Before MicroStrategy began purchasing Bitcoin in November 2020, it was unheard of for a public company to accumulate “risky” crypto. Certainly, some of the best cryptos to buy have gained over 100 times since their launch. However, the lack of clear regulations constitutes a major obstacle.

That quickly changed after Michael Saylor went all-in on Bitcoin, buying billions worth of BTC. In January 2026, Strategy sold shares and purchased over $3 billion worth of Bitcoin. Not to be outdone, Metaplanet is also executing its own plan to raise funds and purchase Bitcoin.

25 hours of reading pic.twitter.com/YPhua9p7d3

– Metaplanet Inc. (@Metaplanet) January 29, 2026

All of this is happening just as the Bitcoin price is stuck below $90,000, with hopes that the BTC USD price will surpass $100,000 in the next two weeks. Sentiment remains bearish, but given the fundamentals, buyers may have a chance to show their hand.

Cryptocurrency Fear and Greed Chart

1 year

1m

1w

24h

DISCOVER: Best new cryptocurrencies to invest in in 2026

Metaplanet plans to buy $137 million worth of Bitcoin

Earlier today, Japan-listed Metaplanet approved a plan to raise up to $137 million from foreign investors to buy more Bitcoin and pay down debt. Interestingly, even after this news was made public, Metaplanet stock barely shook after the filing, a sign that markets are already expecting aggressive Bitcoin accumulation from the company. If anything, it shows that the market supports Metaplanet’s shift from a hotel operator to a “Bitcoin treasury company.”

Metaplanet will sell new shares and warrants to foreign investors. Specifically, the raise is divided into two main parts in order to maximize capital while managing dilution to current shareholders. They are issuing 24.5 million new shares of common stock at around $3 per share, with the aim of raising around $78 million immediately.

Metaplanet has closed its first institutional transaction of shares + warrants to accelerate our Bitcoin strategy. Total proceeds of up to 21 billion yen, including 12.2 billion yen in shares issued at a premium of 5% (499 yen) and up to 8.8 billion yen of one-year warrants issued at a premium of 15% (exercise of 547 yen… pic.twitter.com/OprgedN4Fd

– Simon Gerovitch (@gerovitch) January 29, 2026

Shareholders also approved the issuance of 159,440 warrants, giving investors the right to subsequently purchase more shares at a fixed price. If all of these measures are exercised over the next year, it could bring in an additional $56 million.

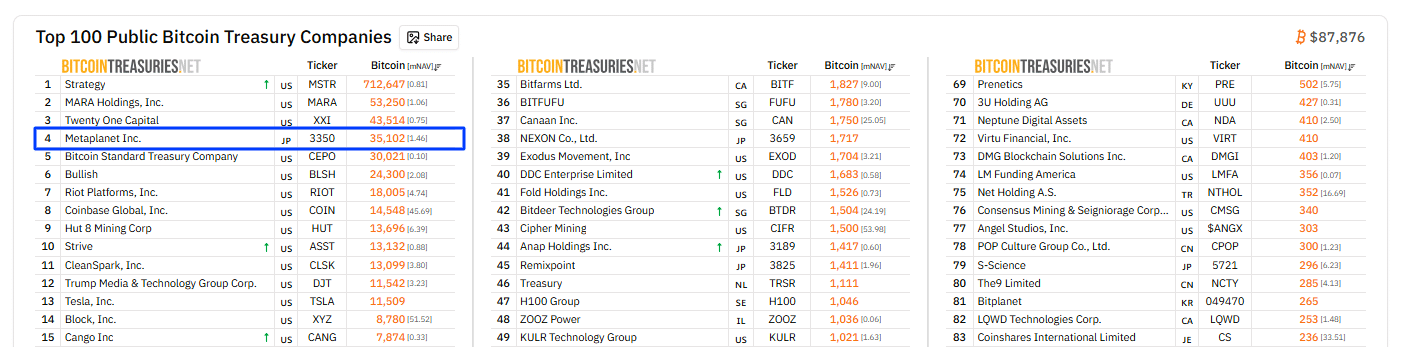

It should be noted that Metaplanet has been very transparent about its plan to purchase Bitcoin. Of the $137 million, a large portion will be allocated to purchasing Bitcoin. When they do, it will cement their position as one of the largest corporate shareholders in the world.

(Source: Bitcoin Treasures)

Another part of the amount collected will be used to repay existing loans. Logically, debt clearance allows them to recharge their credit facilities. In turn, this will give them more flexibility to borrow again if the price of Bitcoin falls.

However, unlike MicroStrategy, Metaplanet will leverage its BTC. For example, they invest in their “Bitcoin Income” segment. This division uses derivatives, such as selling put options, to generate returns on its existing holdings.

DISCOVER: The best Meme Coin ICOs to invest in 2026

Is This a New Playbook for Corporate Bitcoin Treasuries

Metaplanet calls itself a “Bitcoin cash company.” This means that Bitcoin is at the center of its strategy and not as a side experience. This mirrors the playbook used by MicroStrategy and discussed in our guide to enterprise crypto treasuries. However, they are a game changer when it comes to fundraising.

The company already holds tens of thousands of BTC worth billions of dollars. By targeting foreign investors primarily through private placements, Metaplanet leverages a larger pool of capital than typically available to small-cap companies on the Tokyo Stock Exchange. This flexibility is important when you want to buy Bitcoin during price drops.

The motivation is simple: Metaplanet capitalizes on the high volatility of its own shares. Since stocks often trade at a “premium” to the actual value of the Bitcoin the company owns, the company can sell expensive stocks to buy “cheap” Bitcoin. This is a game straight out of the MicroStrategy playbook.

Additionally, diversification away from the yen means that MetaPlanet is now more focused than ever on BTC yield, which is simply a measure of the amount of BTC held per share. Even though the shares will be diluted after the $137 million increase, the BTC yield will increase since they will hold more BTC.

METAPLATE MOON MATHEMATICS

Metaplanet had a BTC return of 568.2% last year.

Their small size helped.

Even assuming they never trade at a huge multiple and assuming a much lower BTC yield, returns will still be ridiculous over the next 5 years.

1× mNAV returns with 75% BTC… pic.twitter.com/92zLtbA9rz

–Adam Livingston (@AdamBLiv) January 5, 2026

Overall, this is a bullish sign for Bitcoin. When public companies raise real money to buy Bitcoin, it reinforces the idea that institutions view BTC as a long-term hedge and not a quick fix. Corporate purchases tighten supply. Bitcoin has a hard cap, so when companies lock it in their balance sheets, fewer coins trade freely. This supply squeeze often leads to higher prices over time.

DISCOVER:

- 16+ New and Upcoming Binance Announcements in 2026

- 99Bitcoins State of the Crypto Market Report for Q4 2025

Follow 99Bitcoins on X For the latest market updates and subscribe on YouTube for daily market analysis from experts.

The article Metaplanet Plans $137 Million Bitcoin Purchase Using Offshore Stock Trade appeared first on 99Bitcoins.

METAPLATE MOON MATHEMATICS

METAPLATE MOON MATHEMATICS