- Long-term holders started selling Bitcoin to short-term holders.

- Social media sentiment and crypto market news remained mostly positive.

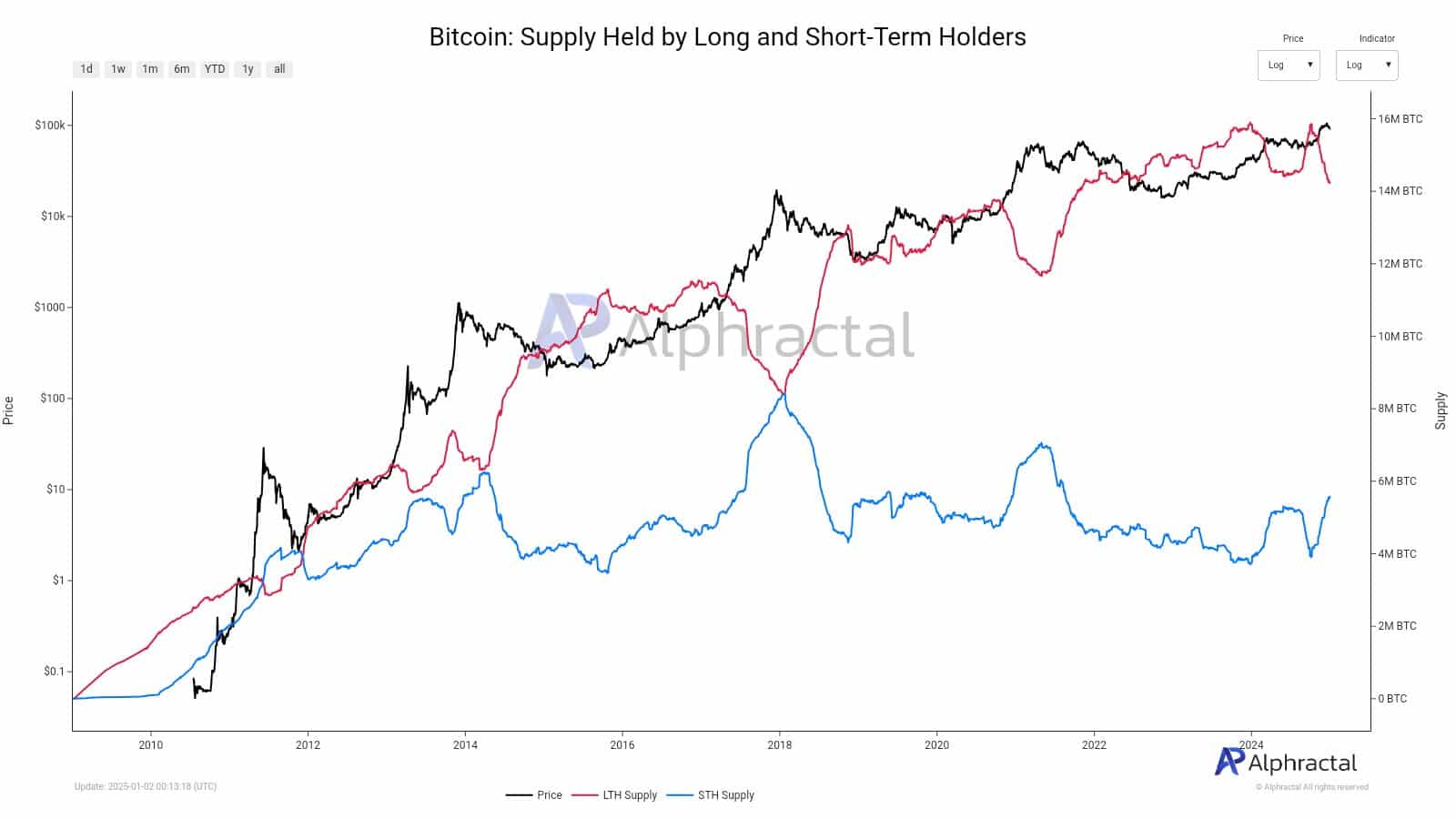

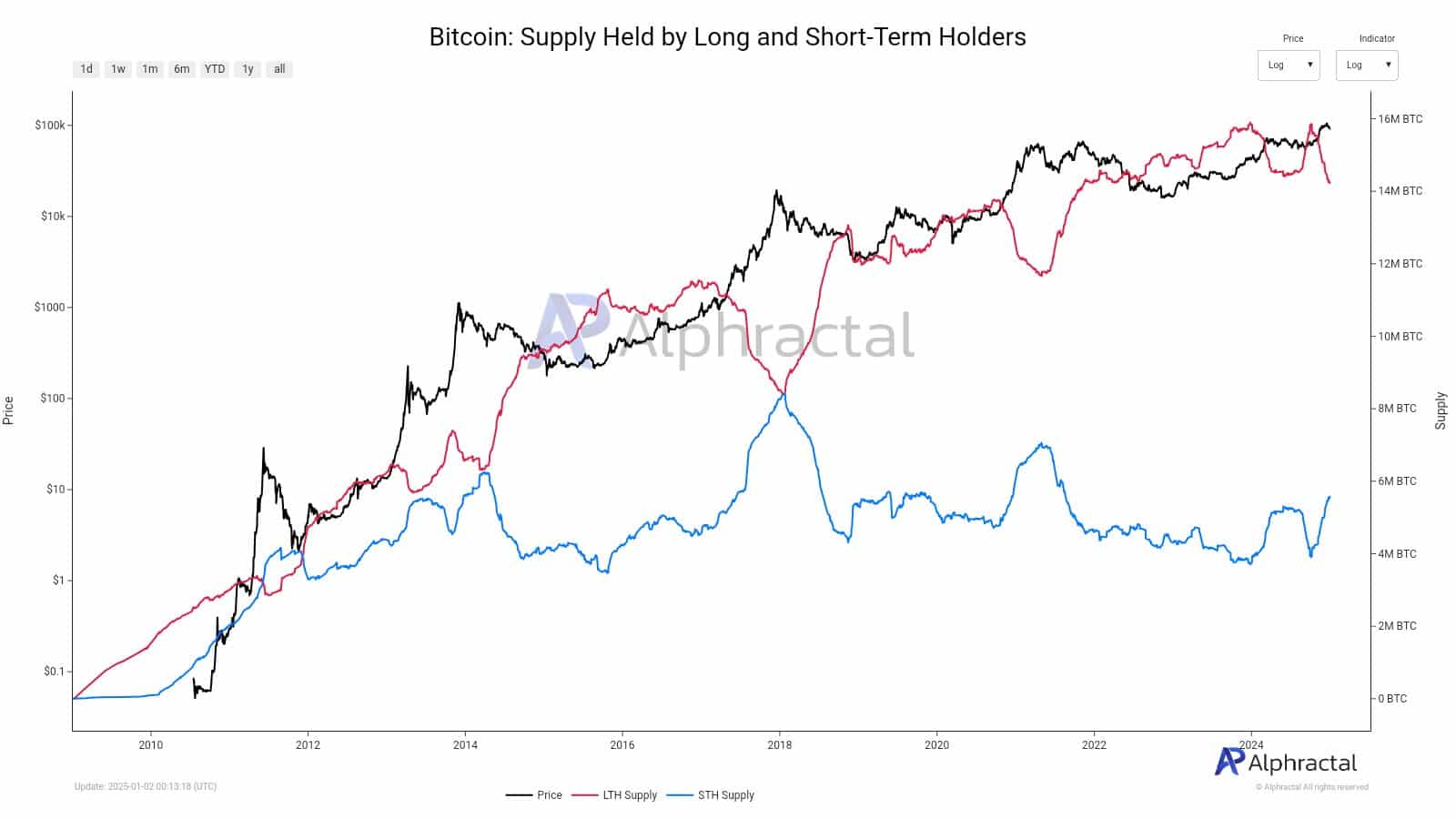

Historical Bitcoin (BTC) data has revealed significant shifts between long-term (LTH) and short-term (STH) holders. LTHs have begun to divest their holdings to STHs, marking a notable shift in BTC ownership dynamics.

The Coin Days Destroyed metric has risen, indicating that large, older holdings are being sold, often portending volatility.

Simultaneously, the supply held by STHs increased, capturing these coins, suggesting a shift from seasoned investors to new market participants.

Source: Alphractal

This redistribution could potentially destabilize prices in the short term, as new holders may be less likely to hold onto their securities despite the turmoil, leading to increased selling pressure.

Historically, such transfers have preceded either significant price corrections or consolidations, as the behavior of new holders during market swings could dictate the next major move.

If LTH continues to sell off strongly, it could limit potential rebounds or exacerbate downturns, depending on market reactions and broader economic indicators.

Bitcoin Power Network

However, the power grid that tracks Bitcoin’s strength signals never exceeded the 100% power threshold until recently, an area indicative of cycle highs.

The network reading for 2025 showed a slight increase, reaching 82.5% strength, signaling robust market dynamics but short of a definitive cycle peak.

This suggests that even though Bitcoin is approaching an important market moment, a cycle top has not definitively formed as the market navigates into early 2025.

