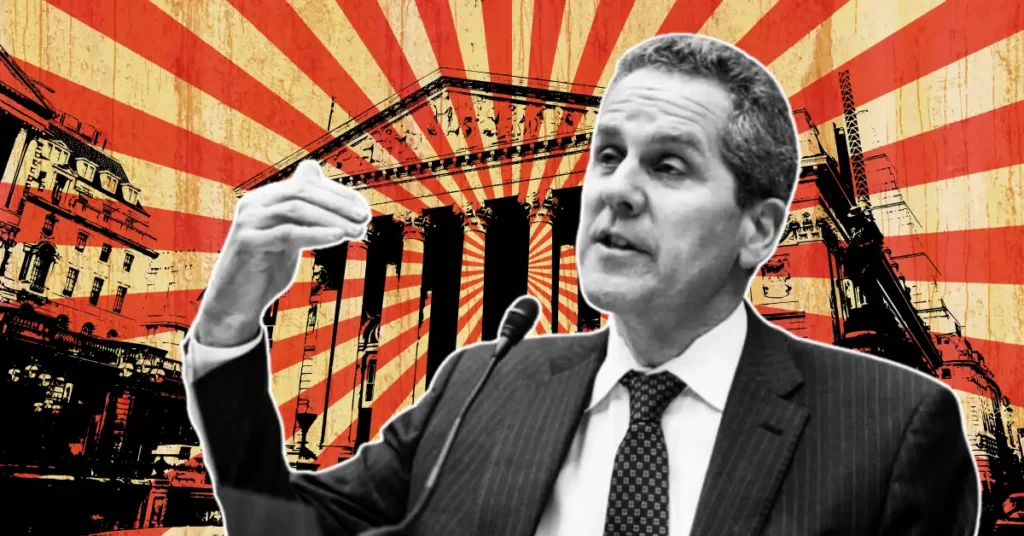

In the latest development, the Federal Reserve announced Monday that Michael S. Barr would step down as vice chairman overseeing the Federal Reserve Board. However, he will remain a member of the Board of Governors.

In a statement included in the Federal Reserve’s announcement, Barr suggested that he decided to resign voluntarily in order to avoid a possible dispute with the incoming Trump administration. Jaret Seiberg, a financial analyst at TD Cowen, warned that Barr’s resignation reflects growing political influence in banking regulation, as agency leaders no longer stay in place when administrations change, leading to more changes. of politics.

Eleanor Terett notes Barr’s ties to Elizabeth Warren

Fox business reporter Eleanor Terett spoke to struggling to engage in and hold crypto assets.

Controversial mandate

Barr has had a significant influence on the financial system’s relationship with cryptocurrencies. Although he has previous experience in crypto, including advising Ripple, his tenure has been controversial for the crypto industry. He has advocated for the Federal Reserve to regulate and enforce laws on stablecoin issuers in the United States, a move that has been criticized by Republican lawmakers.

- Read also:

- Major victory! HashKey Europe Obtains Crypto VASP License in Ireland

- ,

Senator TimScott notably criticized Michael Barr for his failure to oversee the security of the banking system, citing his role in the spring 2023 bank failures and the problematic Basel III Endgame proposal. “I am ready to work with President Trump to ensure that we have responsible financial regulators at the helm,” he noted.

Michael Barr had planned to stay in office until 2026, but his resignation raises uncertainty around a key proposal requiring big U.S. banks to hold more capital to avoid future crises. Barr played a crucial role in the proposal, which seeks a 19% capital increase for big banks like Citigroup and JPMorgan. The banking sector strongly opposed this project.

Never miss a beat in the crypto world!

Stay ahead of the curve with breaking news, expert analysis and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs and more.