Chain data show that major Ethereum investors have added to their assets recently, a panel that could be optimistic for the price of ETH.

Ethereum big holders Netflow has become recently positive

In a new article on X, the intelligence platform of the Intotheblock market has spoken of the trend of major Netflow for Ethereum holders. This metric measures the clear quantity of the cryptocurrency which moves in or out of the wallets controlled by large supports.

The analysis company defines three categories for investors: retail, investors and whales. Retail members hold less than 0.1% of the supply of their balance, that of investors between 0.1% and 1%, and that of whales of more than 1%.

At the current exchange rate, 0.1% of ETH’s offer, the threshold between retail and investors, is worth more than $ 214 million, a very substantial amount. This means that the addresses that are able to qualify for investors are already quite important, not to mention those who have reached the whales.

As such, the major holders, the real cohort of interest in the current discussion, includes these two groups. Thus, the large Netflow holders keep a trace of the transactions linked to investors and whales.

When the value of this metric is positive, this means that large money investors on the network receive a net number of deposits in their portfolios. On the other hand, it is under the brand zero suggests that these key holders participate in the net sale.

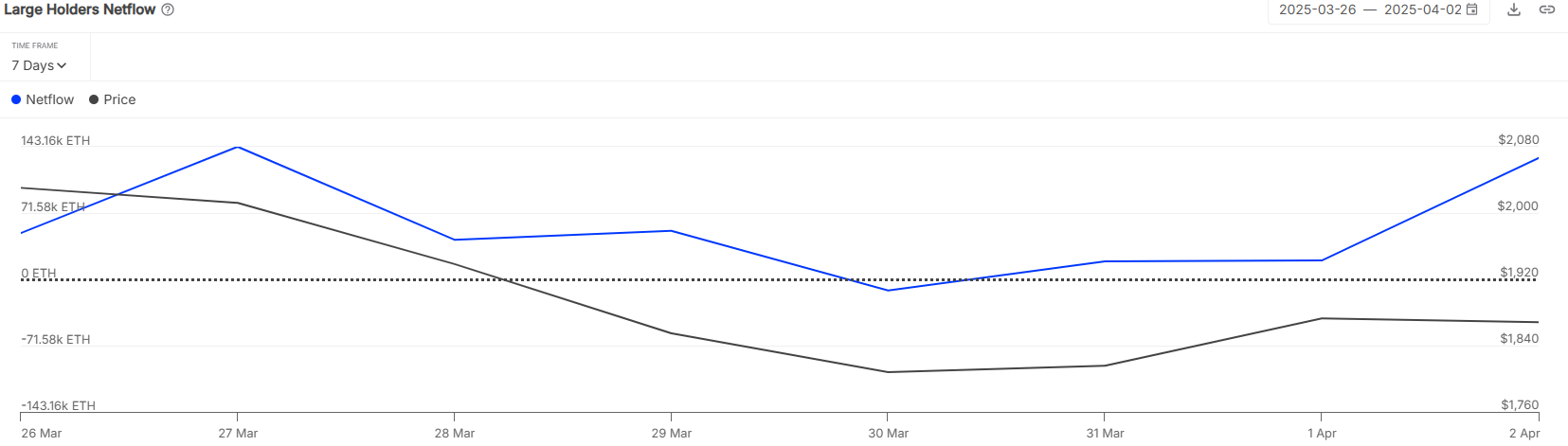

Now here is the graph shared by Intotheblock which shows the trend of the big holders of Ethereum Netflow during last week:

The value of the metric appears to have been positive in recent days | Source: IntoTheBlock on X

As it is visible above, the major holders of Ethereum Netflow remained almost entirely on the positive territory for the graph period, which implies that investors and whales have accumulated. Only the second of the month, these key entities were taken care of on a net of 130,000 ETH (around $ 230 million).

The net entries for the big holders came while the cryptocurrency decreased, it is therefore possible that this cohort believes that recent prices have offered a profitable entry into the asset. It now remains to be seen whether this accumulation would be sufficient to help ETH reach a background or not.

In some other news, Ethereum costs have been due to the lowest level since 2020 this quarter, as the analysis company pointed out in another post X.

The changes that occurred in key ETH metrics during the first quarter of 2025 | Source: IntoTheBlock on X

After a sharp drop of 59.6%, the total Ethereum transaction fees is down to $ 208 million. According to Intotheblock, this trend is “mainly driven by the increase in the gas limit and transactions passing to L2S”.

Ethn price

Ethereum experienced more than $ 1,900 earlier in the week, but it seems that the optimistic momentum has already exhausted while the room is back at $ 1,770.

Looks like the price of the coin has plunged recently | Source: ETHUSDT on TradingView

Dall-E star image, intotheblock.com, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.