While Ethereum has moved back above the $3,500 price mark, fresh buying pressure is seen around the leading digital asset. Small and large investors or traders are starting to buy the altcoin at a rapid pace, which indicates strategic positioning of investors.

Top-tier investors regularly buy ETH

Following the recent rebound of the price of Ethereumseveral investors are showing new interest in the leading altcoin. Prime’s report on X revealed that this new buying pressure is particularly evident among high-profile players, also recognized as whale investors in the crypto landscape.

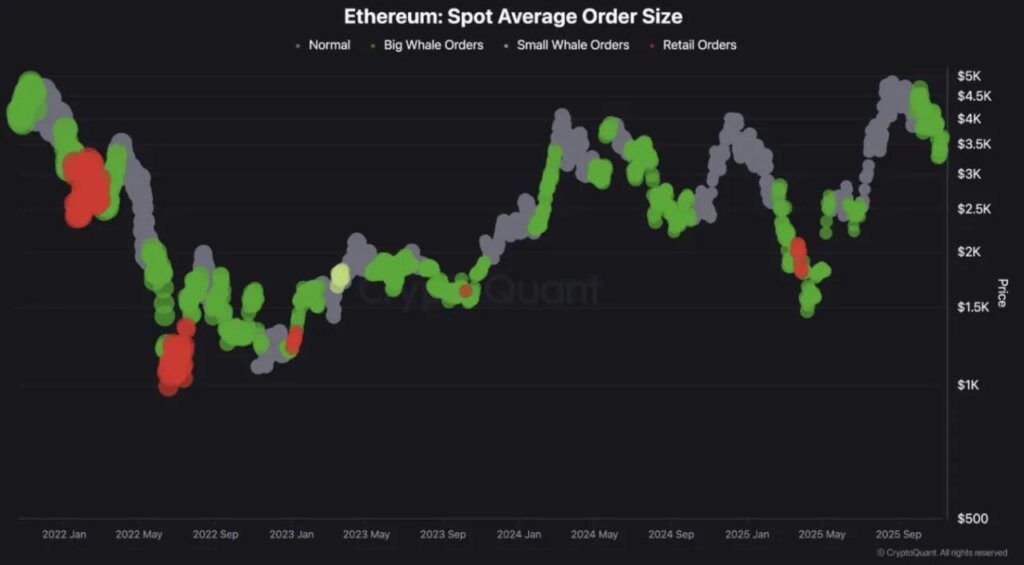

According to Ethereum Spot average order size data, ETH whale investors are quietly returning to the gradually bullish crypto market. This indicates a clear shift in whale action, with large wallet addresses again accumulating ETH after several weeks of outflows and fear.

The renewed interest from deep-pocketed investors coincides with ETH’s gradual recovery from the recent pullback, indicating that whales view current levels as an attractive long-term entry point rather than a sign of weakness. As accumulation among large investors increases, this suggests that smart money could be preparing for ETH’s next major breakout.

It is worth noting that this buying pressure from the big players is at the $3,200 price level. Prime said the whales are taking advantage of the fall in the price of Ethereumbecause they buy the altcoin at a low price.

The continuation of this whale acquisition is likely to boost the expected rally. Meanwhile, the next possible target for ETH is between $4,500 and $4,800 if the $3,000 to $3,400 range is reached. support zone remains strong.

Companies are still betting on ETH

This heavy accumulation by large players is evident in the persistent purchasing of the asset by institutional firms such as Bitmine Immersion. Institutional adoption and interest appears to be growing alongside the brief rise in ETH price.

Ash Crypto, market analyst and investor, has reported a massive new Ethereum acquisition linked to the leading treasury asset company. Data shared by the market analyst reveals that the company purchased over 23,521 ETH, worth around $82.8 million, at the start of the new week. “Tom Lee wants all your Ethereum,” Crypto added.

In another postAsh Crypto highlighted that Bitmine Immersion acquired ETH worth more than $400 million last week. Such heavy and persistent buying actions underscore the company’s unwavering belief in the altcoin’s long-term prospects. Bitmine’s continued accumulation stands out amid this period of conflicting market sentiment, indicating that the company believes ETH’s next phase of growth may be far from over.

Amid the buying pressure, the latest readings of the Ethereum Fear and Greed Index show that the market is sliding firmly towards fear levels. A move into the Fear Zone signals growing anxiety due to the current volatile state of the broader cryptocurrency market.

Featured image from Pxfuel, chart from Tradingview.com

Editorial process as Bitcoinist focuses on providing thoroughly researched, accurate and unbiased content. We follow strict sourcing standards and every page undergoes careful review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance and value of our content to our readers.