Nine of the largest European banks, notably ING, Unicredit, Danske Bank, Seb, KBC, Dekabank, Banca Sella and Raiffeisen Bank International – have decided to collaborate on a stablecoinde supported by the Euro. As part of the European Union market regulation (EU) regulation as part of the Crypto-Sets Regulation (MICA), collaborating banks will deploy the Stablecoin in the second half of 2026. Will this change the situation for European cryptography payments? Will the stablecoin supported by the euro reduce the dependence of Europe with regard to staboins labeled in US dollars?

On September 25, 2025, ING published the joint declaration confirming that “the initiative will provide a real European alternative to the Stable Stables market at American home, contributing to strategic autonomy in Europe in terms of payments.”

According to banking giants, Stablecoin will provide low -cost and low cost payments and payments. In addition, it will allow 24/7 access to effective cross-border payments, programmable payments and improvements in supply chain management and digital asset establishments, which may vary from securities to cryptocurrencies.

Breakup

Nine European banks combine to launch a stable Eurocoin Eurocoin compliant with mica, with a target start in 2026.

Traditional finance locks digital money for the euro zone.

pic.twitter.com/w967mjw3gr

– Dustybc Crypto (@thedustybc) September 25, 2025

Discover: 20+ Next Crypto to explode in 2025

“Digital payments are essential for new payments denominated in euros and financial market infrastructure”

Member banks have clearly indicated – they are open to new members. Consequently, additional banks should join the nine of origin.

“This digital payment instrument, taking advantage of Blockchain technology, aims to become a European payment standard for trust in the digital ecosystem,” said the joint declaration.

The project is interestingly led by a newly formed company based in the Netherlands. He will request licenses and monitoring from the Dutch central bank, positioning himself as an “electronic weapon institution”.

Floris Lugt, digital assets lead to ING and the joint public representative of the initiative said that “digital payments are essential for new payments linked to the euro and financial market infrastructure. They offer significant efficiency and transparency, thanks to the programmability features of Blockchain technology and 24/7 and 7/7.

“We believe that this development requires an approach to the industry level, and it is imperative that banks adopt the same standards,” he added.

DISCOVER: Next crypto 1000x: 10+ Crypto tokens which can strike 1000x in 2025

The new European directives have strengthened the demand for stablescoins supported by the euros

An analysis in 2024 of Kaiko Research revealed that even if Europe has traditionally delayed the United States and the APAC with regard to crypto trade, the stablescoinds supported by the euro have constantly increased in volume since the beginning of the year. This concretely suggests that the request for Stablecoin is finally resumed in the European markets.

In particular, the Stablecoin USDC de Circle should obtain substantial market share of its largest rival, USDT de Tether, found Kaiko. Anastasia Melachrinos, analyst at Kaiko Research, stressed that the USDC could potentially benefit from the new European directives.

Explore: 9+ High risk crypto at high risk to buy in 2025

Key dishes to remember

-

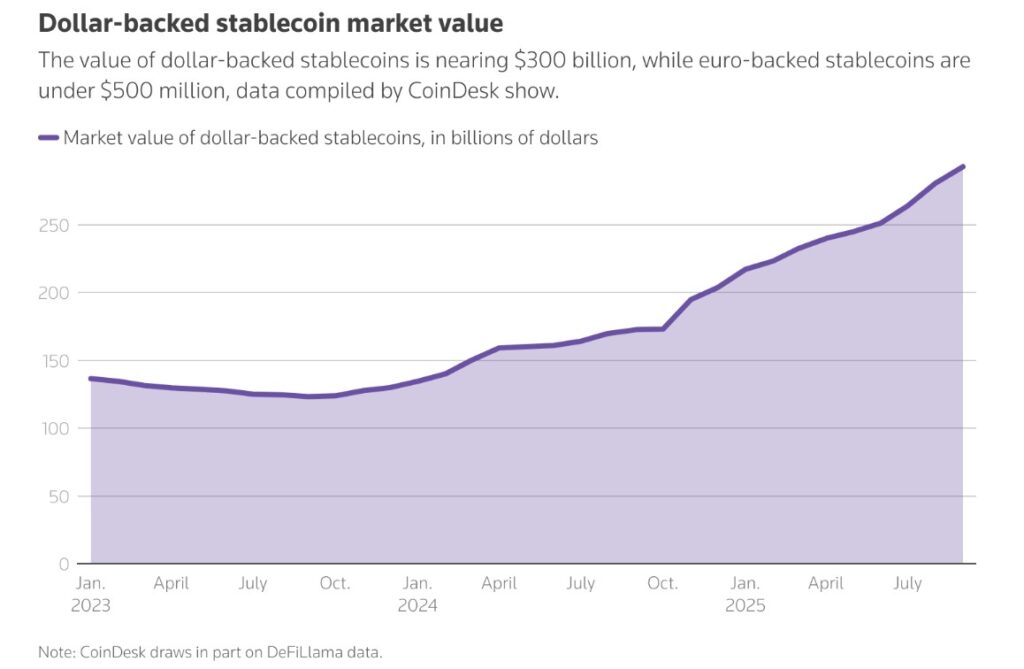

Stablecoin to support the euro should reduce the dependence of Europe towards the stablescoins labeled in US dollars – which are currently dominating the world market.

-

The Stablecoin euro aims to allow payments and low -ended regulations at low ends through borders, available 24/7.

The launch of the stablecoin station supported by Euro in H2 2026? Nine European banking giants unite the forces appeared first on 99Bitcoins.

Breakup

Breakup