In cryptocurrency trading, risk management isn’t just a backup plan; it’s a critical strategic element. That’s why we’re excited to introduce Kraken Pro’s new take profit/stop loss orders on futures trades, allowing you to predefine your exit points Before you submit an order.

Sometimes called “bracket” or “conditional*” orders, these are sophisticated methods that impose discipline, ensuring that profits are made and losses are contained.

But what makes it a favorite among advanced traders is not just its functionality, it is its ability to automatically turn strategy into action, allowing traders to sleep a little easier at night.

*If we’re being really picky, these are OTOCO (One-Triggers-a-One-Cancels-the-Other) commands, but that’s a mouthful!

Understanding take profit/stop loss (TP/SL)

So yes, you could You already have separate take profit (TP) and stop loss (SL) orders set in Kraken Pro. But take profit/stop loss orders make this much more convenient.

These are advanced conditional orders that automatically place simultaneous take profit and stop loss orders. linked to a primary order. This automation ensures that no matter which direction the market goes, exit strategies are already in place to capture profits or mitigate losses at predefined prices.

It is important to note that if the TP or SL is triggered, the other order will be automatically cancelled. You do not have to worry about manual cancellation. This feature is known as One Cancels the Other (OCO).

Using Take Profit/Stop Loss in Kraken Pro

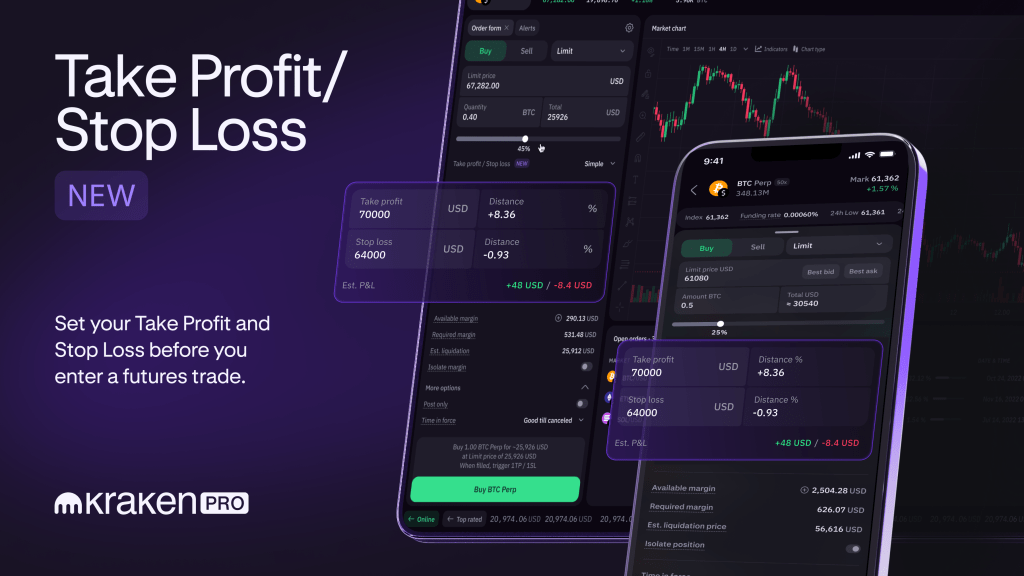

You can now find the take profit/stop loss option in the Kraken Pro order form widget when a futures market is selected on the web and mobile app:

1. Selecting the trigger price:

- In the order form widget, after selecting a futures market, you can configure your take profit/stop loss orders.

- Choose your trigger based on reference price, last price or index price, depending on your trading strategy and market analysis.

2. Defining the matched distance and trigger price:

- Set the paired distances for TP and SL from the entry point. This simplifies the process of determining the distance between your targets and your opening price. You can also visually adjust the placement by dragging the order preview levels on the chart.

- Use the built-in preview feature to see estimated profit and loss scenarios based on your specified parameters.

Integrating TP/SL into a Futures Trading Strategy

Here are some examples of how an advanced futures trader might use TP/SL:

- Defining entry and exit points based on technical analysis

- Before entering a position, a Kraken Pro trader develops his thesis on how he thinks the market will move using technical analysis indicators and clearly identifies his upside price target for the trade if the market moves favorably.

- Conversely, they also identify the downward price level from which their thesis is invalidated.

- The trader uses a TP/SL order to define his entry as well as predefined exit points based on the levels he identified above.

- Optimizing the risk/reward ratio

- A trader tends to follow a strict risk/reward ratio for each trade setup.

- They identify a market structure that they believe is a good entry point.

- Using the estimated PnL function in TP/SL, they can calibrate the risk they are willing to take on the trade by determining the percentage of lag from their entry, in order to maintain a favorable risk/reward ratio in accordance with their trading plan.

TP/SL provides Kraken Pro futures traders with optimized risk management to capture profits and mitigate losses. By leveraging TP/SL to predefine exit points and assess risk/reward ratios, clients can plan their strategies in advance. And make sure they are executed accurately, all in one request.

As always, our dedicated support team is available to guide you and answer any questions you may have.

These materials are provided for general informational purposes only and do not constitute investment advice, or a recommendation or solicitation to buy, sell, stake, or hold any cryptoassets, or to participate in any specific trading strategy. Kraken makes no representations or warranties, express or implied, as to the accuracy, completeness, timeliness, suitability, or validity of this information and will not be liable for any errors, omissions, or delays in this information or for any losses, injuries, or damages resulting from the display or use of it. Kraken does not and will not work to increase or decrease the price of any particular cryptoasset that it makes available. Certain crypto products and markets are unregulated and you may not be protected by government compensation and/or regulatory protection schemes. The unpredictable nature of the cryptoasset markets may result in the loss of funds. Tax may be payable on any return and/or increase in the value of your crypto assets and you should seek independent advice on your tax position. Geographic restrictions may apply.

Trading futures, derivatives and other instruments using leverage involves an element of risk and may not be suitable for everyone. Read the Kraken Futures risk statement to learn more.