Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Ethereum saw a spectacular turnaround this week, bouncing more than 21% compared to its recent hollow of $ 1,380 in just hours. The strong recovery came in response to an unexpected change in macroeconomic policy: US President Donald Trump announced a 90 -day break on reciprocal prices for all countries, with the exception of China, which is now faced with a steep 125%price. The news sent a ripple in the world markets, causing a short -term rally of risk assets, including the crypto.

Related reading

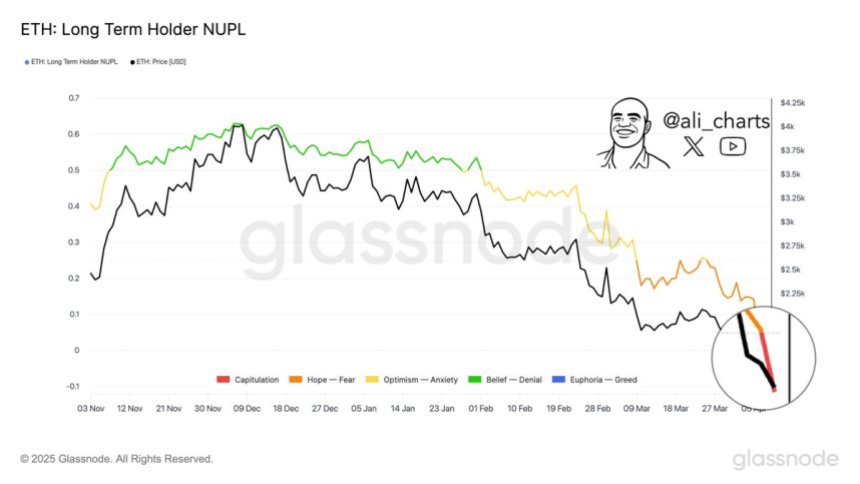

Ethereum, who had undergone strong sales pressure for weeks, seems to have found temporary relief. According to Glassnode data, long-term email holders are starting to fold, discharging positions at a loss after months of decline. Historically, these long -term holder’s capitulation moments have often marked the bomb phases and preceded significant rebounds.

Although short-term volatility remains high, some analysts consider this configuration as a potential opportunity area, especially for counter-contracts who seek to accumulate during peak fear. The market is now looking to see if ETH can keep its earnings or if a wider uncertainty will fold the prices. One thing is clear: the next few days could be essential for Ethereum’s trend before the second half of 2025.

Ethereum finds relief in the middle of chaos, but the market remains on board

Ethereum is now at a Pivot crossroads after enduring weeks of incessant pressure and uncertainty. The recent increase in levels of less than $ 1,400 offered a glimmer of hope, while the bulls are starting to push the downward trend. This rebound follows aggressive volatility not only in the crypto, but in global actions, with a price action shaken by continuous geopolitical disorders and macroeconomic instability. The unpredictable position of US President Donald Trump on prices remains a joker, keeping the world’s world markets.

Since the peak at the end of December, Ethereum has lost more than 60% of its value, which stimulates an increasing concern that a large -scale bear market could take place. Many investors have already left positions, while others remain away while waiting for clarity. However, some see the opportunity.

According to high -level analyst Ali Martinez, long -term Ethereum holders have now entered what is commonly called “capitulation” mode – a step where even the most patient investors are starting to comply under pressure. Martinez thinks that this could have a rare window for counter-current buyers. “For those who look at the revolving risk dynamics, this phase has historically marked the areas of accumulation of choices,” he shared on X.

Although the way of Ethereum is still uncertain, the current feeling suggests that a critical test is underway, one which could determine if this recovery has legs, or if new pain is ahead.

Related reading

The bulls seek to confirm recovery with a key break

Ethereum shows signs of short -term strength because it forms a bullish “Adam & Eve” inversion scheme on the 4 -hour graph. This conventional technical training, which begins with a low -shaped V -shaped form followed by a rounded background, often points out a potential escape if the price action holds and follows. For Ethereum, recovery of the level of $ 1,820 is the first step to confirm this upward structure.

If the bulls can push the ETH above this level with conviction, the next key challenge is at the Mobile average at 4 hours 200 hours 200 (MA) and the exponential mobile average (EMA), which both converge around the bar of $ 1,900. A decisive escape through this area would validate the configuration of recovery and could launch a more sustained movement above.

Related reading

However, not recovering the level of $ 1,800 in the coming days can keep ETH stuck in a consolidation range. If it is rejected, the price could remain in accordance with the beach between the current levels and the lower support area close to $ 1,300, where ETH has recently rebounded. For the moment, all eyes are on how the price reacts to the resistance levels to come, because the bulls aim to regain control and change the momentum in the short term in their favor.

Dall-e star image, tradingview graphic