Key Notes

- Canary’s LTCC ETF recorded $1.64 million in net assets as of October 31.

- Litecoin lags behind Solana and Hedera ETFs in terms of investor inflow.

- Stake.com now accounts for approximately 16% of Litecoin’s daily on-chain transactions.

Litecoin price closed October at $99, gaining 3% as the United States welcomed its first Litecoin ETF. Canary’s LTCC fund began trading on October 28, joining the Solana and Hedera ETFs as the latest cryptocurrency derivative assets listed for regulated trading in the United States.

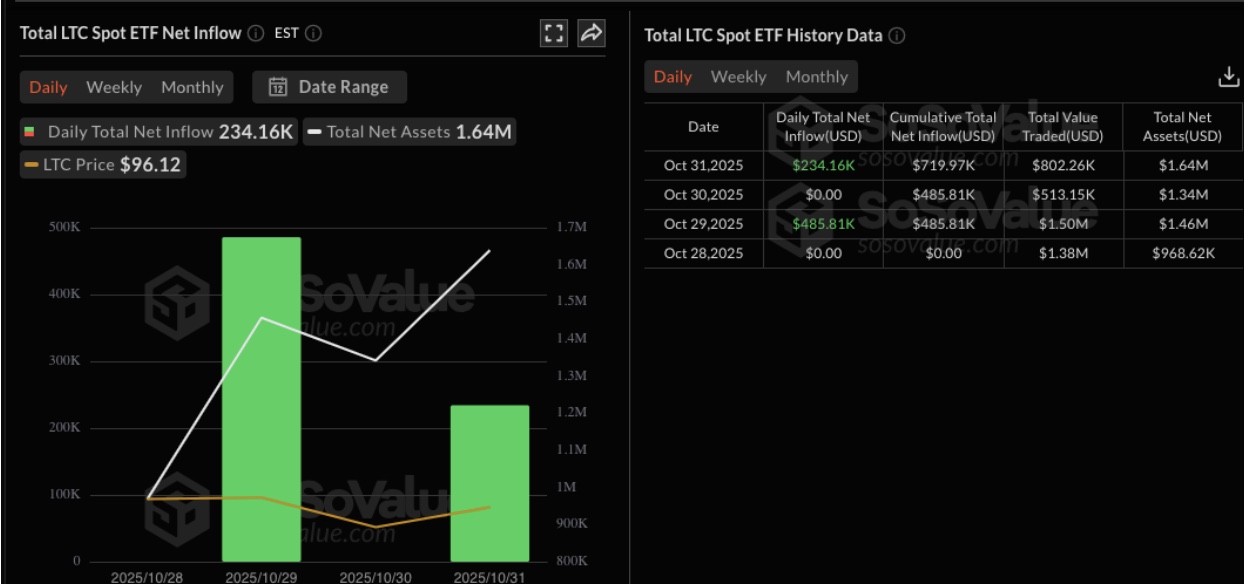

According to data from SoSoValue, LTCC’s cumulative total net inflow reached $719,970, with a total traded value of $802,260 and total net assets of $1.64 million as of October 31.

Litecoin ETF Market Performance as of November 1, 2025 | Source: Sosovalue

In comparison, the performance of Litecoin ETFs lags behind newly launched funds. Solana’s fund accumulated $199 million in inflows and $502 million in net assets, while Hedera’s ETF saw $44 million in inflows and $45.93 million in assets. Litecoin’s correlation with Bitcoin (BTC) appears to have limited demand for LTC ETFs this week. Net outflows of $191 million on Friday helped Bitcoin ETF total withdrawals surpass $1 billion over the past three trading days.

Stake now represents 16% of Litecoin transactions

Amid late adoption of ETFs, Litecoin continues to attract demand in online payment ecosystems. A report shared by community analyst bogdanoffig on

Did you know?

Litecoin represents a significant percentage of crypto usage in In fact, Litecoin has been the number one crypto used there for at least two years in a row!

