- At the time of writing, DOT was trading in a four-hour consolidation phase and at a major support line, signaling a bullish outlook.

- The accumulation and distribution (AD) ratio is trading in a pattern that will determine its rally

Polkadot (DOT) has been sluggish since the start of the month, remaining in a consolidation phase on the charts. The same was highlighted by its modest price changes – up 0.97% over the month, with the crypto gaining just 1.57% in 24 hours.

However, despite these movements, the future direction of DOT depends on a major departure from the various models that have surfaced.

Is a major rally imminent for DOT?

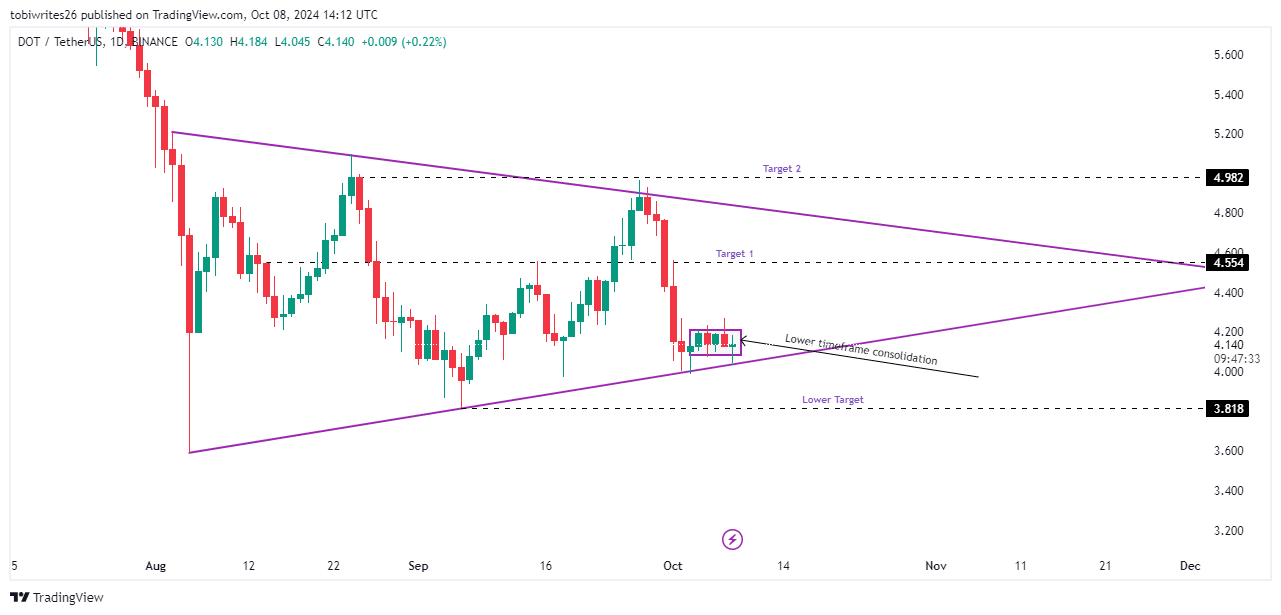

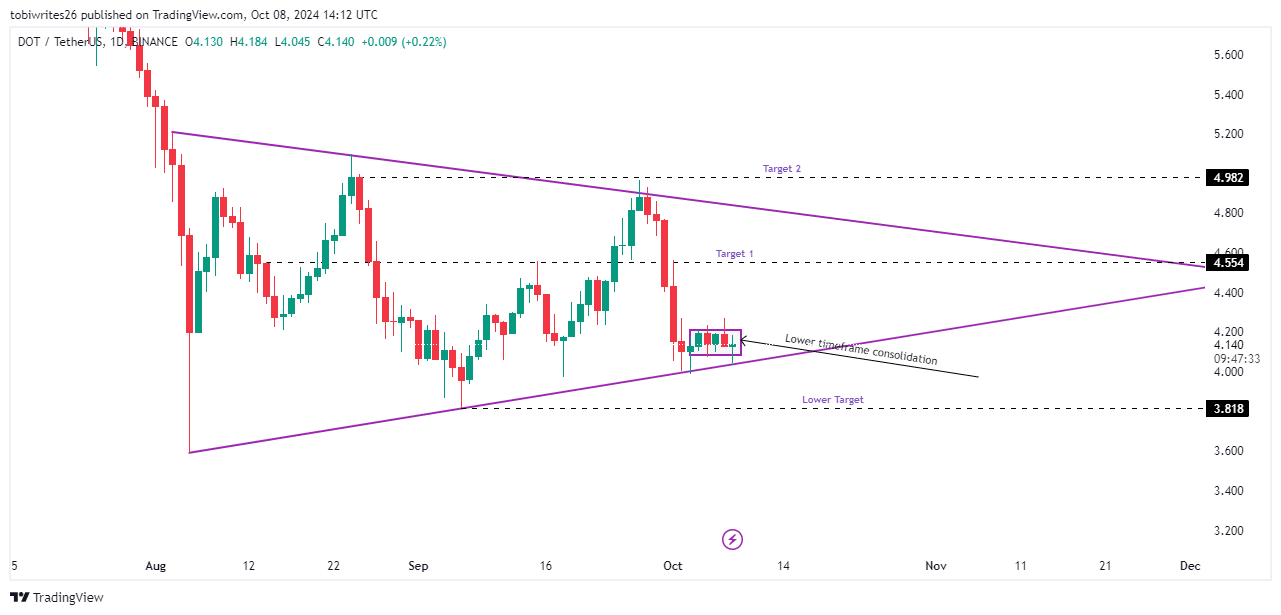

At press time, DOT was trading in a symmetrical triangle pattern, with price movements oscillating within a defined range. Despite historical uptrends from similar positions, DOT has instead consolidated at the triangle’s lower support since October 2.

Breaking out of this consolidation phase could propel DOT towards two potential targets: the first at $4.554 and a subsequent level at $4.982. Without a breakout, DOT could return to its September low of $3.818.

Source: Commercial View

Overall market sentiment also seemed quite optimistic, suggesting an upward trend for DOT in the coming sessions. Additional information from AMBCrypto also supports the likelihood of a sustained increase in DOT.

Buying activity confirmed, but DOT rally remains conditional

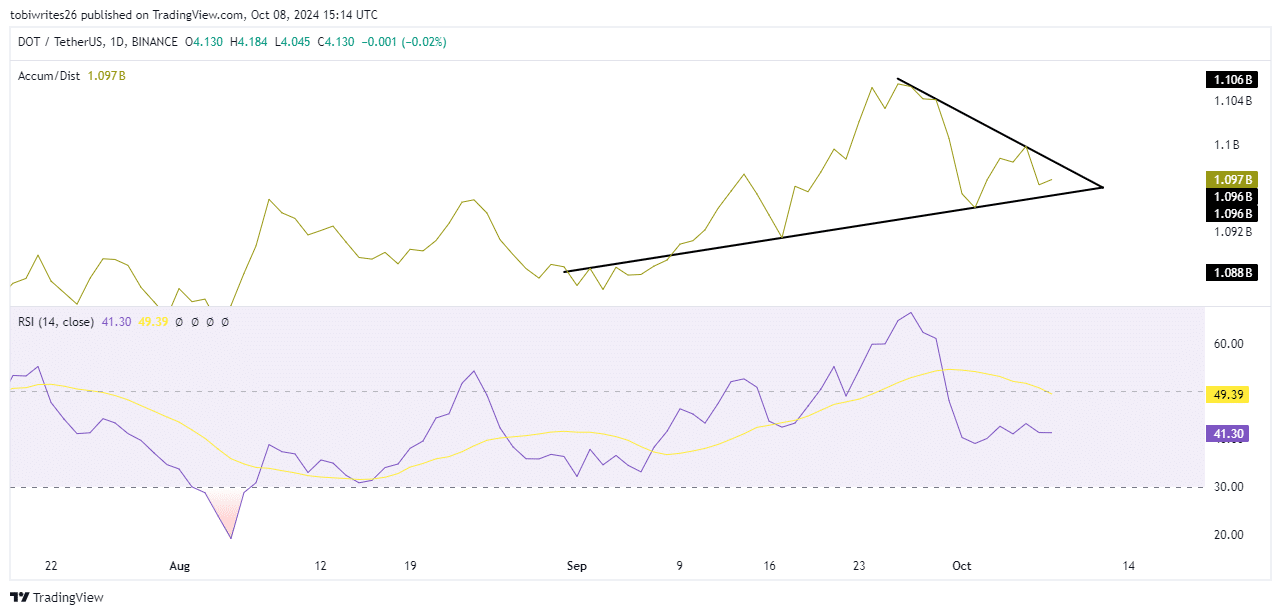

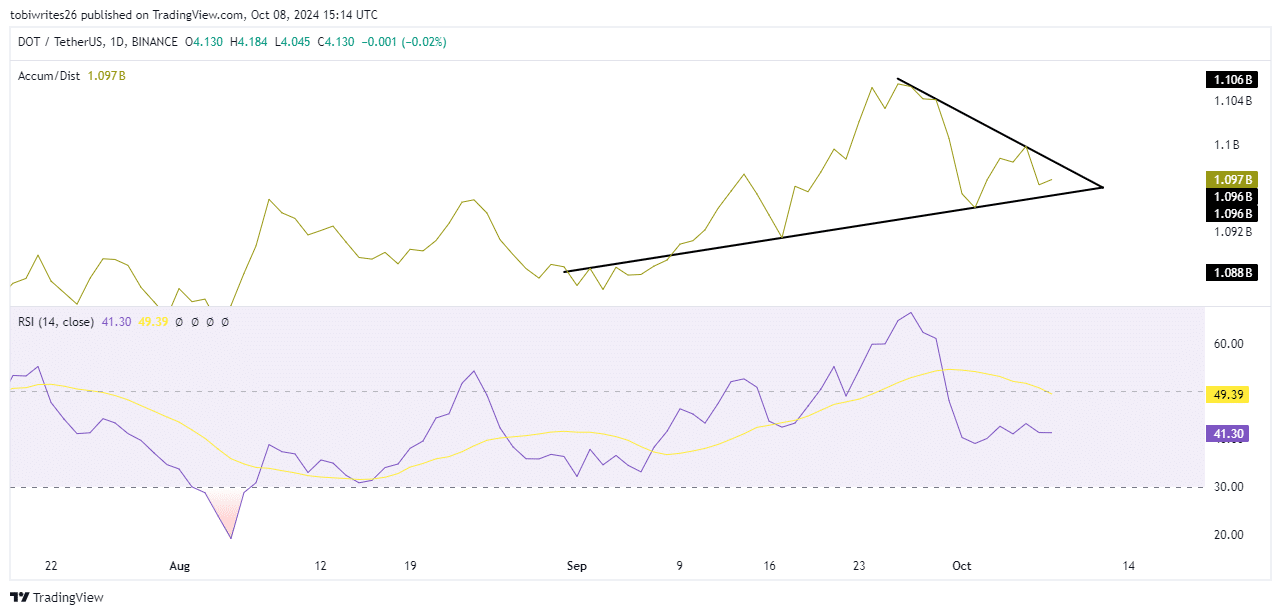

The technical Accumulation and Distribution (AD) indicator was trending upward, indicating ongoing accumulation. Its conclusions correspond to the consolidation phase identified earlier in the graph.

For a bullish breakout, the AD line must cross the upper resistance line of the triangle pattern in which it is trading. If this happens, we can expect more buying activity, which could push the price of DOT higher.

Source: Commercial View

Additionally, the relative strength index (RSI), which measures the speed of price changes, has been moving higher. This means that DOT price will likely continue its upward trend, possibly surpassing the upper limits of the consolidation channel.

Interest in DOT shifts to bulls

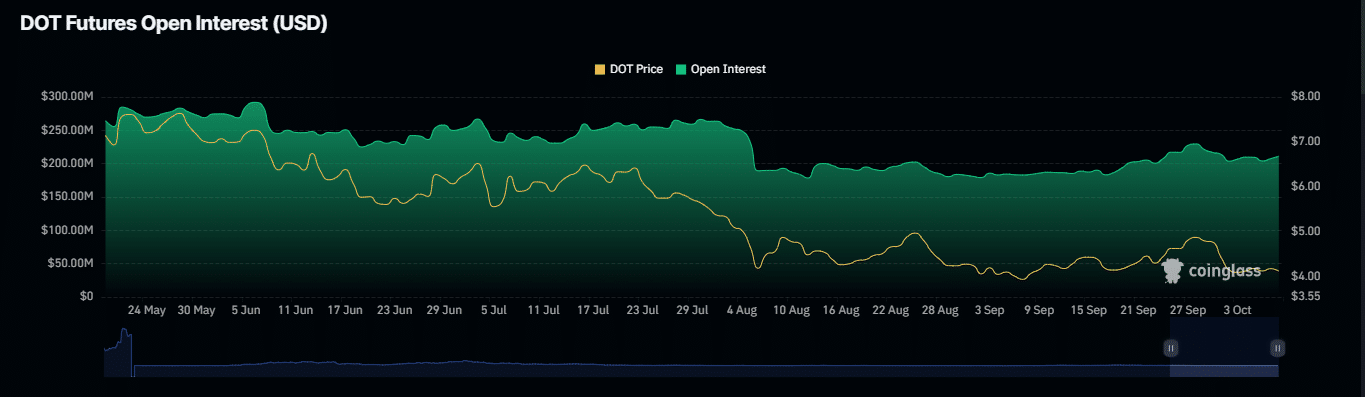

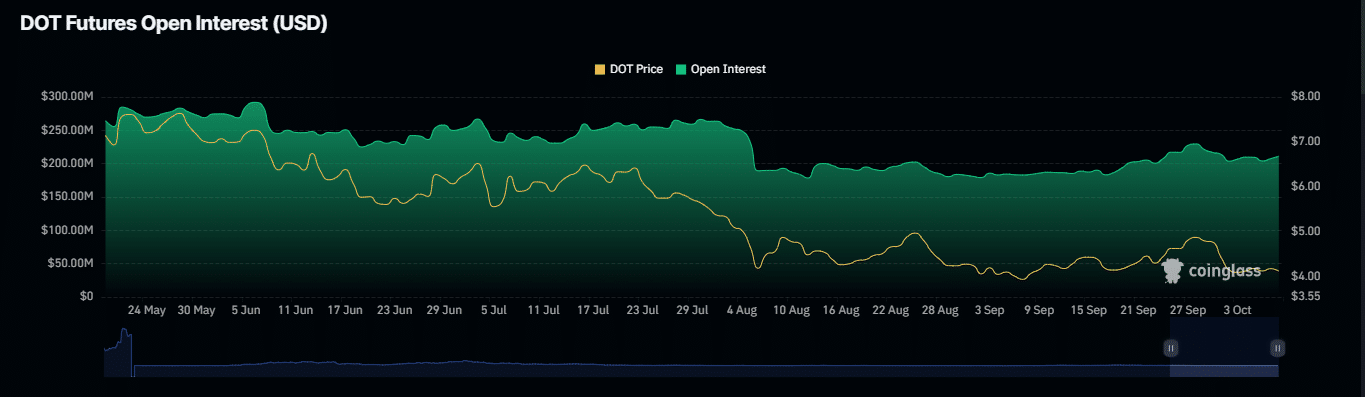

Open interest in DOT, which hit its monthly low on October 6, has continued to gain momentum, as charts from coin mechanism.

This rise can be interpreted as a sign of increasing bullish activity in the market, reinforcing the prevailing bullish sentiment.

At the time of writing, open interest was down slightly by 1.03%, valued at $209.93 million. If this uptrend continues, it could reach new highs and enter positive territory.

Source: Coinglass

Under these conditions, we can expect DOT to continue its rally, while meeting and potentially surpassing its target prices.