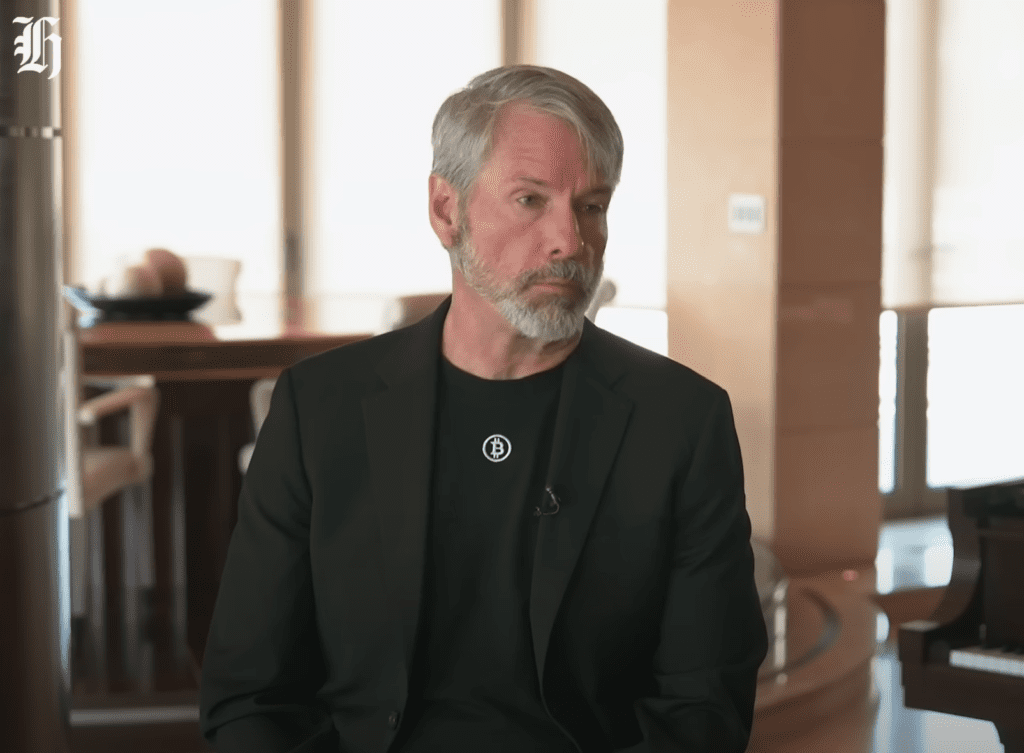

In a segment, Fox News’s contributor Lara Trump – Wife of Eric Trump, son of US President Donald Trump – asked Michael Saylor about the increasingly essential role of bitcoin in the global financial landscape. Often praised as a “Bitcoin evangelist”, Saylor told his initial skepticism towards the BTC, explained why he finally chose to bet as a digital organ, and provided a vision of the way in which the wider adoption could reshape economic systems, both in the United States and internationally.

Lara Trump meets Bitcoin Bull Saylor

During the discussion, Saylor retraced his introduction to Bitcoin in 2013, when he considered it “a quirk”. It was not until 2020 – Amid what he described as an “existential crisis” in his business – that he turned into Bitcoin as a means of preserving and potentially increase the value of companies.

Explaining his point of view, Saylor noted: “I realized that I was going to have a rapid death or a slow death where I had to take a risk and transform the business. So what we have done is that we are looking for something like digital gold that we could buy from our company’s balance sheet which would save the business and give us a future. »»

Although microstrategy is mainly known for business analysis software, Saylor has swiveled in a Bitcoin strategy at a time of increased uncertainty on global markets. This decision, he said, was motivated by the conviction that the standard financial system based on Fiat offered insufficient protection against economic shocks.

An important part of the interview was centered on the reason why Saylor considers that Bitcoin is a logical improvement in physical gold. He underlined the fixed supply of the assets – ended at 21 million parts – his portability and his verifiable property through decentralized networks: “How do you improve gold?” You do it digital so that I can send it from New York to Tokyo in a few minutes. (…) There are only 21 million bitcoins – 21 million forever. You can take it with you. No one can move it away.

Saylor argued that Bitcoin works less as a speculative investment and more as a savings vehicle – to put money in a bank, but without intermediaries which can freeze or retain funds. “And if you just wanted to save your savings and put it in a bank in the cyberspace which promises to never freeze your funds, which is not managed by humans, it is managed by incorruptible software?” He asked.

He described the creation of Bitcoin by the pseudonym Satoshi Nakamoto as “a reaction to the great financial crisis” of 2008-2009, when confidence in traditional banks and the currencies supported by the government vacillates. This historical context underpins Saylor’s point of view according to which Bitcoin, unlike previous attempts at digital money, has successfully established itself as “sovereign money” apart from the control of a single entity or government.

At one point, Lara Trump asked Saylor to clarify how he distinguished Bitcoin among the sea of alternative cryptocurrencies. Saylor noted: “When I started looking for digital gold, I saw that there were 10,000 different cryptography networks. (…) What is the winner? What is sure? (…) The largest and the most precious seems to be bitcoin. Was it copied? Can it be copied? Well, he had been copied 10,000 times and they all failed. »»

According to Saylor, the domination of the Bitcoin market and transparent monetary policy make it the “secure choice”. He also underlined the unique moment when its creator, Nakamoto, has actually disappeared, renouncing any pretension to control or property. In Saylor’s words, “It’s my gift. It’s sovereign money.

The appearance of Saylor at the top of the White House cryptography was also a focal point of the interview. Saylor stressed the importance of the summit to guide American policy to adopt technologies of emerging digital assets: “If we want to make America again large, we must do it with creativity, with imagination, innovation, with inspiration. (…) This administration (…) believes that we can grow and innovate our way to a better world. We can create digital tokens that 40 million companies can emit overnight and they can collect 10 billions of dollars in order to engage in capital creation and innovation. »»

Speaking on the Bitcoin Strategic Reserve Reserve Order by President Trump, Saylor said: “If the United States government is starting to hold it in a strategic reserve, the beneficiary will be America.” Saylor has also urged the creation of clear legal paths so that American companies emit digital tokens, digital titles and digital currencies – saying that such executives transform the United States into “bankers in the world”.

When asked what he would say to President Trump to do for the cryptography sector, Saylor replied that the former president had already “done the first thing” by “highlighting (ING) Bitcoin as a value store, in digital gold”. But Saylor also wants federal approval to extend more: “The second thing is to support the creation in law from a legitimate path for issuers in the United States to issue digital tokens, digital titles and digital currency.”

Asked about five, 10 or even 100 years of future, Saylor expressed his confidence that large technological companies – Apple, Google, Microsoft, Amazon – will integrate Bitcoin custody and transactional capacities in their software and services. He predicted: “I think the banks will embrace the families of Bitcoin (…) will start more and more like their savings account. The Yoga studio, the restaurant, the hotel chain – they will be able to raise capital to improve their business and innovate. »»

At the time of the press, BTC exchanged $ 83,226.

Star image created with dall.e, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.