- The $ 0.55 supply area has been highlighted as critical resistance on several fronts.

- For Dogwifhat, the purchase pressure for the past few days was not strong enough to report a trend reversal.

The Memecoin market has experienced a certain relief in the last 24 hours of negotiation. At the time of the press, CoinmarketCap data showed that the same sector has increased by almost 2% in market capitalization and an 8.5% increase in daily negotiation volume.

This came after a Bitcoin (BTC) rebound beyond the resistance of $ 82.5,000 on April 11.

Dogwifhat (WIF) joined 9% in 24 hours, but he still had a downward perspective on higher deadlines. The solana -based the meme (soil) followed 18% of 18% in the last three days.

Should WIF traders expect the momentum to be supported during the coming week?

Traders would probably be more profitable than the purchase of wif

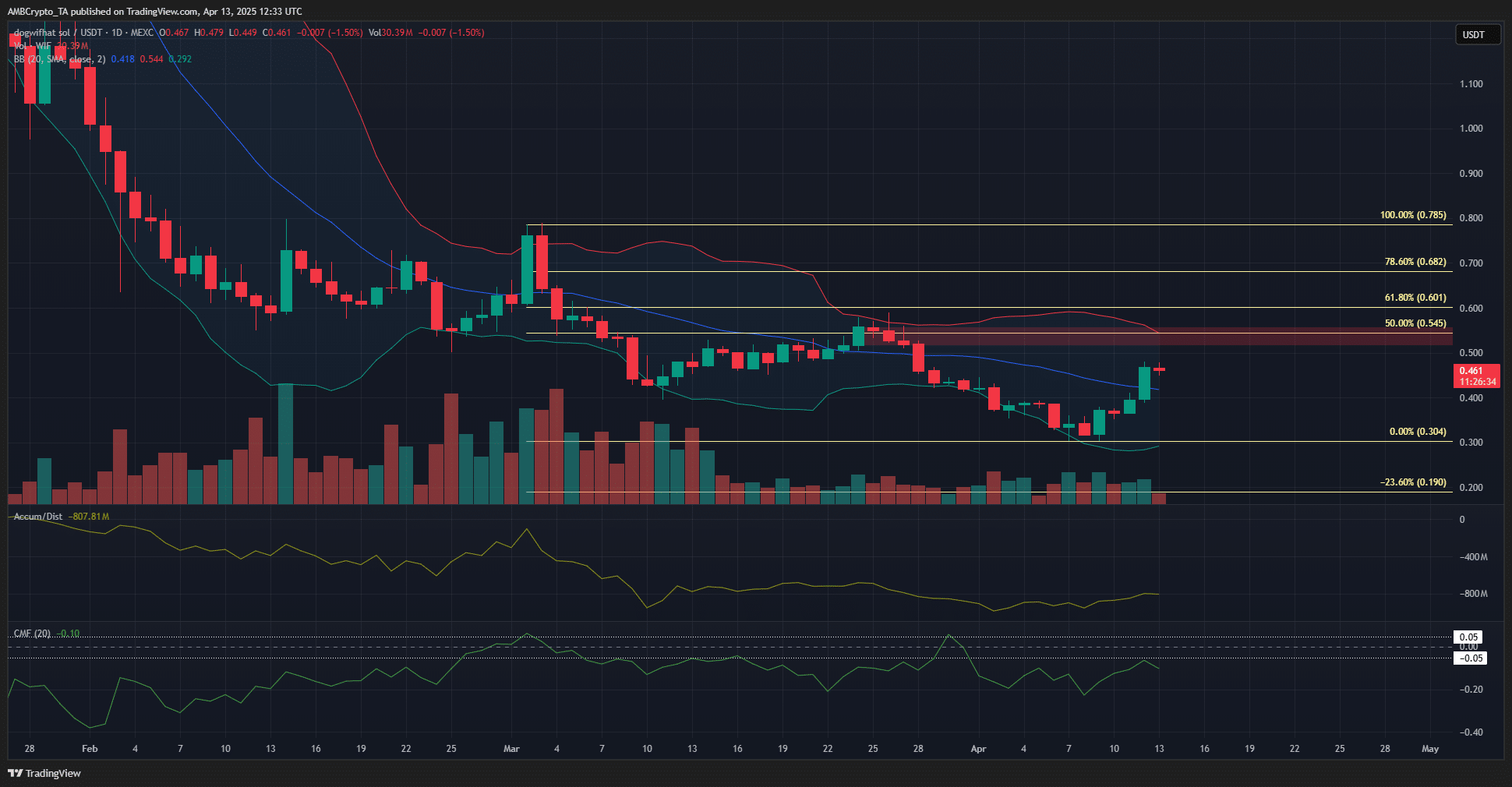

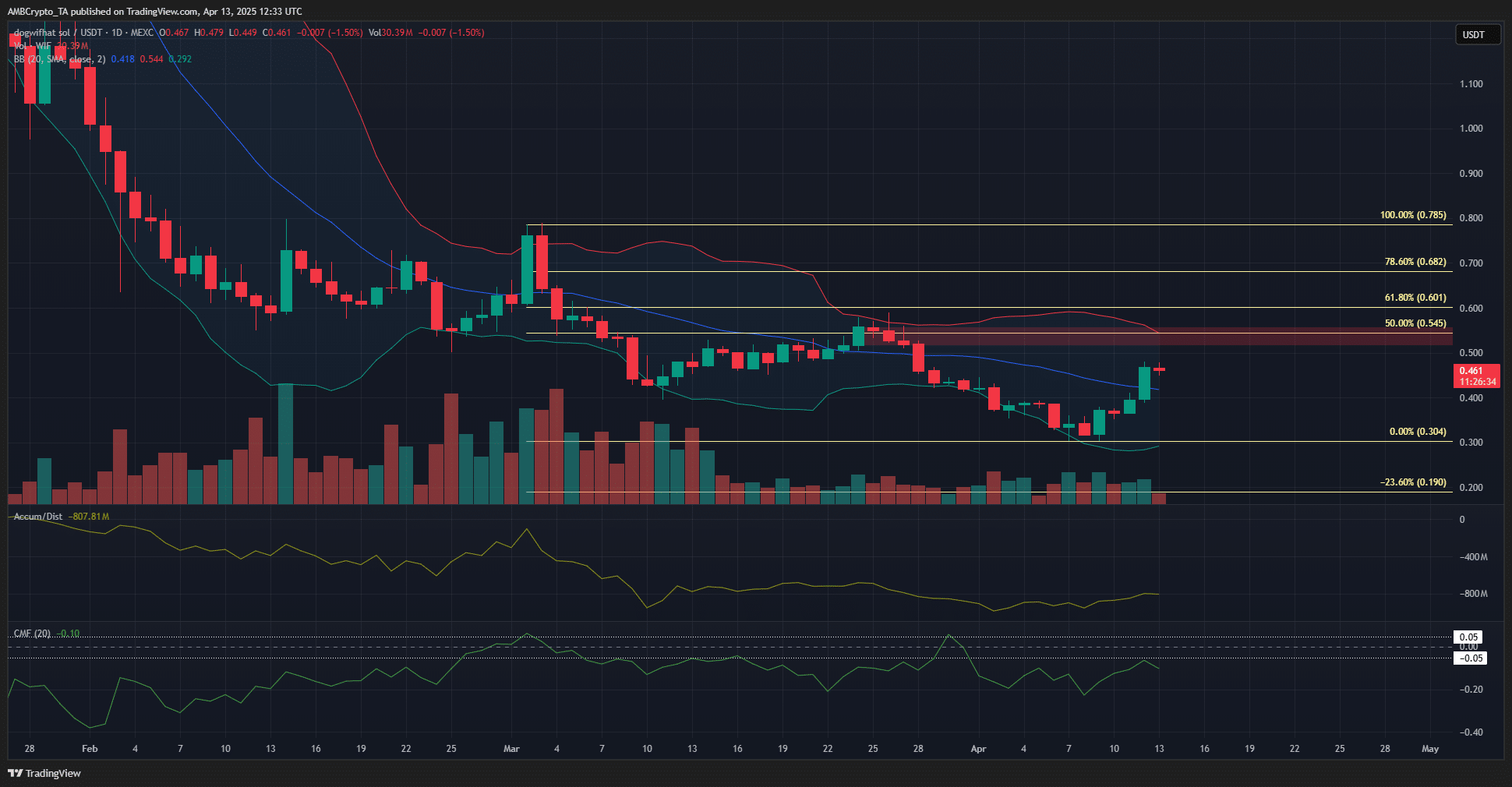

Source: wif / usdt on tradingView

Despite recent earnings, Dogwifhat worked under a downward structure on the daily graph, like many other altcoins. Losses in recent weeks have been too serious to recover, and traders and investors would better seek sales opportunities.

Technical analysis helped refine when these opportunities can arise.

Delivered in red, the $ 0.55 lowering control block coincided with the 50%Fibonacci trace level, drawn on the basis of the last six weeks down. He also had a confluence with the upper group of Bollinger.

The A / D indicator saw a rebound in April but could not climb over the recent High set during the third week of March. This has shown some purchase pressure, but no domination on their part.

The CMF was more scathing. It was less than -0.05 in the majority of the last three months. Together, the volume indicators underlined the regular sales pressure and the lack of bullish force.

Traders can use the region from $ 0.5 to 0.55 to sell WIF.

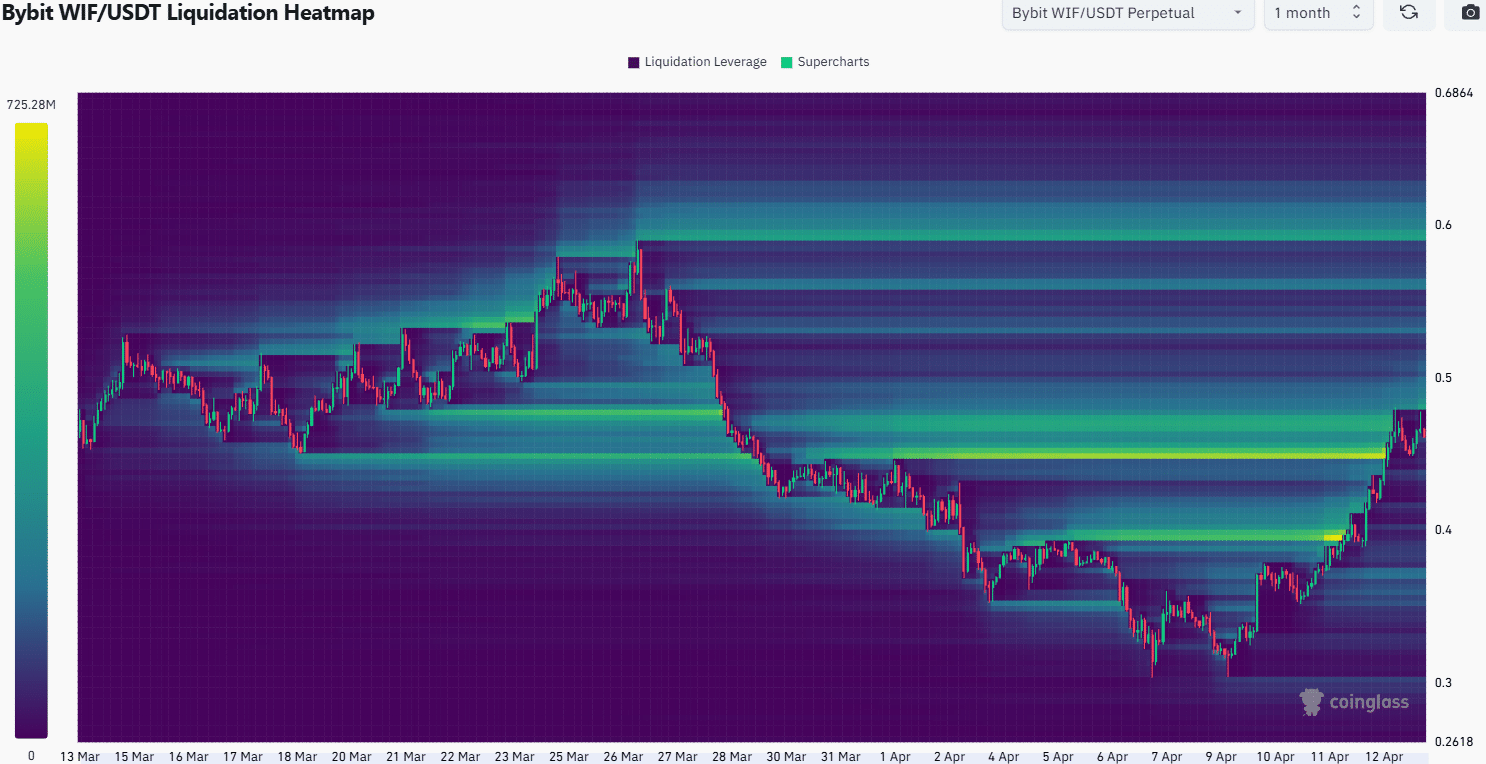

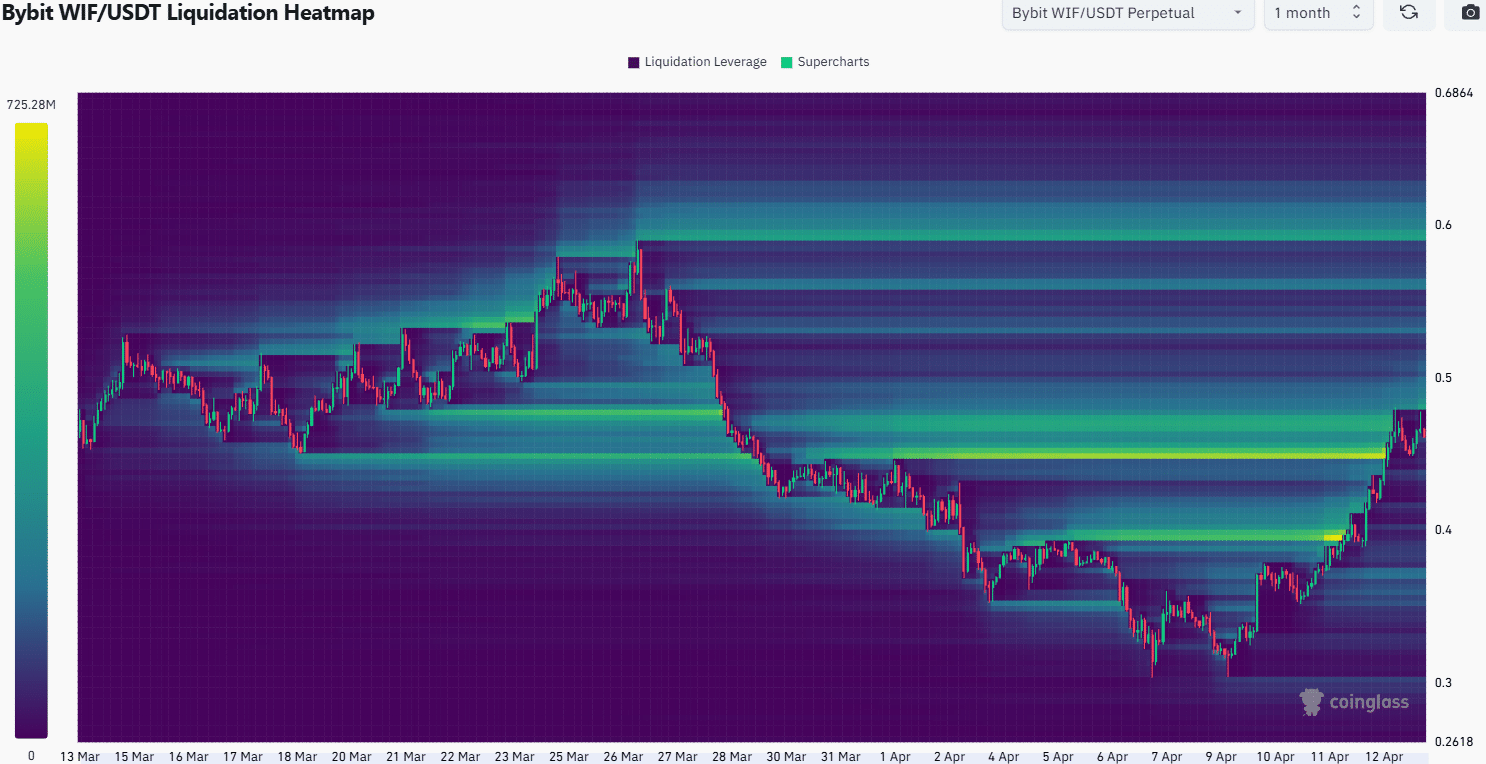

Source: Coringlass

The one month liquidation thermal card showed that the region from 0.45 to 0.47 $ had been filled with short liquidations. After swept through this level, Wif Bulls was able to maintain prices over $ 0.42, instead of seeing their earnings annihilated quickly. The BTC boot increases could have influenced the feeling of the market.

The accumulation of liquidity from about $ 0.48 to $ 0.5 marked it as a short -term objective. Further north, the level of $ 0.6 was the next notable liquidity pocket. Given the confluence of resistances around $ 0.55 and the low demand, a rupture seemed unlikely.

If WIF can consolidate about $ 0.46 in the next 24 to 48 hours, the liquidity of about $ 0.5 would likely increase thicker. This WIF consolidation scenario during the next day, followed by a price rebound and a downward overthrow later, appeared the most likely short -term result.

Traders who seek to short-circuit the same must look at the area from $ 0.5 to $ 0.55, as well as the BTC trend, to determine whether the sale would be an option feasible or not.

Notice of non-responsibility: The information presented does not constitute financial investments, exchanges or other types of advice and is only the opinion of the writer