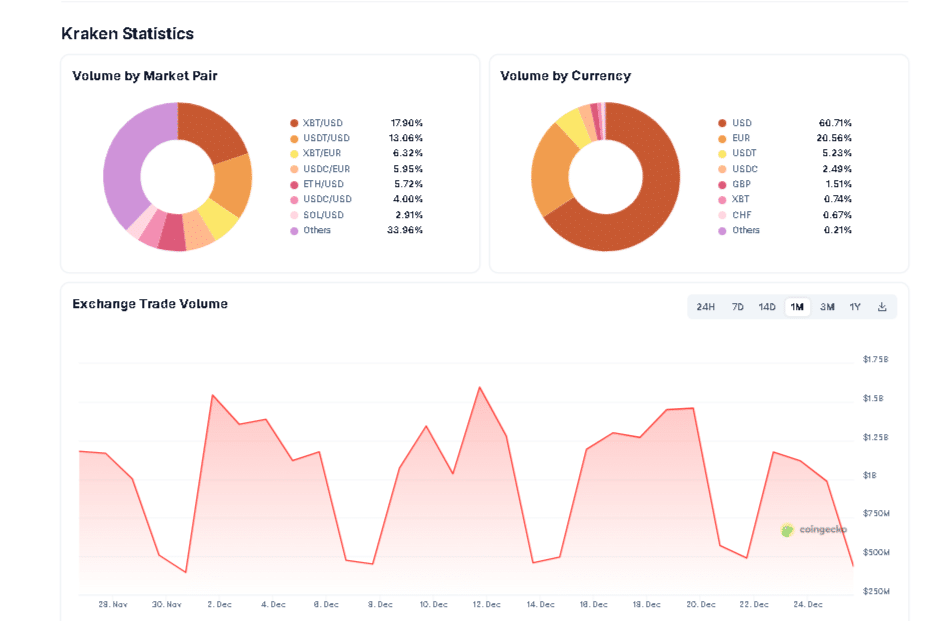

(Source – CoinGecko, Kraken)

Although Kraken’s IPO target is the first quarter 2026 window, the real story is in the private books. Kraken is reportedly finalizing a $500 million pre-IPO round this month, targeting a valuation of $15 billion. This is a significant jump from its 2022 valuation and suggests that Wall Street is already pricing in the “regulatory thaw” following the rejection of the SEC’s action.

Will a Kraken IPO Really Spark Another Bull Run?

Think of an IPO (IPO) as a company opening its doors to ordinary stock investors for the first time. Kraken, one of the oldest crypto exchanges, now wants to sell shares on a traditional stock market, the same way big banks jumped into crypto and brought a new cachet of seriousness to the sector. Kraken is eyeing an IPO as early as 2026, following the easing of pressure from U.S. regulators and the SEC dropping a high-profile lawsuit.

This timing is important. In 2025, crypto companies completed approximately $8.6 billion in transactions, including Kraken’s acquisition of futures platform NinjaTrader for $1.5 billion, as reported by the Financial Times. This type of transaction flow suggests that big players continue to invest heavily in crypto infrastructure, even when token charts look unattractive.

We are also seeing a wave of other registrations. Circle, the company behind the USDC stablecoin, listed on the NYSE in June 2025, and exchanges like Gemini and Bullish also went public. For you, as a retail investor, this opens up a second path into crypto: you can buy shares of the companies that operate the rails, not just the coins themselves.

DISCOVER: 20+ next cryptos that will explode in 2025

How Could Kraken’s IPO Shape the Next Crypto Cycle?

Every crypto cycle has a story. Previous cycles focused on Bitcoin halving and pure speculation. This intermediate cycle resembles a “Wall Street build,” where exchanges, stablecoin issuers, and mining companies list on exchanges and raise regulated capital. That aligns with the broader debate we cover regarding the crypto market. path to 2026.

When a major exchange lists, it sends a simple message to traditional investors: crypto is not going away. Public companies are required to publish audited financial statements, follow strict disclosure rules and report to regulators. This transparency gives pension funds, asset managers and even ETF providers greater confidence to increase their exposure to the sector over time.

The regulatory context is also changing. A bipartisan US proposal aims to shift oversight of many crypto exchanges to the CFTC, recent reports highlight. More predictable rules tend to attract larger, slower-moving capital, which alleviates some of the chaos we see in purely unregulated markets.

For you, that means more ways to express your views on crypto. You can hold Bitcoin directly. You can buy stablecoins like USDC which sit at the center of this new structure. You can also own shares in exchanges and infrastructure companies that could benefit from a return in trading volume.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Could Reach 1000x in 2025

What are the risks for regular investors when crypto goes public?

Here’s the uncomfortable part: a Kraken IPO doesn’t guarantee that its stock will perform well or that token prices will rise. Coinbase’s 2021 IPO looked like a triumph at the top of a bull run, then the stock crashed as the cycle turned. Cryptocurrency-related stocks still trade as high-beta technologies. When Bitcoin sneezes, they catch a cold.

Public listings can also cause beginners to become overconfident. A ticker tape and a Wall Street listing number do not turn a crypto business into a safe bond. Revenue depends on volatile transaction volumes. Regulatory rules may still change. Hacks, outages, or legal disputes can directly impact exchange profits.

So how do we approach this safely? Treat crypto company stocks the same way you treat altcoins: understand the business model, read the earnings reports, and remember that they correlate with the broader crypto cycle that we explore in our coverage of US regulations and our articles on the 2026 supercycle debate.

Kraken’s push into public markets shows that the enterprise layer of crypto is maturing, even as prices fluctuate. If you stay curious, manage risks, and focus on education rather than FOMO, you can continue this mid-cycle progression without losing any sleep.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Follow 99Bitcoins on X for the latest market updates and subscribe on YouTube for daily market analysis from experts

The post Kraken IPO Plan Signals New Mid-Cycle Push for Crypto appeared first on 99Bitcoins.