- 15 million LUNC tokens were burned, but the price fell by 4.19% due to reduced market interest.

- Futures open interest reached $9.27 million, marking a significant decline as trading volume plunged 66.35%.

The Terra Luna Classic (LUNC) ecosystem is seeing a mix of developments as price trends, token burns, and futures trading volume grow.

However, recent token burns and price movements suggest a potential shift in the market, but the latest price movements and open interest data indicate a complex situation.

LUNC Price Update and Market Activity

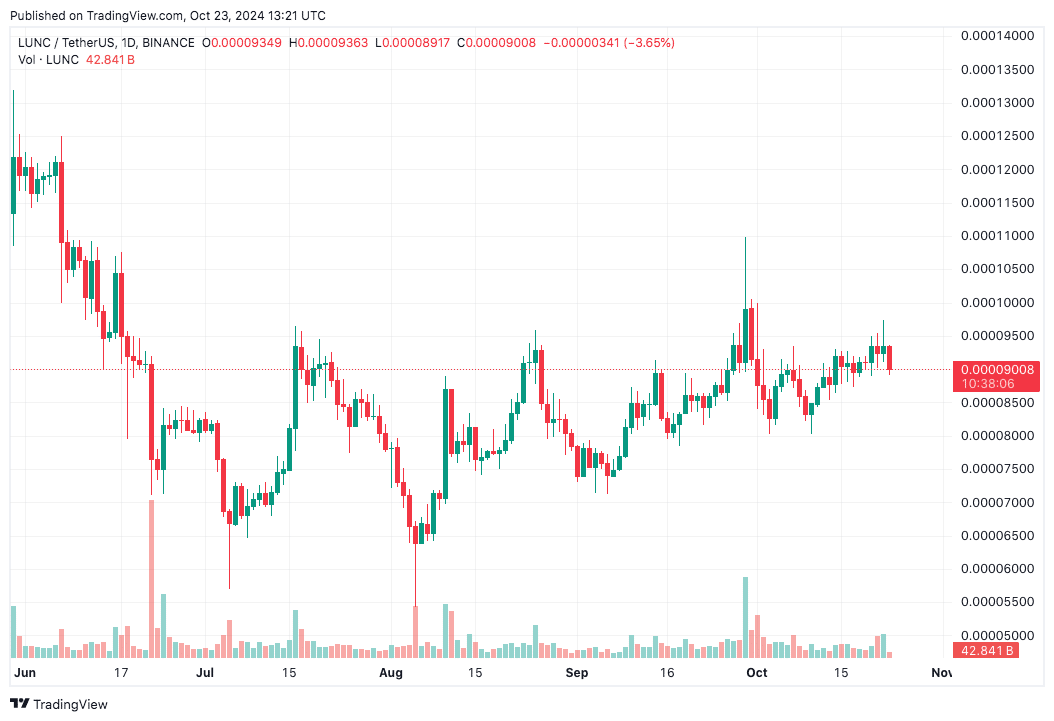

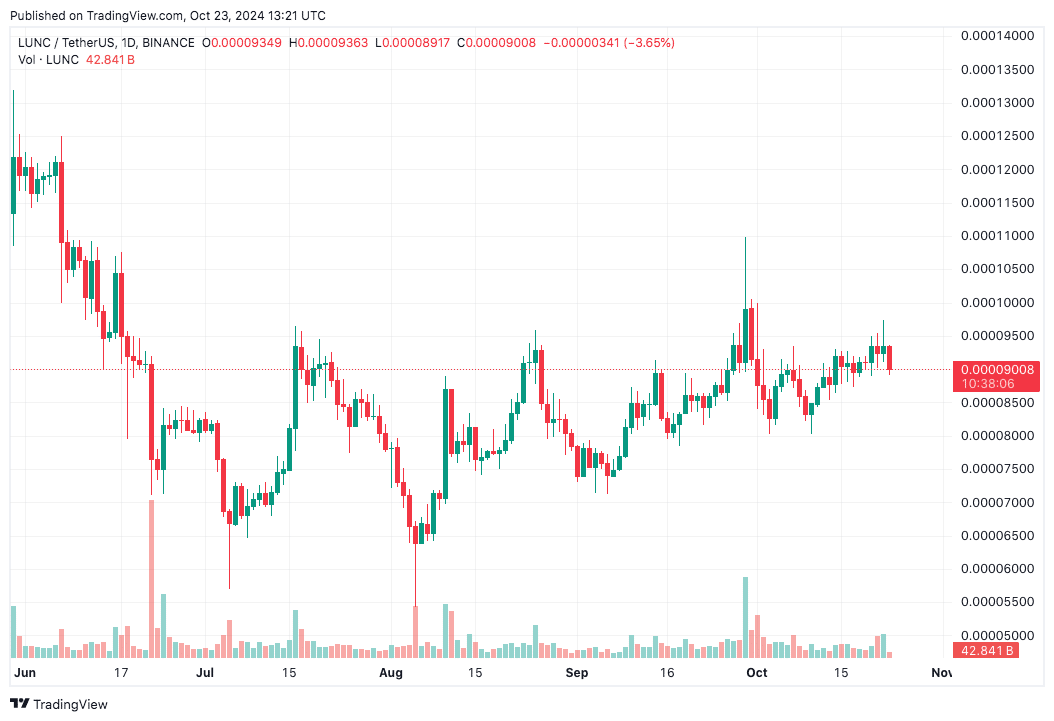

Terra Classic (LUNC) is located at $0.00009008 at press time, reflecting a 4.19% decline over the past 24 hours. The 24-hour trading volume for LUNC is reported at $27,294,595.

Over the past seven days, LUNC has seen a modest increase of 0.37%, suggesting some stability in a largely volatile market. LUNC’s circulating supply is estimated at approximately $5.7 trillion, bringing its market capitalization to approximately $513.1 million.

Source: Trading View

This price movement occurs after a burn of 15 million LUNC tokens on October 22, as part of ongoing efforts to reduce supply and potentially spur price growth.

Although the deflationary approach aims to increase value over time, the immediate impact has been limited, as the recent price decline shows.

Technical analysis: ascending support and resistance levels

The LUNC price chart shows an ascending trendline, indicating a continued attempt by the bulls to push the price higher. The trendline has provided support over the past few weeks, creating higher lows.

If the price maintains this upward trajectory, it could signal further bullish momentum.

Key resistance is noted at the $0.00012740 level, which represents the next target for a potential breakout. A successful breakout of this level could lead to further price increases, provided buying pressure continues.

Source: Trading View

On the downside, support levels are identified at $0.00008850 and $0.00006390. These levels could act as cushions in the event of a price decline, particularly if the ascending trendline fails to hold.

A fall below these support levels could indicate a downtrend reversal.

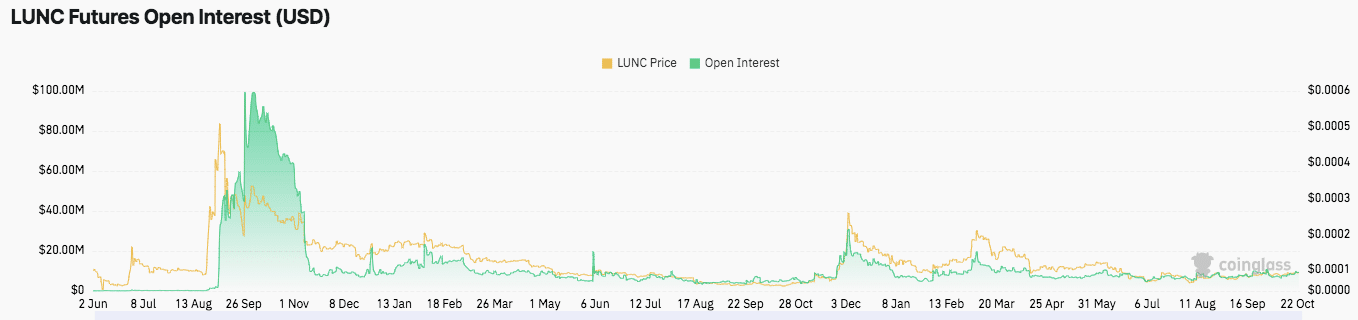

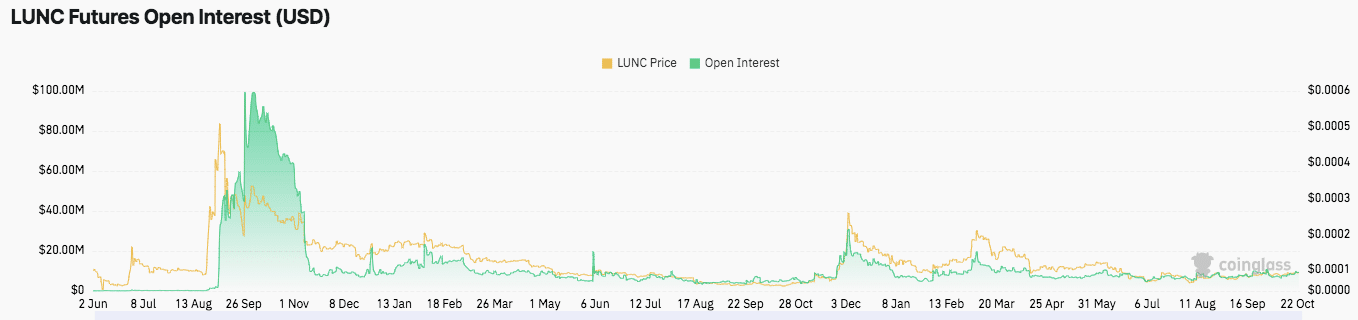

Futures Market: Open Interest and Volume Decline

The LUNC futures market showed a notable decline in open positions, which currently stand at $9.27 million, down 4.68% from recent levels, according to Coin Data.

This decrease in open interest aligns with a broader trend seen over the past year. Open interest peaked at nearly $100 million in September 2022 before trending downward.

A decline in open interest rates suggests a decrease in market participation, potentially reducing short-term volatility.

Source: Coinglass

Is your wallet green? Check the LUNC Profit Calculator

Additionally, LUNC futures market volume fell 66.35%, reaching $10.45 million.

This reduction indicates a decrease in speculative interest, which may be due to a variety of factors, including current price stability and market sentiment.