Ethereum Layer 2 solutions take another L as ENS Labs abandoned its plans for Namechain, choosing to deploy the upgraded ENSv2 protocol directly on Ethereum. The change of plans comes after Ethereum upgrades reduced gas registration fees by more than 99%, eliminating the need for a separate chain. Ethereum price is stable around $2,080, and the renewed focus on the mainchain reinforces long-term bullish investor sentiment.

The move marks a major strategic shift for ENS, echoing Buterin’s view that core infrastructure should remain on the Ethereum mainchain as scaling matures.

Vitalik Buterin didn’t water down his position, suggesting that many current Layer 2 designs could become obsolete as base layer scaling improves.

ETHEREUM BRINGS PROTOCOLS TO THE MAINNET.

ENSv2 has just canceled its L2

and deploys exclusively on Ethereum L1.For what?

ENS gas costs down around 99% year-on-year

L1 gas limit doubled (30M → 60M)

UX Improvements Now Available on Mainnet

Fusaka has proven that the new upgrade cadence works.… pic.twitter.com/rnxgkvyQAV

-BMNR Bullz (@BMNRBullz) February 7, 2026

EXPLORE: Top 20 cryptocurrencies to buy in 2026

Are Ethereum L2 solutions useless? What pushed the ENS to make this choice?

To understand this pivot, let’s think of Ethereum as a congested and very expensive highway. For years, the traffic (transactions) was so intense that tolls (gas fees) skyrocketed to $50 just to register a name. ENS originally planned Namechain as a bypass route, a Layer 2 rollup, to divert traffic and reduce costs.

But this solution is no longer necessary.

ENS lead developer Nick.eth explains that recent network upgrades, including the Fusaka update, have increased mainnet capacity faster than expected. Data shows a 99% reduction in registration fees compared to last year.

This directly reflects recent discussions in which Vitalik announced that the L2 vision no longer fits the needs of each project. If the mainnet is cheap and secure, building a new complex chain solves a problem that no longer exists.

Vitalik gently but definitively buried the 2022-2024 narrative according to which "l2 will save Ethereum"

now it’s official: if your rollup doesn’t do anything unique beyond scaling > you’re just another L1 with a nice deck and marketing

2026 = year l2 either slows down… pic.twitter.com/MN4aLrggNl

— Malewicz

(@malewiczz) February 3, 2026

DISCOVER: The 12+ Most Popular Crypto Presales to Buy Now

What changes for ENS users?

Instead of having to connect assets to a new network to manage their domains, users can stay on the Ethereum mainnet while benefiting from the low fees typically reserved for L2s.

The next ENSv2 upgrade focuses on a new registry architecture. It offers enhanced ownership models and flexibility without the technical headache of switching to another chain. Nick.eth emphasized that ENS needs to meet users where the ecosystem is going.

Although the network has faced challenges, such as when recent upgrades triggered dust attacks, the overall stability and throughput improvements have made the mainnet viable again. Engineering efforts are now 80% focused on core ENSv2 features rather than maintaining a custom blockchain.

This movement signals a potential trend reversal. For a long time, the talk was that everything had to move to layer 2 to survive. The fact that ENS is staying put suggests that L1 scaling is finally catching up.

As institutional interest returns to Ethereum, projects are realizing that the security and simplicity of mainnet could outweigh the benefits of launching their own chains.

ENS confirms that the protocol will remain highly interoperable with existing L2s like Optimism and Arbitrum, ensuring that users across the ecosystem are still supported.

