Litecoin and Mantra have rallied two figures this week. Technical and chain analysis suggests that the two altcoins are ready for additional gains next week. The Bitcoin Flash crash is less than $ 100,000 and its yield greater than $ 104,000 fueled optimism among crypto traders.

The versions of American macroeconomic data, the performance of technological actions and actions and the developments of artificial intelligence are the main market movers for Bitcoin. Altcoins like LTC and OM follow Bitcoin closely because the correlation remains high.

Litecoin and Mantra could extend the gains, shows the technical analysis

The technical analysis supports LTC and OM gains, on the daily time. Mantra (OM) consolidated in a way linked to the range for several weeks between mid-December and January. OM left the beach between $ 4.5352 and $ 3,1730.

On Friday, when writing the editorial’s moment, OM is traded at $ 5,6263, near its summit of $ 5,9,500, as observed in the tradingView graph below.

On the daily delay, OM formed a support area between $ 4.443 and $ 4.069. It is a key imbalance zone and a correction could see the mantra bounce on this beach.

Two key technical indicators, the index of relative resistance and the indicator of divergence of medium mobile convergence support an upward thesis for OM. RSI bed 76 and is sloping up. Although this generally generates a sales signal, when combined with MacD’s green histogram bars above the neutral line, it highlights an underlying positive momentum in the OM price trend.

A new test of the summit of all OM time is probably next week if the token supports its momentum upwards.

Litecoin was consolidated within the upper and lower limits of the range at $ 129.11 and $ 92.57. The LTC ended its consolidation and broke out of the support area, less than 8% under its peak of 2025 of $ 141.22.

Litecoin is negotiated at $ 131.64 at the time of the editorial staff, early Friday.

The LTC / USDT daily price table shows an imbalance zone between $ 102.57 and $ 114.04, two key levels for Litecoin in the event of altcoin correction.

RSI and MacD show an underlying positive momentum in the Litecoin price trend. RSI bed 61 and is sloping up and MacD shows green histogram bars above the neutral line.

Traders must monitor a re-test of the peak of 2025 and an attempt to gather around 2024 of $ 147.06.

Chain analysis supports a bullish thesis

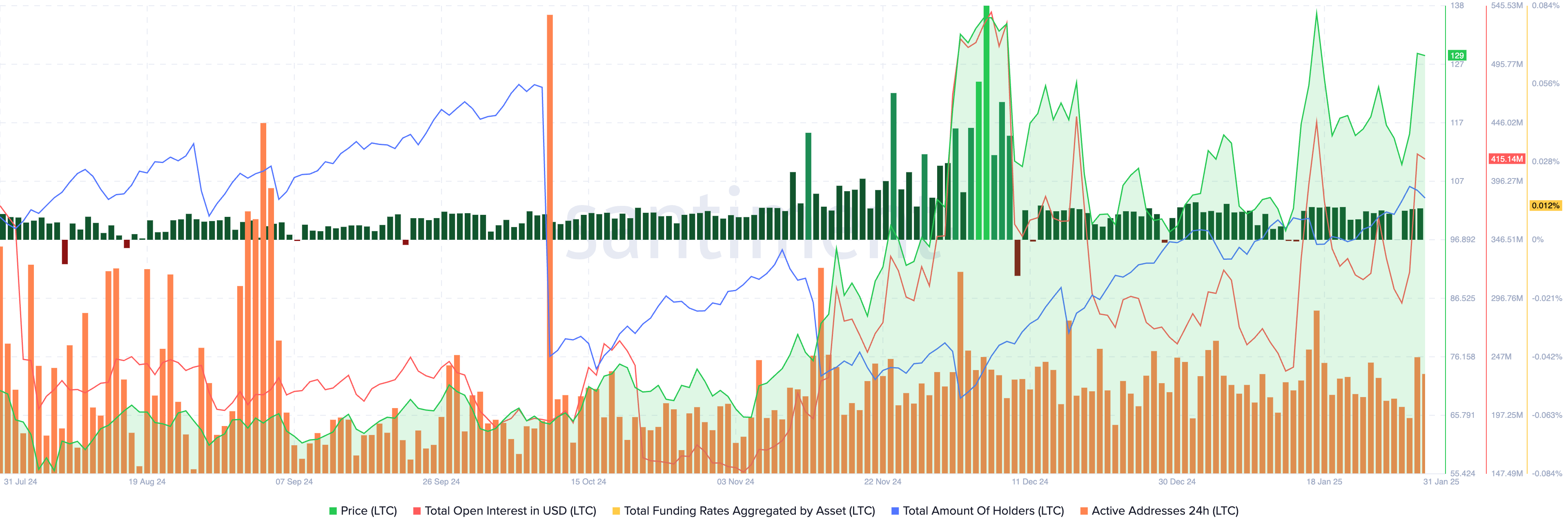

The metrics on healths highlight the growing relevance and demand for Litecoin among traders this week. The total open interest between the exchanges of derivatives in the SLD reached nearly $ 420 million on January 30, marking a peak in the graph below.

The total number of LTC holders increased regularly between December 2 and January 31, according to health data. Friday, metrics climbed to 8.13 million.

The number of active addresses remains higher than the average of 2024, and the total funding rates associated with LTC read positive, which means that the merchants of derivatives maintain a bias bias on Litecoin.

