Join our Telegram Channel to stay up to date on the coverage of information on the breakup

Metaplanet deploys a yield curve supported by Bitcoin and a preferred action program aimed at making BTC a credible form of guarantee markets in Japan capital, a decision to challenge the domination of traditional fixed income products.

The Bitcoin -supported yield curve would create a pricing framework for collected credit in Bitcoin, opening the door to institutional investors to draw from the BTC while locking predictable yields.

The “Metaplanet Prefs” program will further arrange the company’s croissant Treasury of the company by issuing instruments supported by BTC on several credit profiles and maturity.

Bitcoin’s head of the Bitcoin strategy, Dylan Leclair, said in an X Post today that initiatives mark the next step in Metaplanet’s mission to “digitally transform the capital markets of Japan” and to prepare for “hyperbitcoisation”.

By integrating Bitcoin into the country’s fixed income structure, the company becomes a legitimizing the BTC as a guarantee of institutional quality.

The announcements land on the Metaplanet best quarter tables, with income up 41% of 1.239 billion yen of 1.239 billion yen (8.4 million dollars) and a net profit to a profit of 11.1 billion yen ($ 75.1 million) with a loss of 5 billion yen.

Metaplanet publishes solid quarterly results

The new Metaplanet initiatives occurred when it announced a performance of a solid district.

The company’s revenues climbed 41% of the trimester-trimester (QOQ) to 1.239 billion yen, or about $ 8.4 million. Net profit also rebounded at a profit of 11.1 billion yen ($ 75.1 million) with a loss of 5 billion yen last year.

Metaplanet Q2’s profits:

– income ¥ 1.239b ($ 8.4 million) + 41% Qoq

– gross profit ¥ 816 m ($ 5.5 million) + 38% qoq

– Ordinary benefit 17.4b ($ 117.8 million) against – ¥ 6.9b

– net income 11.1b ($ 75.1 million) against – ¥ 5.0b

– Active ¥ 238.2b ($ 1.61 billion) + 333% Qoq

– net assets 201.0b ($ 1.36 billion) + 299% Qoq– Metaplanet Inc. (@metaplanet_jp) August 13, 2025

The performance of the beginning of the beginning of the year (YTD) overshadowed the average gain of 7.2% displayed by the TOKYO (TOPIX) CORE 30 stock index, which is a reference that follows the giants, including Toyota, Sony and Mitsubishi Heavy Industries.

Metaplanet also outstanded Nintendo and SoftBank Group, who both displayed two -digit gains during the same period, but have lagged behind the Bitcoin Treasury firm by a wide margin.

CEO Simon Gerovich said In an X post earlier in the day that this last quarter of performance marks the strongest of society.

With the stellar results of the neighborhood and the launch of two new initiatives, Metaplanet is perfectly placed to continue its Bitcoin accumulation strategy.

One day before the results were released, the company announced that it had bought an additional 518 BTC for around $ 61.4 million. Gerovich revealed that the average purchase price of this most recent acquisition was around $ 118,519 per BTC, assets generating a yield of 468.1% for YTD.

Metaplanet acquired 518 BTC for ~ 61.4 million dollars at ~ ~ $ 118,519 per Bitcoin and reached BTC yield of 468.1% YTD 2025. At 8/12/2025, we hold 18,113 $ BTC Acquired for ~ $ 1.85 billion to ~ $ 101,911 per bitcoin. $ MTPLF pic.twitter.com/gm2bybgyf0

– Simon Gerovich (@gerovich) August 12, 2025

After the last purchase of Bitcoin, the Japanese company now contains 18,113 BTC, which was acquired for around $ 1.85 billion to $ 101,911 per BTC.

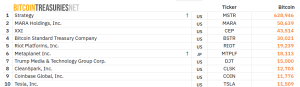

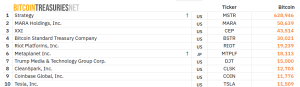

Metaplanet is now just over 1,000 BTC to exceed RIOT platforms as a fifth largest business bitcoin holder worldwide. Riot currently holds 19,239 BTC, Bitcoin Treasures data shows

Investors are also increasingly placed on the bets that Metaplanet’s BTC strategy will pay off. According to the profits report, the number of Metaplanet shareholders climbed 350% since the company began to buy BTC in the fourth quarter of 2024.

The strategy, the company which was the pioneer of Bitcoin purchases funded by the debt, still maintains a comfortable advance in the Treasury race of the BTC. The software giant led by Michael Saylor holds 628 946 BTC.

The biggest corporate bitcoin holders (Source: Bitcoin Treasury))

Metaplanet, however, intends to acquire 210,000 bitcoin by the end of 2027. Assuming that the 5 best holders of the corporate BTC, excluding the strategy, do not buy more crypto, Metaplanet could become the second largest Bitcoin holder next year.

At the beginning of the month, the company already announced that it was aimed at raising $ 3.73 billion thanks to a share offer to support its accumulation of Bitcoin.

* Q&R concerning the changes in the articles of association and the conservation registration for a broadcast of up to 555 billion JPY in perpetual privileged stock * pic.twitter.com/v7tps0Oe1z

– Metaplanet Inc. (@metaplanet_jp) August 1, 2025

The United States leads to the number of Bitcoin vouchers in the Pro-Crypto Trump

In the past 30 days, 15 other companies have added bitcoin to their balance sheets, pushing the total amount of these companies worldwide at 292.

Bitcoin Treasury Statistics (Source: Bitcoin Treasuries)

The United States has the most bitcoin cash companies, with 99 companies of this type. In second place is Canada with 43 companies holding BTC.

A possible reason for the higher number of Bitcoin vouchers in the United States could be linked to the Pro-Crypto administration under the American president Donald Trump, who pushes to make the United States the capital of the world crypto.

Trump has already started to keep his pro-Crypto campaign promises since entering the White House for a second term, and has signed the law on genius stablecoin, among other changes in cryptographic policy.

Under the new administration, the Securities and Exchange Commission of the United States (SEC) also abandoned several high-level cases against American cryptography companies, while its president, Paul Atkins, seeks to facilitate the license requirements of cryptography with his initiative of “crypto” recently unveilete.

Following the example of the SEC, the US Future Trading Commission (CFTC) also launched its “Crypto Sprint” initiative earlier this month, announcing that it began to explore the Trading Spot Crypto on the term scholarships.

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup