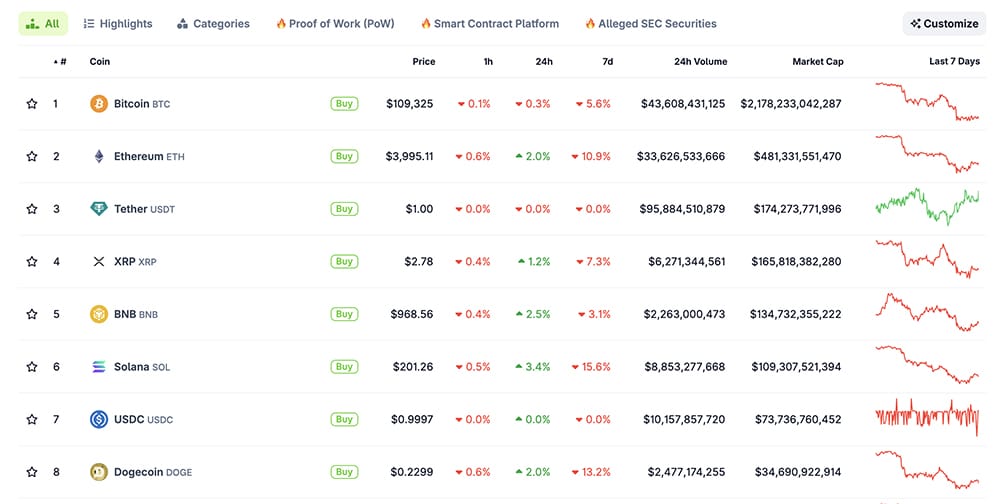

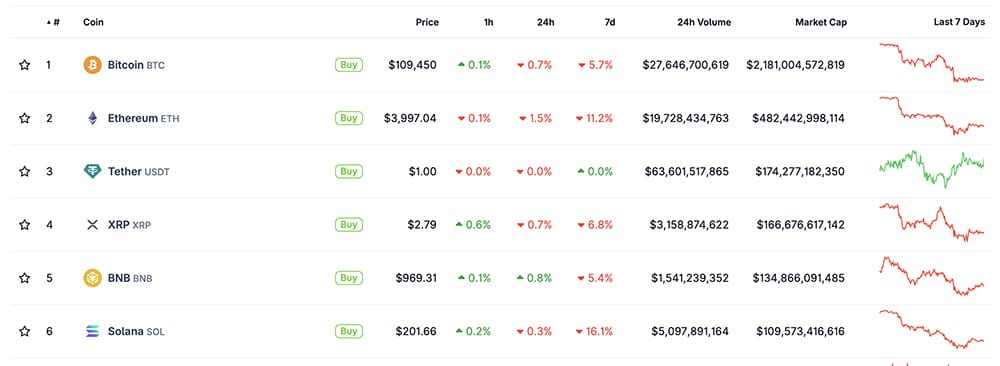

Today, in the latest news, the cryptography market is unexpectedly after the expiration of trading options with high issues of yesterday. The USD BTC pair holds a little less than $ 110,000, a surprise for those who expected brutal volatility. The USD XRP pair shows a minimal movement, because the market atmosphere has complained, despite the crazy news around it.

Ethereum and Solana Usd Pairs both displayed light gains, adding a green shade to what was planned as a chaotic day. Despite a general wait, there was no panic. The current feeling is something that most cryptographic media report today.

DISCOVER: 9+ Best same to buy in 2025

BTC USD and XRP Crypto are in the news today: stability on the shock after the expiration of the negotiation option

Looking at the numbers, we see a clear theme: resilience.

According to Coinglass, BTC ▲ 0.28% The open interest has dropped to $ 77 billion during the expiration, but has already rebounded at $ 78 billion. Big Money is repositioning. The USD BTC pair, which is often the bell tower, acts like a barometer of this calm.

(source – BTC / USD, open interest, coiglass))

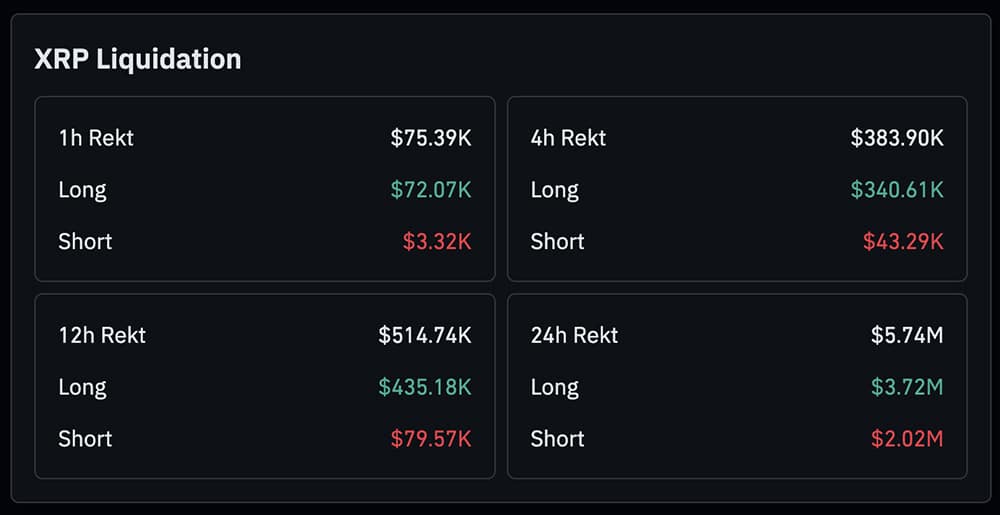

On the Xrp ▲ 2.62% Side, reports that daily liquidations remain less than $ 10 million, unusually silent statistics given the recent market conditions.