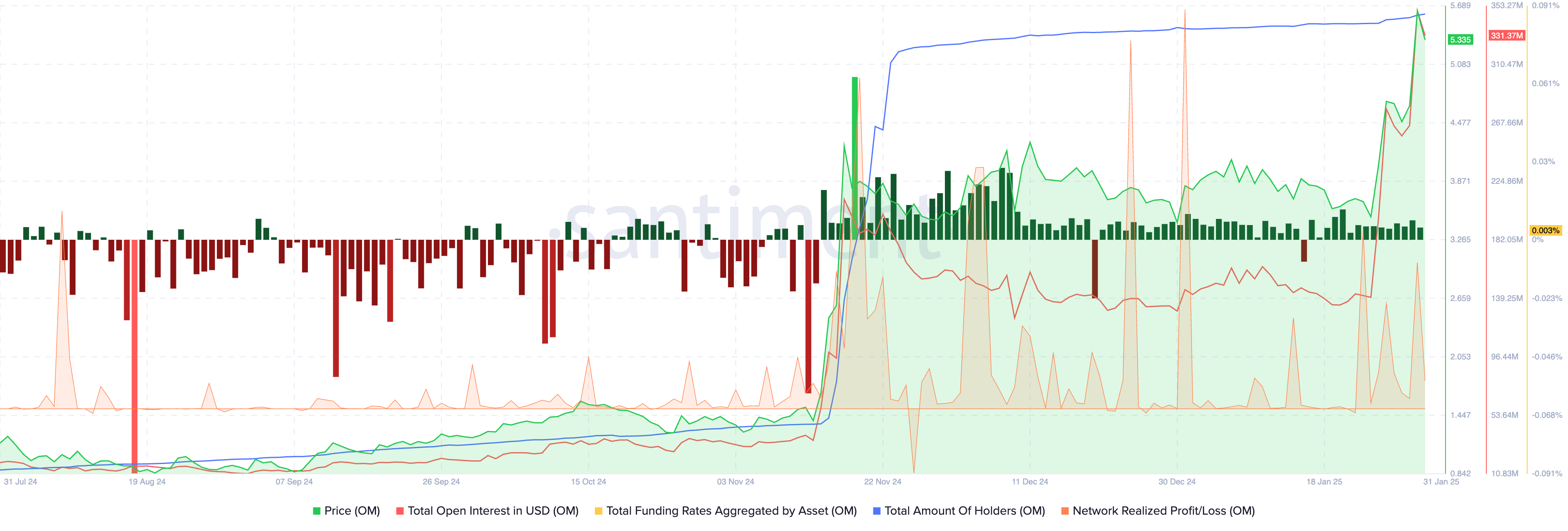

In the case of Mantra (OM), the total amount of holders climbs slowly, reached nearly 44,000 on Friday. Key measures as well as the funding rate show a bias bias and a positive value for almost two weeks, confirming the relevance and demand for the token on the derivative market.

The network realized that the profit / loss metric used to follow the net profit / the loss of all the tokens moved to the chain one day a given day shows several positive peaks in January, signaling the profit. Merchants must monitor large positive points because this would imply a large volume sale by traders deducting their portfolio, which could lead to an OM Price correction.

Total open interest in OM reached its highest level on January 30 above $ 348 million.

Market movers push Litecoin and higher mantra

The anticipation of the approval of the Litecoin stock market negotiated funds in the United States is one of the main market movers who increased the LTC price this week. As the SEC officially recognizes the 19B-4 deposit of Canary Capital for an ETF of Litecoin Spot, the merchants are hoping for approval.

As a rule, approval from the FNB Spot generates demand and interest among institutional investors and large portfolio merchants. Developments in the FNB could feed new gains in Litecoin next week.

Eric Balchunas, Bloomberg Intelligence analyst commented development in a tweet on X:

The recent announcement of Mantra on a partnership with the Damac group, a real estate giant, for tokenizing assets on their channel is a key market mover for OM Token this week. JP Mullin, co-founder and CEO of Mantra, said,

“This partnership with Damac Group is an approval from the RWA industry. We are delighted to associate with such a prestigious group of leaders who share our ambitions and to see the incredible opportunities to put traditional financing opportunities on the channel. »»

The other key market mover is Bitcoin recovery from the flash accident of less than $ 100,000 on Monday. The correlation between the tokens and the Bitcoin remains relatively high, supporting their earnings.

Bitcoin Catalysis Rally in Litecoin and Mantra

The three -month correlation between Bitcoin and Litecoin is 0.84 and between Bitcoin and Mantra is 0.87. The relatively high correlation suggests that the price of Bitcoin prices influences the prices of LTC and OM, therefore, additional BTC gains could push higher assets.

A flash accident in Bitcoin could push traders on the edge because BTC could drag the assets correlated with it, efforcating millions of dollars in market capitalization. American macroeconomic outings, the circulation of technological actions and actions and activities of institutional investors based on the United States have generally influenced the price of bitcoin.

LTC and OM holders must look at the daily trend of Bitcoin to predict sudden movements in both altcoins.

Strategic considerations

Merchants who accumulated LTCs as part of the $ 100 level could consider making profits on a percentage of their assets, at least 30% before a correction in Litecoin. The staggered benefit is recommended while Litecoin is stable above the beach-related consolidation area.

Merchants holding OM acquired less than $ 3.87 should ideally consider taking offense while the Altcoin is negotiated above $ 5. Associations can enter when OM is closer to $ 4 and wait for a re-test from the top of all time at $ 5.95 before making profits.

Disclosure: This article does not represent investment advice. The content and equipment presented on this page are only for educational purposes.