The crypto loan shrinks 43% from the peak

Last week, Galaxy Digital published a report entitled The state of cryptographic loanswho examined loans and borrowing both centralized and decentralized through the cryptographic ecosystem.

We no longer hear as much about decentralized finance (DEFI), so let’s quickly see what it is. DEFI refers to alternatives based on blockchain to traditional financial services such as loan, loans and repository yields. Although Defi has often been grouped with non -buttocks (NFT), offers of initial parts (ICO) and mecoins, it was initially supposed to provide conventional financial services to the blockchain.

What stands out the most in the Galaxy report is the extent of the collapse on the cryptography loans, which began to crash in 2022 and has not recovered since. A leading factor in the disappearance of space was that many of the largest lenders – notably Genesis, Celsius Network, Blockfi and Voyager – all filed for bankruptcy, which has destroyed a lot of market value in the process. According to Galaxy, the total size of the cryptography loan market was $ 36.5 billion in the fourth quarter of 2024, down 43% compared to its summit of $ 64.4 billion in the fourth quarter of 2021.

Galaxy thinks that the market will rebound, because it is already on a resumption of its stockings, but I am personally not sure. Many people have been burned by these loan products, especially if they held an instrument offered by one of the companies that collapsed. Beyond that, if you are new in crypto, the mechanisms behind these platforms are more confusing than they are attractive.

In addition to that, the disappearance of some of the high lenders and the well -known stories of risk unwacted by them created a problem of confidence in space. When four of the biggest players go bankrupt in two years, it is difficult to convince anyone, especially new arrivals, that even if you essentially have the same commercial model, as “this time will be different”.

I do not think that loans are disappearing, but involving new users on board will be a difficult battle unless the real need for these loan services emerge or that yields only become so attractive that users cannot let their pieces go to the implementation to gain interest.

Donald Trump could launch a web3 game

Rumor says Donald Trump is launching a crypto game. According to reports, the game would have a feeling of monopoly and would be led by Bill Zanker, the same person who helped launch Trump’s NFT and even.

Although there is not much information on how the game works or even how cryptocurrency will be involved, what is known is that the game should be launched later this month. Unfortunately, Trump and his team could not have chosen a worst time to launch it, while the web game market is shrinking, does not develop.

According to DAPPRADAR, investments in the web game3 only totaled $ 91 million in the first quarter of 2025, a drop of 71% compared to T2 2024. Unique daily active portfolios in space also decreased by 3% over the same period, which suggests that the market is cooling from user’s point of view.

The launch of a crypto game in this type of climate can be more a challenge than what is a financial boon, in particular with the memory of the most recent crypto of Trump, fresh in investor leaders and potential users: the launch of the $ Trump Memecoin, which has been down more than 85% since its launch date.

Ethereum down 48% in the past year

The past few years have been difficult for almost all cryptocurrencies, but most major pieces have seen a kind of rebound in the past year, except Ethereum. While many household name tokens have displayed small gains or losses in the past year, Ethereum is down 48% and shows no signs of recovery.

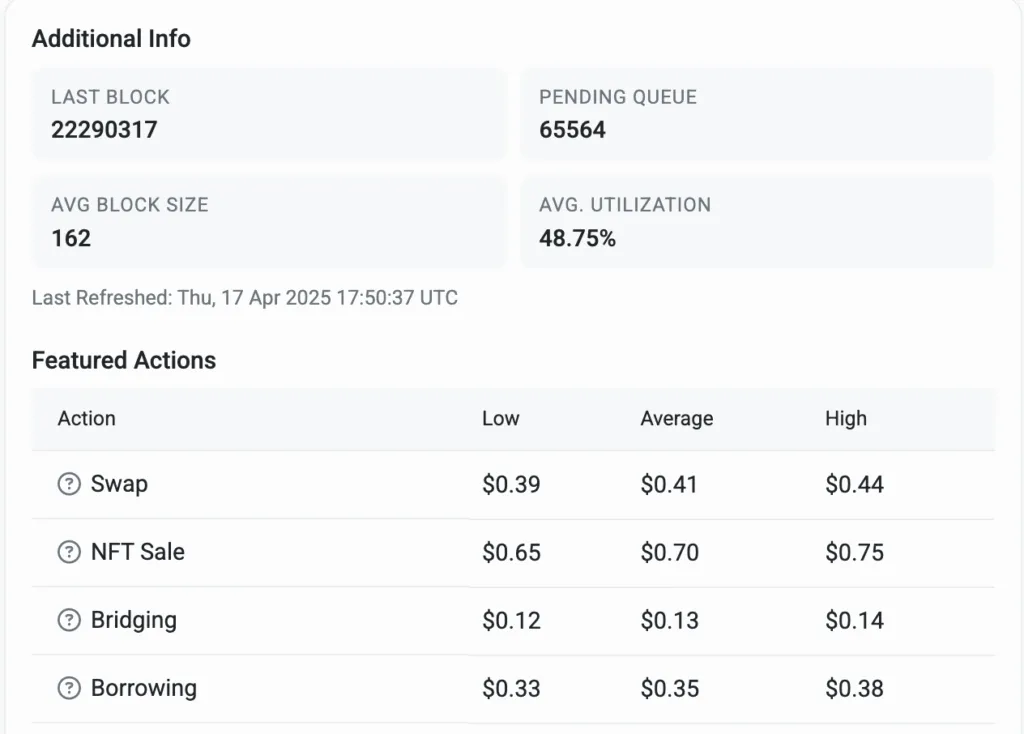

One of the main reasons why Ethereum loses ground is simple: the cost. Despite network upgrades, transaction costs on Ethereum remain significantly higher than those of competing chains. At the time of writing the editorial time, common actions on the chain on Ethereum can cost much more than ten hundred each, while on some of the most competing competing chains, these same actions generally cost the fractions of a penny.

It may not seem much, but these costs are significant or for users of emerging savings. Whether you are a founder who tries to launch a DEFI product or simply someone who seeks to interact with a decentralized application (DAPP), Ethereum can quickly become prohibitive. In some cases, users must even “complete” their portfolios just to afford the transaction costs, which is not an excellent user experience.

But the purpose of this segment is not to drag Ethereum, it is to underline what the difficulties of Ethereum tell us on the wider market.

I think that the disappearance of Ethereum reveals that the market no longer cares about the inheritance status – it was enough to be one of the first coins or tokens that existed. But now it looks like people who really use blockchains or who are interested in using the block chains are more concerned with affordability. To be fair, recognition of the brand still counts, but it is not because a blockchain had recognition of the brand in the past that it will maintain this status if it falls into disgrace with blockchain lovers. If a blockchain nails these two criteria, it will attract users and developers.

If he fails in one or the other of these areas, in particular while competitors gain ground – this may become less relevant. Ethereum always has a name recognition, but at the moment, it is seriously missing with regard to affordability, which is why creators choose to use other blockchains, which attracts Ethereum users to these other channels and why the market price reflects its dissatisfaction with regard to Ethereum.

Look | Mining Disrupt 2025 protruding facts: profitable trends that each minor should know

https://www.youtube.com/watch?v=kj5J8BFXAZY Title = “YouTube Video Player” Frameborder = “0” Allow = “Acceleromment; autoplay; clipboard-twri; Encrypted-Media; Gyroscope; Image-In-Picture; Web-Share” Retrmerpolicy = “Strict-Origine-Ohen-Cross-Ovin” Alowlscreen = “”>