(source – Liquidation XRP, Co -Corkends))

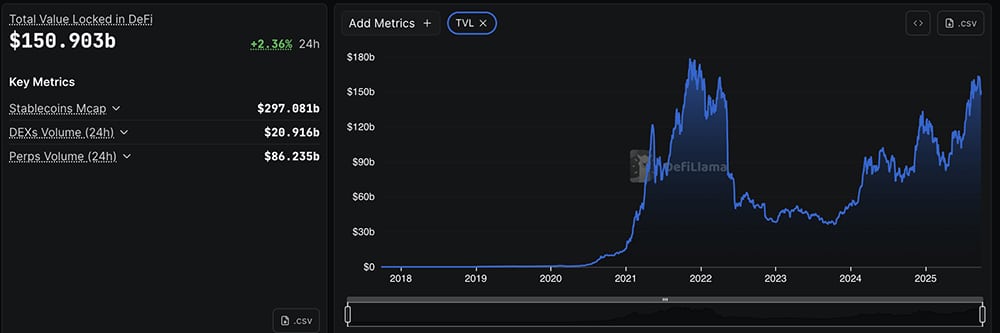

The Defillama data put the total locked value (TVL) on crypto at around $ 150 billion, a marginal weekly increase. It may not seem enormous, but in the context of the low volatility, it means that capital remains and adds.

(source – Defi TVL, defy))

In the meantime, Ethn ▲ 3.12% is in the news today after its financing rates have become positive, displaying a long and detained feeling. Solana, on the other hand, recorded a volume in volume of 5% in the last 24 hours.

Statistics: Ethereum arrives on Dex activity with $ 9.3 billion in volume 24 hours, followed from Solana to $ 6 billion and BSC at $ 5.2 billion. pic.twitter.com/rpv34bs5d7

– Cryptohunt (@ crypohunt47045) September 27, 2025

With the bizarre flattening and the dealers no longer hide aggressively, this calm period could point out a “bullish calm before the storm”.

BTC Dominance holds approximately 58%, which indicates that the market could soon see an Altcoin season.

(source – BTC.D, tradingView))

DISCOVER: 10+ Next Crypto at 100x in 2025

What happens next? Based on trend data, a slow upward version is expected. News on the cryptography market today has a bitcoin up 0.8% in the last 24 hours, Ethereum by 1.2% and XRP increased by 0.5%.

Total liquidations are much lower than $ 150 million, indicating a drop in risk in the system.

The interest open for October is cut bruise, with quince showing $ 78 billion in pending calls. The feeling of the community is always for fear, after weeks of chops.

Meanwhile, the Coingecko ranking shows that altcoins like GROUND ▲ 4.66% And

Bnb ▲ 3.92% are slightly outdated by Bitcoin, which is a good sign for the Altcoin market.

(source – Flirtatious))

This silent phase is misleading. If the macro-waonditions do not aggravate, recovery could happen earlier than expected. The market will be led by BTC, ETH, XRP, while the USD stable stables being struck while the uprights continue to make the headlines.

DISCOVER: Best ICO ICO even to invest in 2025

Join the 99Bitcoins News Discord here for the latest market updates

Crypto fence at regular price today

This Saturday ended with BTC stabilizing at $ 109,000, ETH ending just under $ 4,000. Meanwhile, BNB, Solana and XRP still show major movements.

(source – Flirtatious))

Touch the grass, enjoy the weekend.

Polymarket predicts that BTC USD falls under $ 100,000 by 2026: is this the end?