Source:

This data portends continued market strength for Bitcoin, consistent with predictions that 2025 would be a banner year for crypto, reflecting optimistic prospects of sustained growth and investment enthusiasm.

How do holders feel?

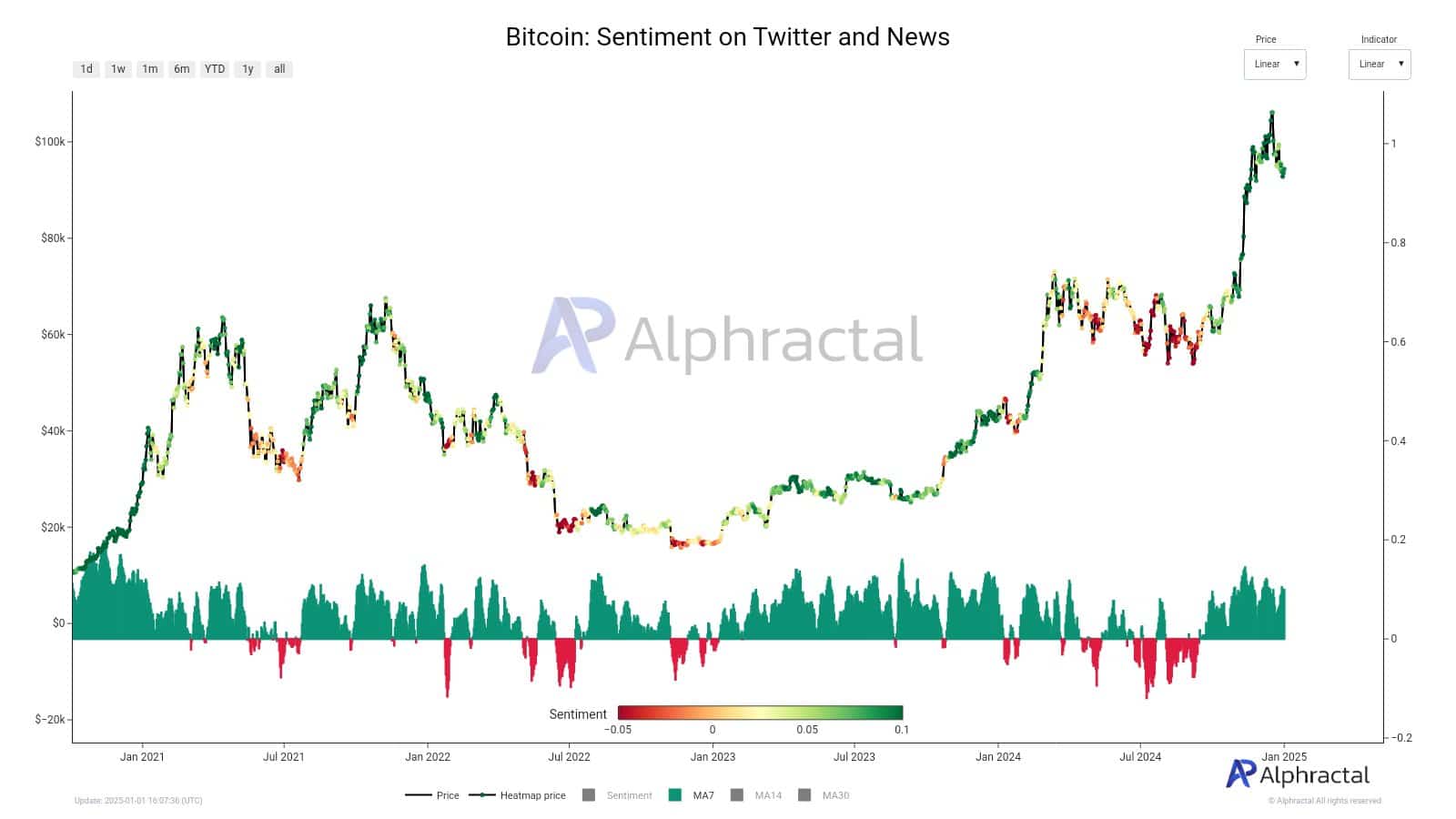

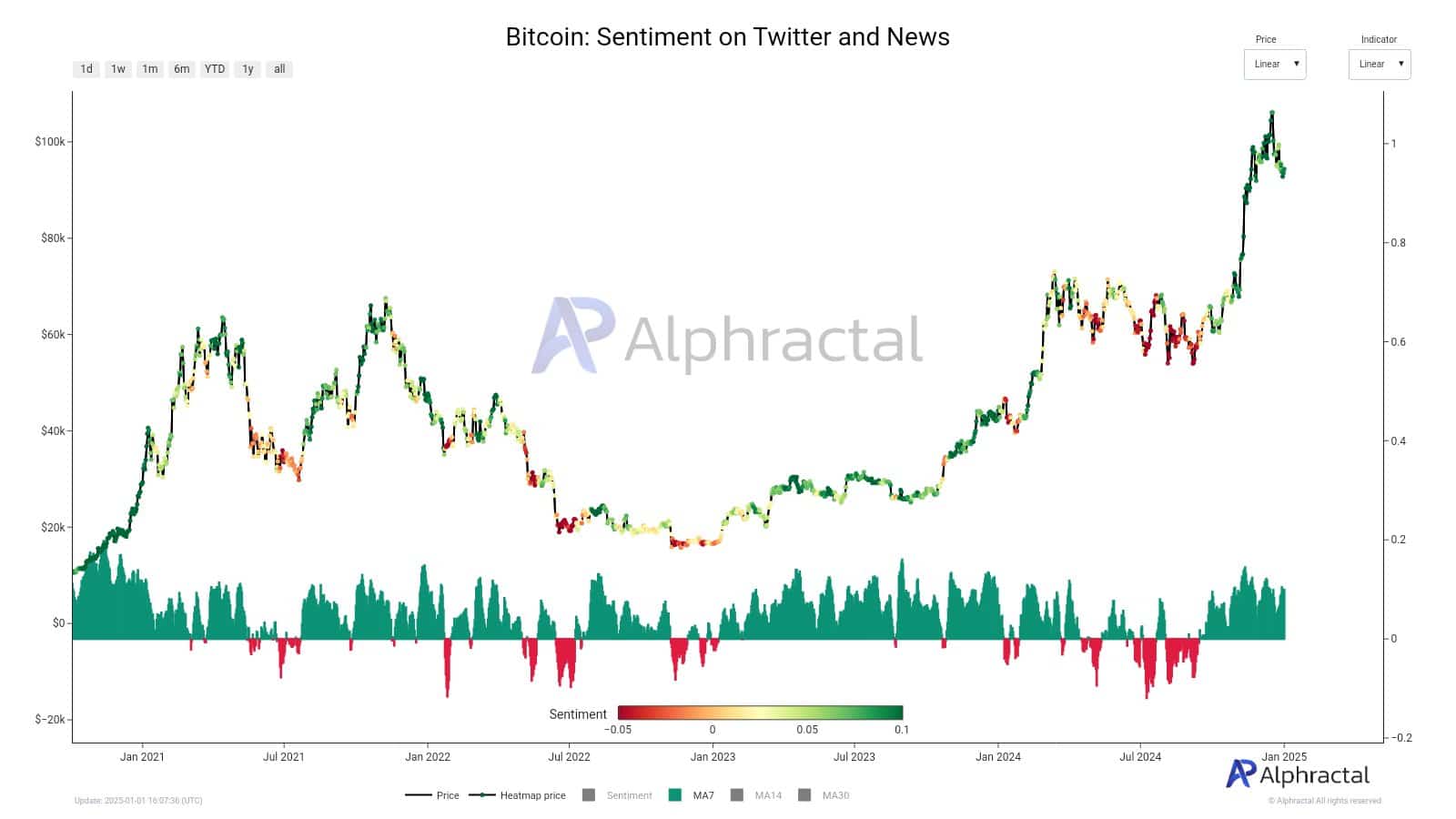

Once again, sentiment analysis for Bitcoin, featured on Twitter and in crypto market news, showed an overwhelmingly positive trend.

There have been only rare instances of negative sentiment among the public, coinciding with notable price fluctuations.

Specifically, despite BTC price hovering between $108,000 and $92,000, investors have demonstrated a lack of fear.

Historical patterns suggest that when sentiment falls significantly, it typically heralds a low price, signaling opportune times to buy. This was observed several times a year.

Source: Alphractal

Finally, the Fear & Greed index, marked at 66 at the start of January 2025, indicated a slight reduction in greed, the lowest since November 2024.

Despite this drop, the prevailing sentiment remained predominantly greedy, suggesting sustained buying interest in Bitcoin.

While the index remained above the neutral 50 mark, Bitcoin price hovered around $95,000, showing stability after recent fluctuations.

Read Bitcoin (BTC) Price Forecast 2025-2026

This alignment of sentiments indicated no immediate rise in prices, but the grounds for continued investment were evident.

This suggests that significant market corrections could still attract massive buying from those betting on future gains.