Interestingly, @Bet represents approximately 16% of daily on-chain Litecoin… pic.twitter.com/hZJEo7aarq

– boglee Ⓜ️🕸 (@bogdanoffig) October 30, 2025

Litecoin’s official

Median Litecoin transaction fees remain below $0.0005, positioning LTC as one of the cheapest and fastest networks for high-volume microtransactions. This real-world usage aligns with the broader trend of altcoins regaining ground in payment utility markets, particularly in regions adopting low-fee payment rails. On Friday, Square, a payments platform affiliated with X founder Jack Dorsey, set aside $50 rewards for 20,000 users for enabling Bitcoin conversations in the app.

Litecoin Price Prediction: Can LTC Maintain Momentum Above $100?

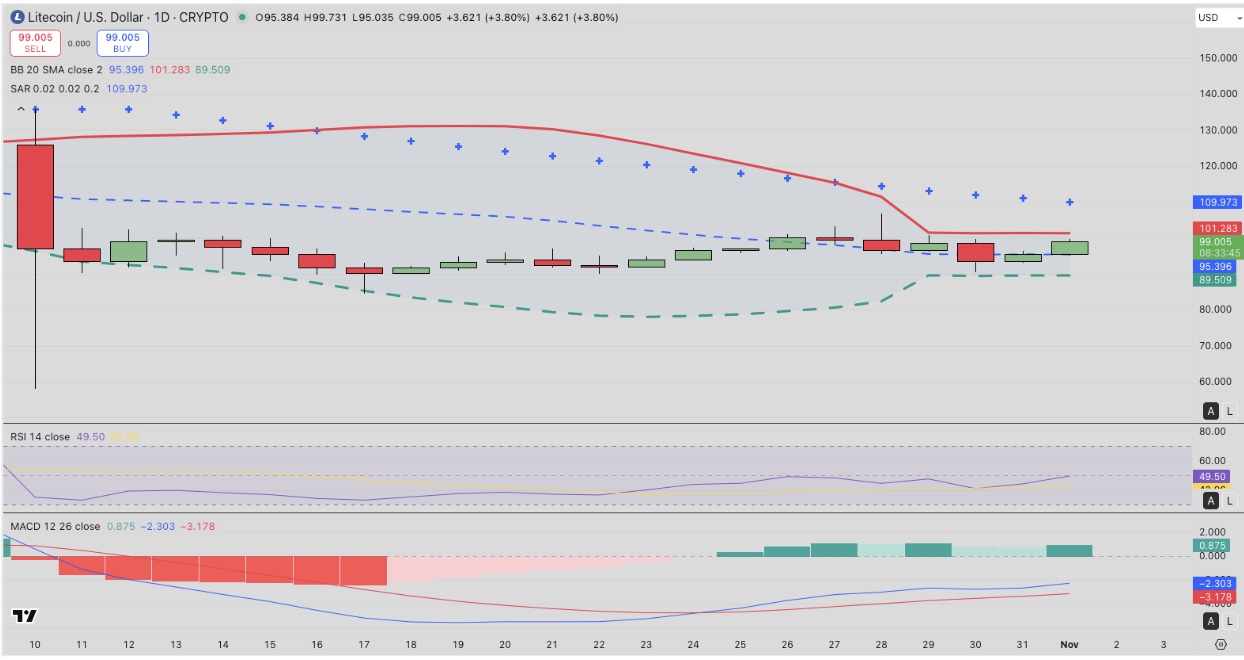

Litecoin’s latest rally towards $99.00 reflects improving sentiment after weeks of turbulence. On the daily chart, LTC/USD is trading just below the upper Bollinger band (at $101.28) while the middle band sits at $95.39, marking this area as a key near-term support base.

Parabolic SAR points above the price at $109.97 indicates continued bearish sentiment. The relative strength index (RSI), rising to 49.5, shows sellers ceding control as market momentum approaches neutral territory.

Litecoin (LTC) Price Prediction | Trading View

The MACD line has crossed above the signal line (-2.30 from -3.17), signaling a potential bullish reversal. With the histogram now positive, LTC price appears poised to attempt to reclaim the psychological $100 mark, followed by resistance at $109.97.

Conversely, failure to hold the $95 support level could trigger a slight retracement towards $89.50, aligning with the lower Bollinger band.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with experience supporting various Web3 startups and financial organizations. He completed his undergraduate degree in Economics and is currently studying for a Master’s degree in Blockchain and Distributed Ledger technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn