Join our Telegram channel to stay up to date with the latest news

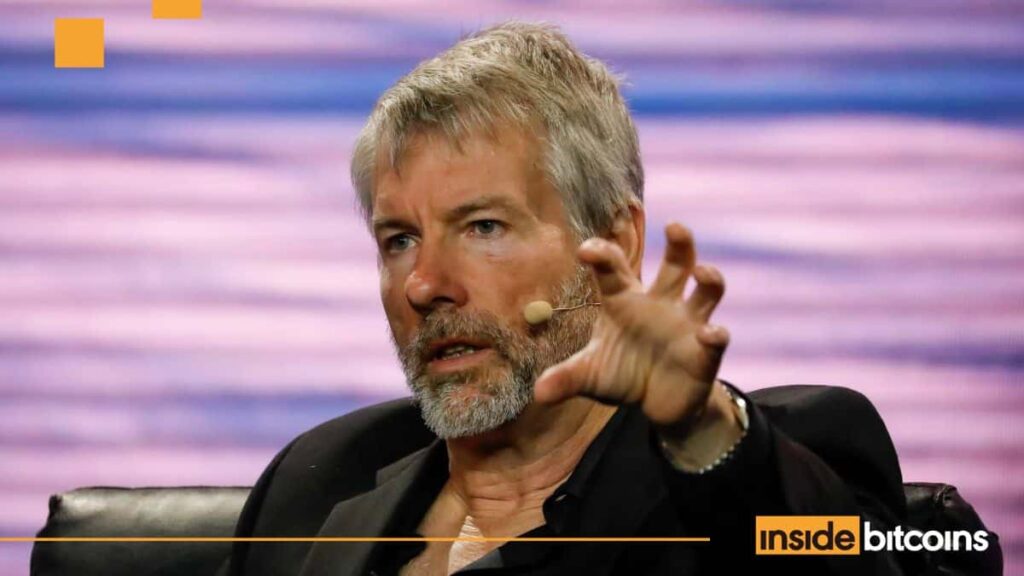

Michael Saylor hinted at a new direction in Strategy’s Bitcoin game plan, swapping his usual “orange dots” for “green dots” in a November 30 article on X.

For the past year, Saylor has used orange dot updates on the SaylorTracker chart on Sundays, a move that frequently preceded Bitcoin buy announcements the next day.

“What if we started adding green dots?” » Saylor said in his latest post on X.

The change has been triggered speculation across the Bitcoin community, observers trying to decode whether the green dots represent stock buybacks, a balance sheet adjustment, Bitcoin sales, or something completely different.

The intrigue comes as Strategy shares continue to slump, alongside the broader crypto market, and follows recent comments from CEO Phong Le that the company may consider sell some of its BTC holdings if doing so is “mathematically” justified to protect the company’s “Bitcoin yield per share.”

Strategy Suspends Bitcoin Buying Frenzy

Strategy has become the biggest business BTC holder worldwide with 649,870 BTC on its balance sheet since the company began accumulating crypto in 2020.

Most recently, the company was among the few that continued to increase their crypto treasuries during the latest crypto market downturn, which not only led to lower crypto prices, but also a decline in the stock prices of digital asset treasury (DAT) companies.

Strategy itself has seen its stock price fall more than 33% in the past month and more than 52% in the past six months, Google Finance. data watch.

Evolution of the strategy’s stock price over the last 6 months (Source: Google Finance)

Despite the pressure on stock prices, Strategy has bought Bitcoin every week between September 11 and November 17. The largest purchase during this period occurred on November 17, when the company purchased 8,178 BTC for $836 million.

Since then, the build-up has been on hold, fueling speculation about future plans.

Strategy would consider selling BTC if funding options dry up

Speaking In a recent interview on the show “What Bitcoin Did,” the company’s CEO Phong Le said the company could resort to selling some of its BTC if the strategy’s multiple to net asset value (mNAV) falls below 1 and financing options dry up.

The $60 billion Bitcoin bet | @Strategy CEO Phong Le pic.twitter.com/w0WBg42PaD

-Michael Saylor (@saylor) November 28, 2025

But if Strategy were to dump some of its BTC, it would contradict Saylor’s mantra that “you don’t sell Bitcoin.”

However, Le noted that Bitcoin sales would be a last resort for the strategy.

“I wouldn’t want to be the company that sells Bitcoin,” he said.

Le added that Strategy has deliberately designed its balance sheet to avoid liquidity stress and maintain margin for opportunistic issuance.

“Our capital is very strong,” he said.

Strategy relied on various debt instruments to raise capital for its Bitcoin purchases. The first debt maturity for these instruments is scheduled for this month, Le said.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news