Key Notes

- The 2018 Whale wallet transferred $250 million in Bitcoin to Paxos while retaining 32,490 BTC valued at $3.4 billion.

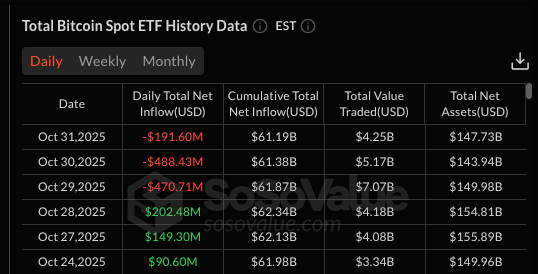

- Bitcoin ETFs experienced three consecutive days of withdrawals totaling $798 million in net outflows in late October.

- Technical indicators show BTC trading at $107,256 with an RSI at 40.50, suggesting weakening momentum and potential risk of a breakout.

A dormant Bitcoin

BTC

$104,467

24h volatility:

2.9%

Market capitalization:

$2.08T

Flight. 24h:

$80.12 billion

The wallet dating back to 2018 transferred 2,300 BTC, worth around $250 million, to Paxos Exchange. The whale still holds around 32,490 BTC, valued at $3.4 billion, according to Arkham Intelligence.

Dormant Bitcoin wallet transfers 2,300 BTC (~$250 million) to Paxos on November 3, 2025 | Source: Arkham

The whale’s move aligns with a wave of profit-taking among large corporate Bitcoin investors in the United States over the past week.

Bitcoin ETFs close October 2025 with 3 consecutive days of withdrawal | Source: Sosovalue

According to data from SosoValue, Bitcoin ETFs saw $798 million in net outflows last week, closing with three consecutive days of withdrawals.

Bitcoin Price Prediction: Bulls Defend $105,000 as RSI Drops Below Midline

Bitcoin price is struggling to regain the $110,000 zone after a sharp 2.97% decline on November 3. The daily chart shows that BTC is currently trading around $107,256, with selling pressure visible from whale wallets and institutional outflows.

Bollinger bands are tightening, suggesting that market volatility is now cooling. The upper band lies near $114,260, forming the main resistance area, while the lower band near $105,536 offers immediate support.

Bitcoin (BTC) Price Prediction, November 3, 2025 | Source: TradingView

The RSI at 40.50 reflects weakening momentum, hovering near oversold territory. The downward slope of the indicator below its signal line (45.86) reinforces the bearish dominance in the short term. However, a rebound above 50 could mark a reversal, especially if ETF inflows resume and whale deposits stabilize.

The current Bitcoin Price Breakout Probability Indicator describes a 38% probability of an early rebound to $112,000. If this optimistic BTC price outlook does not materialize, the 27% probability of a fall below $108,000 is the next likely directional move.

Top Wallet Presale Hits $16.8M as Bitcoin Volatility Intensifies

As Bitcoin price hovers below $110,000 amid increased whale activity, investors are diversifying into promising early-stage projects like Best Wallet (BEST). The current presale has now exceeded $16.8 million, reflecting the growing appetite for decentralized financial products offering both secure storage and yield optimization features.

Best Wallet Presale

Potential investors now have less than 24 hours to acquire the $0.026 BEST tokens via the official Best Wallet website, before the next price level is unlocked.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with experience supporting various Web3 startups and financial organizations. He completed his undergraduate degree in Economics and is currently studying for a Master’s degree in Blockchain and Distributed Ledger technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn