- On the price charts, LINK broke out of a bull flag pattern after weeks of consolidation.

- Whales have stepped up their activity by purchasing a significant share of LINK

Over the past 24 hours, LINK saw a notable price increase of 1.65%, extending its market gains from last week to 22.35%. This means there could be potential for further price movement on the charts.

In fact, market sentiment and price action indicate that LINK could soon see double-digit gains, especially if the prevailing uptrend persists.

Double-digit gains to push LINK to $50?

According to famous crypto analyst Ali, LINK has taken its first step towards a major bullish move. This, after the altcoin broke a key resistance level of the uptrend in which it has been trading.

The pattern at play is known as a bull flag, where price consolidates within a defined support and resistance zone after a major move higher. This sets the stage for more upside, which is usually confirmed once the resistance level is breached – which LINK has already done.

Source: TradingView

The chart, which included Fibonacci retracement levels, highlighted a phase where the price could register slight pullbacks before continuing its upward trajectory. The potential target for this area is $58.64, almost three times its press time value of $22.906.

According to AMBCrypto analysis, LINK whale accumulation will play a significant role in this price surge on the charts.

Whale purchases could boost LINK’s rise

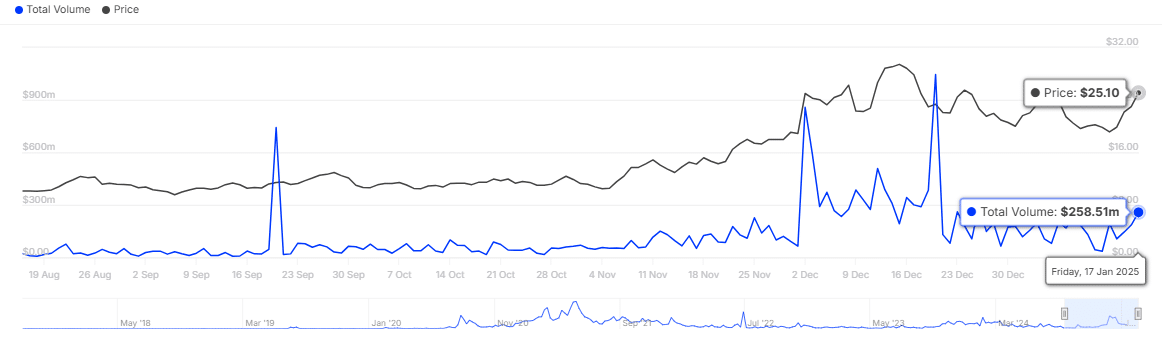

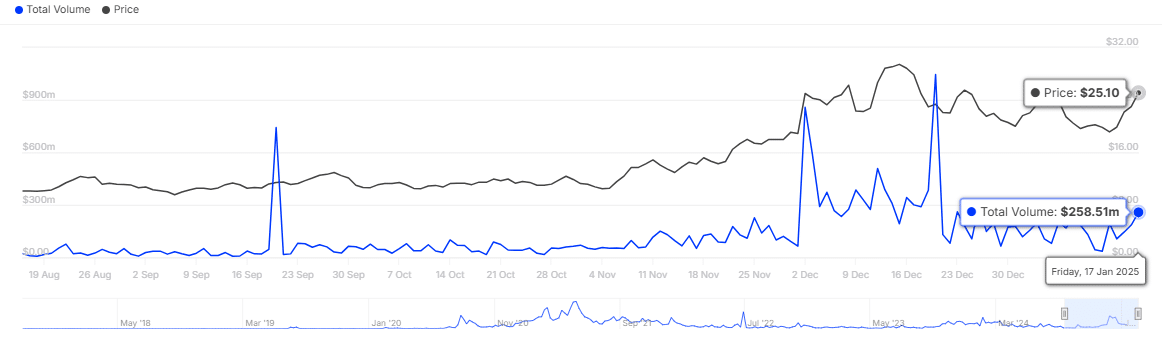

Data from IntoTheBlock also highlighted a significant increase in large investor activity on LINK. These large investors, who typically hold between 0.1% and 1% of the total supply, have played a key role in LINK’s recent price action.

In the last 24 hours alone, the number of large transactions involving LINK reached 593, with a total volume of 10.3 million LINK valued at $258.51 million.

Source: In the block

Such large trades, when followed by a price rise and a bullish breakout on the chart, imply that buying activity dominated the market during this period.

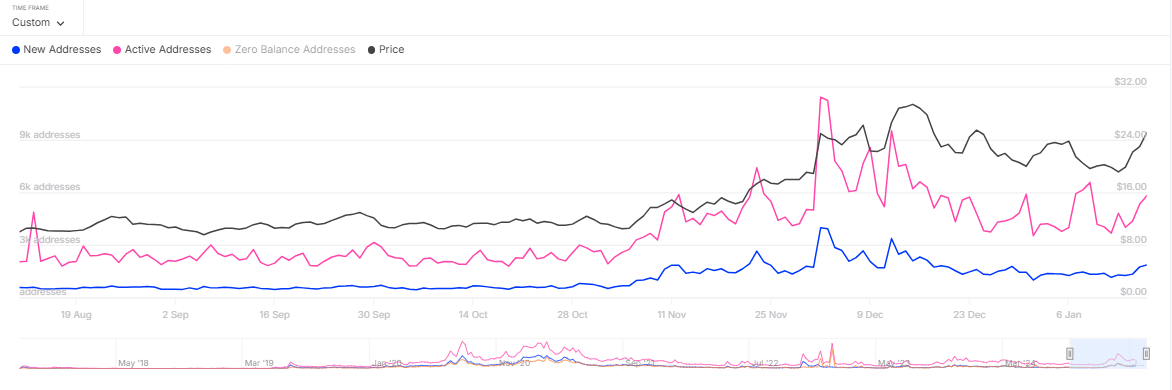

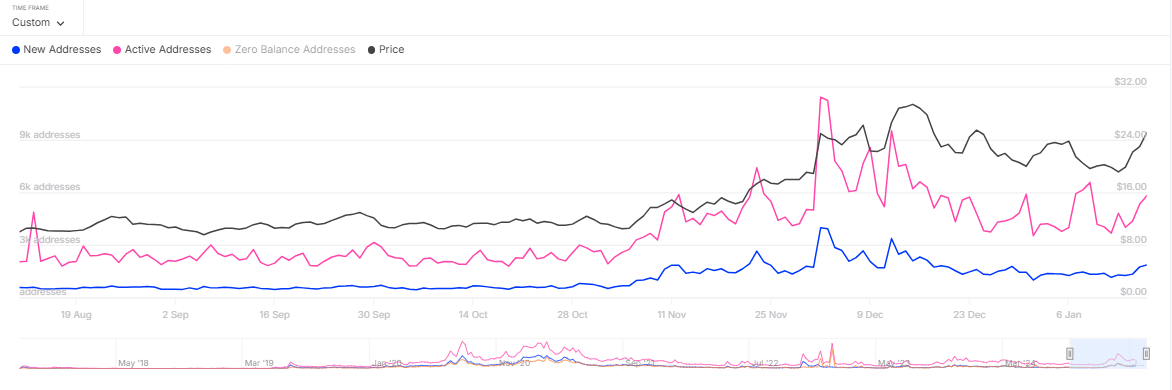

There was also a notable increase in the number of active and new addresses, indicating increased market activity that likely contributed to the latest price rise.

In fact, data from the last 24 hours revealed that the number of addresses involved in LINK transactions increased to 5,810, while new addresses onboarded increased by 1,860.

Source: In the block

On a weekly basis, these figures represented an increase of 39.02% and 40.42%, respectively, highlighting strong bullish sentiment among market participants.

If these trends continue, the continued rise in large transactions, adoption of new addresses, and active address engagement could further support LINK’s momentum.

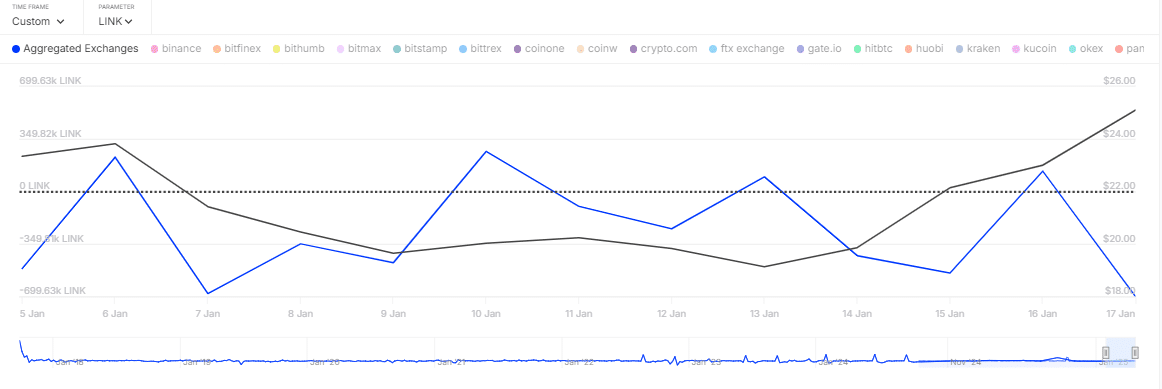

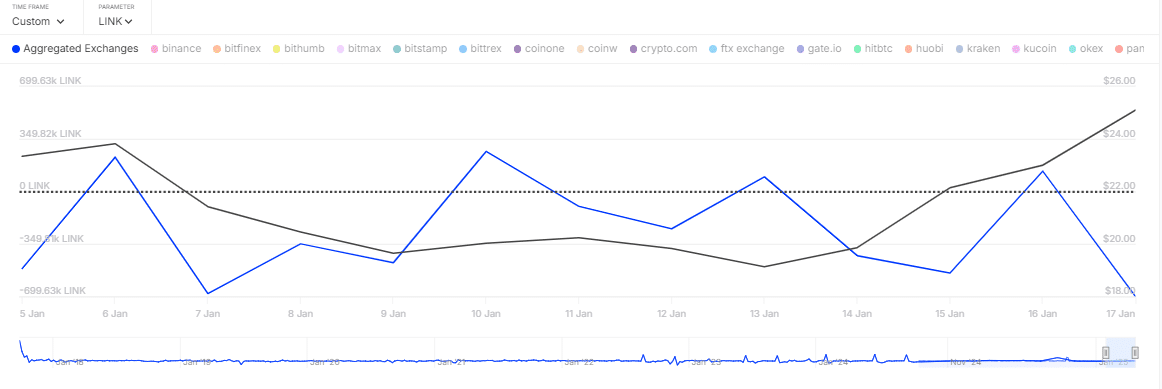

Is a supply shortage looming on the horizon?

Finally, on-chain data revealed high LINK outflows from cryptocurrency exchanges, outpacing market inflows.

This was identified using the Aggregated Exchange Netflow, which tracks deposits and withdrawals of assets across various crypto exchanges. At press time, net flows revealed a negative reading of 149,670 LINK.

Source: In the block

Such a large pullback means that market participants are capitalizing on the prevailing uptrend, preferring to keep their LINK outside of exchanges for long-term storage. This may fuel a supply squeeze for the altcoin.

If this trend continues and net flow remains negative, it could signal a prolonged rise in LINK prices, potentially leading to a supply squeeze.