EXPLORE: 9+ Best High-Risk, High-Reward Cryptocurrencies to Buy in 2026

Ethereum Price Analysis: From Forced Sells to Smart Money Loading

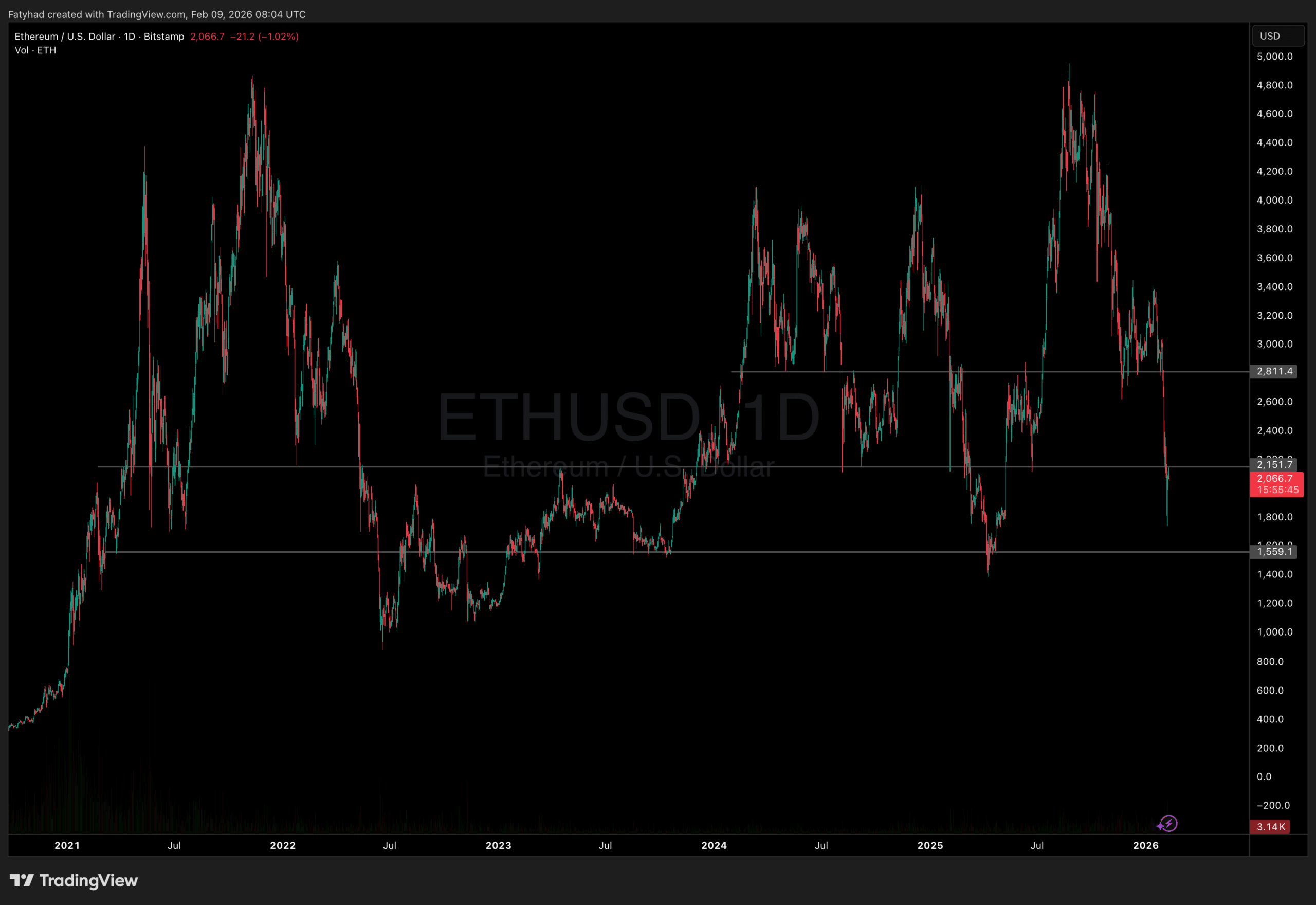

(Source: TradingView)

Ethereum price is trading around $2,066, stabilizing after a volatile week that saw declines between $1,750 and $1,800 before rebounding to the psychological level of $2,000.

On-chain signals are mixed but telling: Lookonchain followed strong selling, including Trend Research depositing its final 651,000 ETH ($1.34 billion), realizing losses of around $747 million after a near-total liquidation amid margin pressure.

Yet counter-trends are emerging: whales are accumulating aggressively. Recent examples include a withdrawal of 60,000 ETH ($126 million) from Binance in 30 hours.

In the short term, resistance between $2,100 and $2,150; a breakout could target over $2,300. Support near $2,000 remains firm for now, with a possible retest of the $1,750 level and $1,550 in a bearish scenario.

DISCOVER:

- 16+ New and Upcoming Binance Announcements in 2026

- 99Bitcoins State of the Crypto Market Report for Q4 2025

Follow 99Bitcoins on X For the latest market updates and subscribe on YouTube for daily market analysis from experts.

Hyperliquid FUD in 2026? Kyle Samani must read the room

After this disastrous start to February, Hyperliquide fudding is not in fashion. So when Kyle Samani, former partner of Multicoin, abandoned this version of

Hyperliquid embodies everything that is wrong with crypto

Degens did not let it pass.

The community presented it as a tough ex-VC deal: either he missed the alpha, or he is still suffering from the Ls of the SOL treasure. Arthur Hayes even launched a $100,000 charity bet on HYPE outperforming big alts through July.

Meanwhile, HYPE is holding around $32, +2% over the past 24 hours, while the rest of the market loses some of its positive momentum following Bitcoin’s crash to $60,000. Hyperliquid perp volumes have exploded (record OI close to $1 billion, daily flows crushing CEXs).

Vitalik Buterin: True DeFi requires reducing counterparty risk beyond USDC returns

Ethereum co-founder Vitalik Buterin has weighed in on the core of DeFi, responding to claims that decentralized finance offers little beyond leveraged crypto positions and self-custody.

He argued that simply lending USDC on platforms like Aave is not considered true DeFi, as it carries significant counterparty risk from centralized stablecoin issuers.

Buterin highlighted algorithmic stablecoins as a promising way forward. He described two scenarios in which they bring significant innovation:

- ETH-backed systems allowing users to transfer counterparty risk to markets;

- Oversized, diversified real asset support (RWA) that is resilient to single asset failures.

He advocated prioritizing decentralized and risk-minimizing designs, ideally moving beyond dollar-pegged assets to diversified indices, in order to realize DeFi’s potential for resilient, trust-minimizing financial services.

> inb4 "muh USDC yield"it’s not DeFi

Would algorithmic stablecoins fall under this?

IMO no (i.e. algorithmic stablecoins are real challenges)

Simple mode answer: if we had a good algorithmic stablecoin backed by ETH, then *even if* 99% of the liquidity is backed by CDP holders who…

– vitalik.eth (@VitalikButerin) February 8, 2026

Binance SAFU Fund Accelerates Its $1 Billion Bitcoin Reserve Plan, Now 73% Complete

Binance’s Secure Asset Fund for Users (SAFU) purchased an additional 4,225 Bitcoin worth approximately $299.6 million, bringing its total holdings to 10,455 BTC: valued at approximately $734 million at current market prices.

The acquisition advances Binance’s January 2026 announcement to convert $1 billion of stablecoin reserves into Bitcoin within 30 days.

The Bitcoin reserve plan is now approximately 73.4% complete, with an average purchase price of $70,213.68 per BTC and an unrealized profit of approximately $3.41 million.

The post (LIVE) Crypto News Today, February 9 – ENS Abandons Namechain L2 Plan as Ethereum Price Holds $2,000 appeared first on 99Bitcoins.

ENS gas costs down around 99% year-on-year

ENS gas costs down around 99% year-on-year (@malewiczz)

(@malewiczz)