Key notes

- CoinShares reported a record inflow of $5.95 billion in digital assets, the highest weekly total on record.

- Bitcoin ($3.55 billion), Ethereum ($1.48 billion) and Solana ($706.5 million) led the rise.

- Bitcoin and Ethereum ETFs saw combined inflows of $4.54 billion.

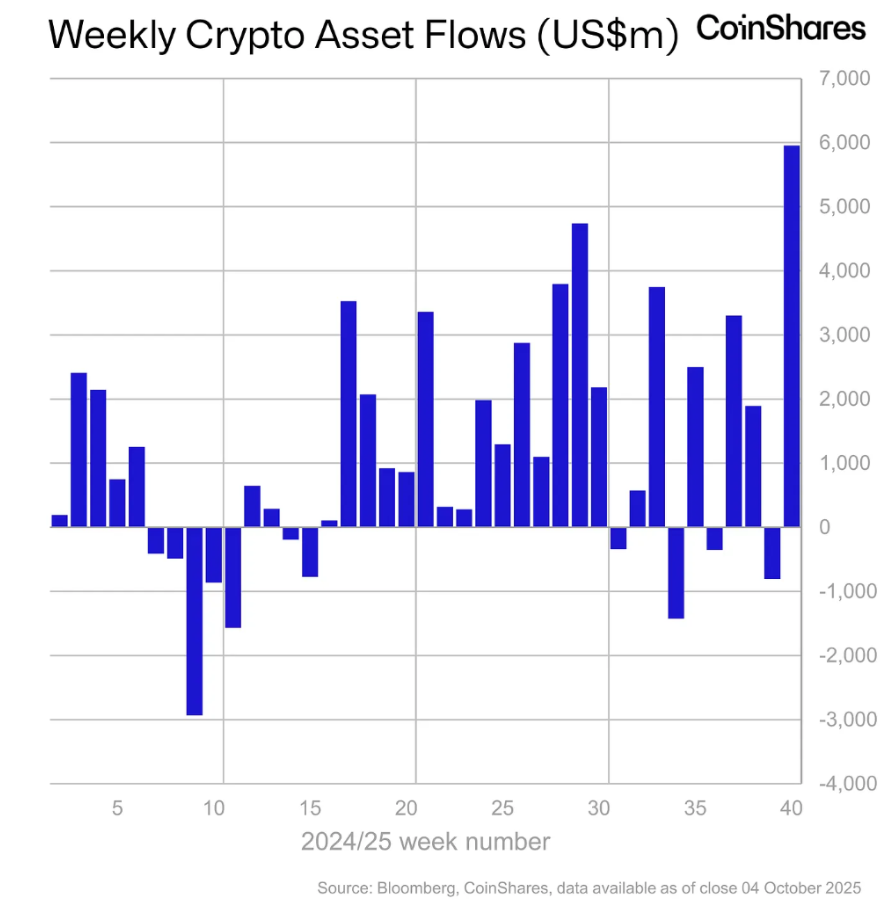

Digital asset investment products saw a massive surge in demand last week, with CoinShares reporting a record inflow of $5.95 billion, the largest weekly total on record.

CoinShares said the flows were a late reaction to weak U.S. jobs data, the Federal Reserve’s recent rate cut, and growing concerns about the stability of the U.S. government. amid closure fears.

According to Coin Sharesthe United States led the wave, attracting $5 billion in new investment, a new all-time high. Switzerland followed with $563 million, also a record, while Germany recorded $312 million in admissions, marking its second biggest week on record.

Weekly Crypto Asset Entries | Source: CoinShares

Bitcoin, Ethereum and Solana lead the charge

Bitcoin

BTC

$121,178

24h volatility:

0.7%

Market capitalization:

$2.42T

Flight. 24h:

B$70.99

was the biggest gainer, raking in $3.55 billion in entries, its largest weekly gain on record. Although the price of Bitcoin is approaching new all-time highs, CoinShares noted that investors have shown no interest in shorting products, showing broad bullish sentiment in the market.

Ethereum

ETH

$4,342

24h volatility:

2.5%

Market capitalization:

$525.37 billion

Flight. 24h:

$41.42 billion

followed closely with $1.48 billion in admissions, bringing its annual total to $13.7 billion, nearly triple last year’s figure.

Solana

GROUND

$221.7

24h volatility:

2.3%

Market capitalization:

$121.08 billion

Flight. 24h:

$7.58 billion

also broke records with $706.5 million in weekly inflows, bringing its year-to-date total to $2.58 billion, while XRP

XRP

$2.81

24h volatility:

1.0%

Market capitalization:

$168.59 billion

Flight. 24h:

$5.15 billion

attracted $219.4 million, both setting new milestones.

However, CoinShares noted that other altcoins saw minimal participation, suggesting that the rally remains concentrated among major assets. Overall, this increase brought total assets under management (AuM) for crypto investment products to a record high of $254 billion.

ETF Flows Highlight Institutional Dynamics

From September 29 to October 3, Bitcoin and Ethereum spot ETFs echoed the buIrish sentiment, showing massive influxes.

From September 29 to October 3 (ET), Bitcoin spot ETFs saw a net weekly inflow of $3.24 billion, marking the second-highest weekly inflow in history. Ethereum spot ETFs saw a total weekly net inflow of $1.3 billion, with all nine ETFs posting positive inflows.… pic.twitter.com/MXpPJa3cP2

-Wu Blockchain (@WuBlockchain) October 6, 2025

CockSpot ETFs saw a net weekly inflow of $3.24 billion, the second highest in history, while Ethereum ETFs added $1.3 billion, with all nine US-listed products seeing positive contributions.

“Renewed institutional demand reinforces market dynamics, marking a key shift in capital flows after weeks of capital outflows. Sustained inflows signal strengthening structural support in the fourth quarter,” Glassnode wrote.

Bitcoin hits new all-time high at $125,000

The price of Bitcoin has surpassed $125,000, marking a new all-time high amid the wave of inflows and ETF enthusiasm. However, CryptoQuant warned that market buying volume recently surpassed $25 billion, a metric that has historically preceded trend inflection points.

“In a downtrend, this often marks a buying opportunity. In an uptrend, this tends to act as a selling opportunity,” CryptoQuant said.

CoinShares added that with the Federal Reserve cutting rates and weak U.S. employment numbers, alternative assets like crypto are seeing record inflows.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

A crypto journalist with over 5 years of industry experience, Parth has worked with leading media outlets in the crypto and finance world, gaining experience and expertise in the field after surviving both bear and bull markets over the years. Parth is also the author of 4 self-published books.

Parth Dubey on LinkedIn