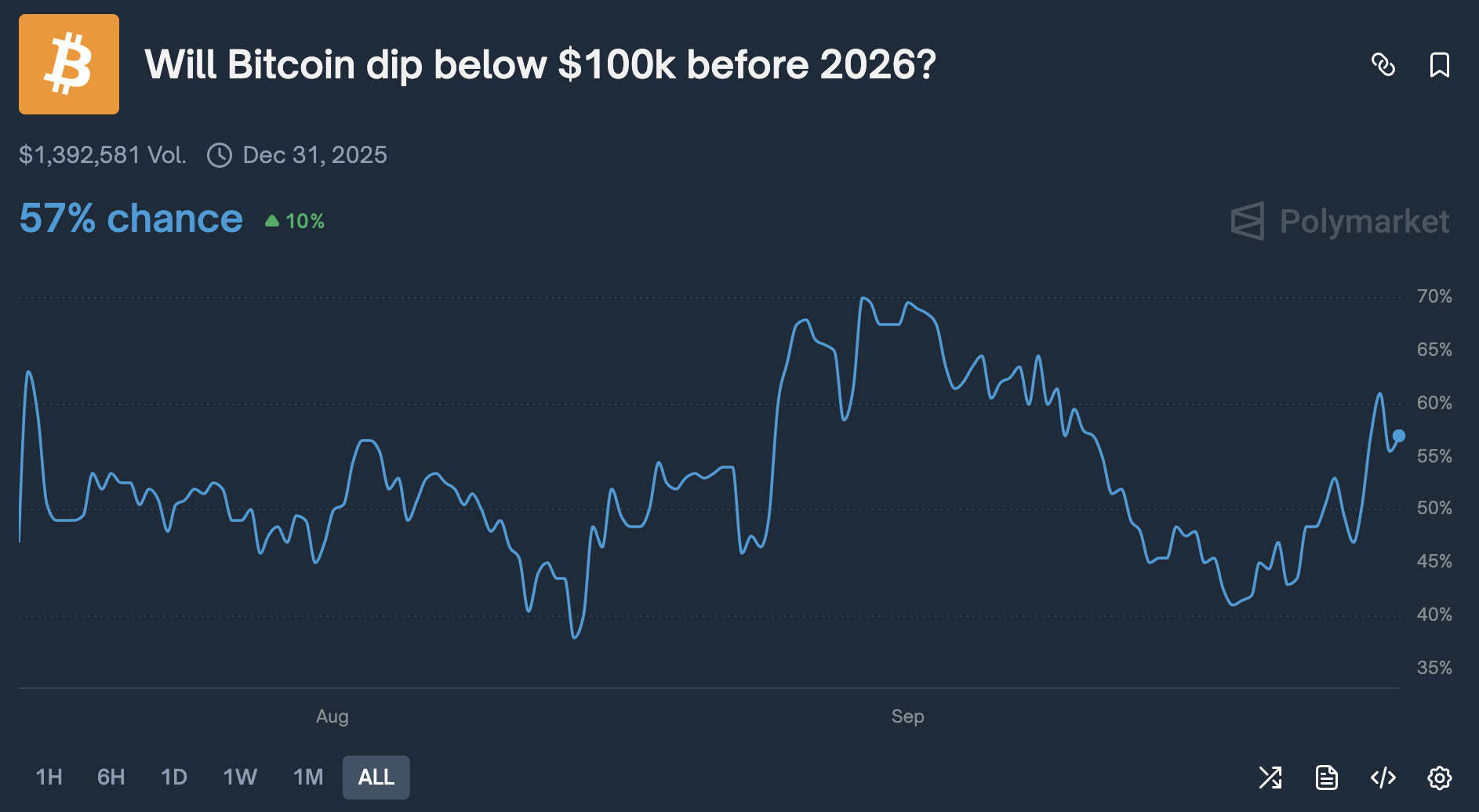

Bitcoin “Will Bitcoin below $ 100,000 before 2026” on the Polymarket prediction platform increased by 10% overnight, and now blurred 57% of “yes”. It occurs while the USD BTC continues to fight in its attempt to recover $ 110,000, highlighting its low short -term short -term action.

All eyes are currently on the monthly fence for Bitcoin. If it enters in October above $ 108,000, its high-time bullish structure will remain intact. However, if it is less than $ 108,000, the fourth quarter could become ugly for the main digital assets and, by proxy, the larger Altcoin market.

(SOURCE: Polymarket))

Read the full story here.

FIRST DIGITAL ID: Has the British book have gone digital? Sterling tokenized explained

British Prime Minister Keir Starmer triggered Fury today when he revealed digital identification plans from the United Kingdom, but do large banks also plan to take the British book (GBP)?

The biggest British banks have launched live tests of “token” digital versions Banking deposits designed for faster and more controlled payments.

(Source – GBP USD, TradingView)

Six lenders, Barclays, HSBC, Lloyds Banking Group, Natwest, Nationwide and Santander, participate in the pilot, who is underway coordinated by UK Finance. The project began on September 26 and will take place until mid-2026.

The tests are focused on three use cases: market payments, Remortgaging and the regulation of digital assets.

According to UK Finance, the objective is to reduce fraud, speed up the regulations and give customers more control over how money moves.

This marks one of the most important steps to date in the push of the United Kingdom to programmable money. Instead of creating a new currency, tokenized deposits work as digital representations of money already held in banks.

We expect them to play a central role in the wider strategy of the country’s digital finance, seated alongside the work of the Banque of England on digital money and titles.

Discover: 9+ best high -risk crypto and high reward to buy in 2025

Read the original piece here.

The post last Crypto Market News Today, September 27: BTC, Ethereum, XRP, Solana Usd Pairs Stable, what is the next step for the crypto? appeared first on 99Bitcoins.

Statistics: Ethereum arrives on Dex activity with $ 9.3 billion in volume 24 hours, followed from Solana to $ 6 billion and BSC at $ 5.2 billion.

Statistics: Ethereum arrives on Dex activity with $ 9.3 billion in volume 24 hours, followed from Solana to $ 6 billion and BSC at $ 5.2 billion.