Strategy, the business intelligence firm that has become the largest holding company of Bitcoin, added 1,142 BTC to its reserves over the past week, bringing total holdings to 714,644 BTC valued at approximately $49 billion.

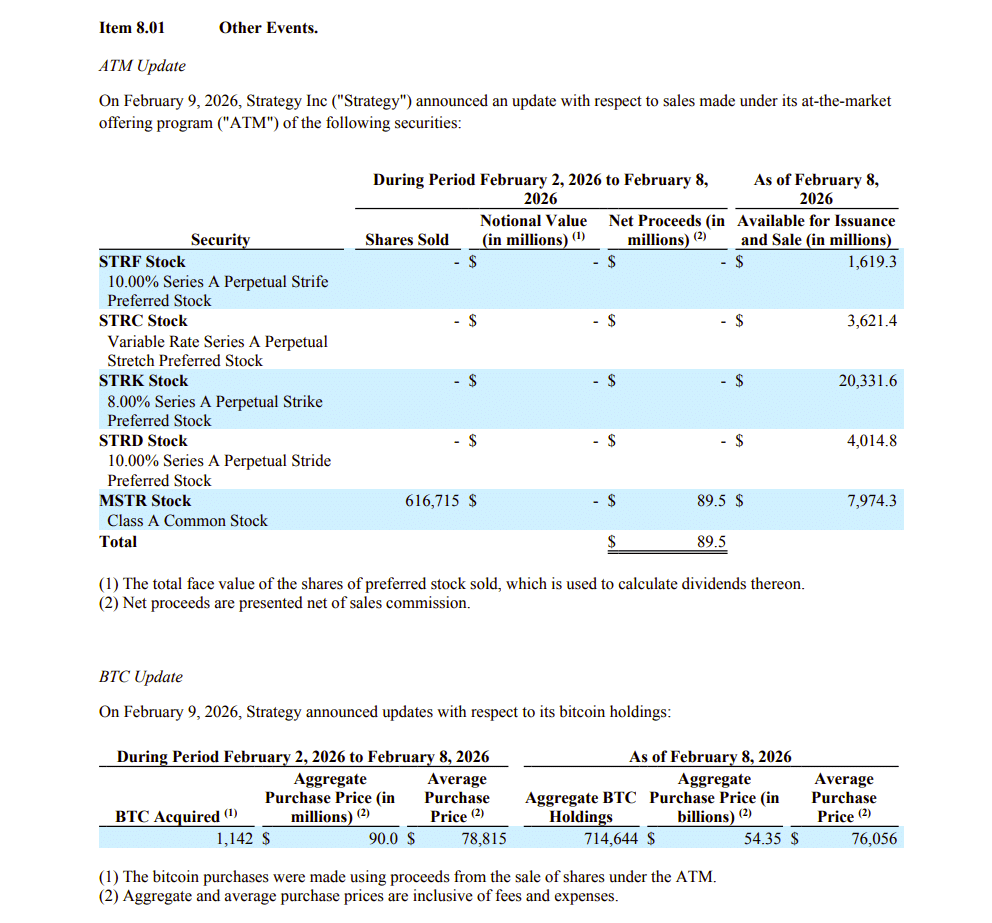

Strategy acquired 1,142 BTC for approximately $90.0 million at approximately $78,815 per bitcoin. As of 02/08/2026, we were hosting 714,644 $BTC acquired for ~$54.35 billion at ~$76,056 per bitcoin. $MSTR $STRC

– Strategy (@Strategy) February 9, 2026

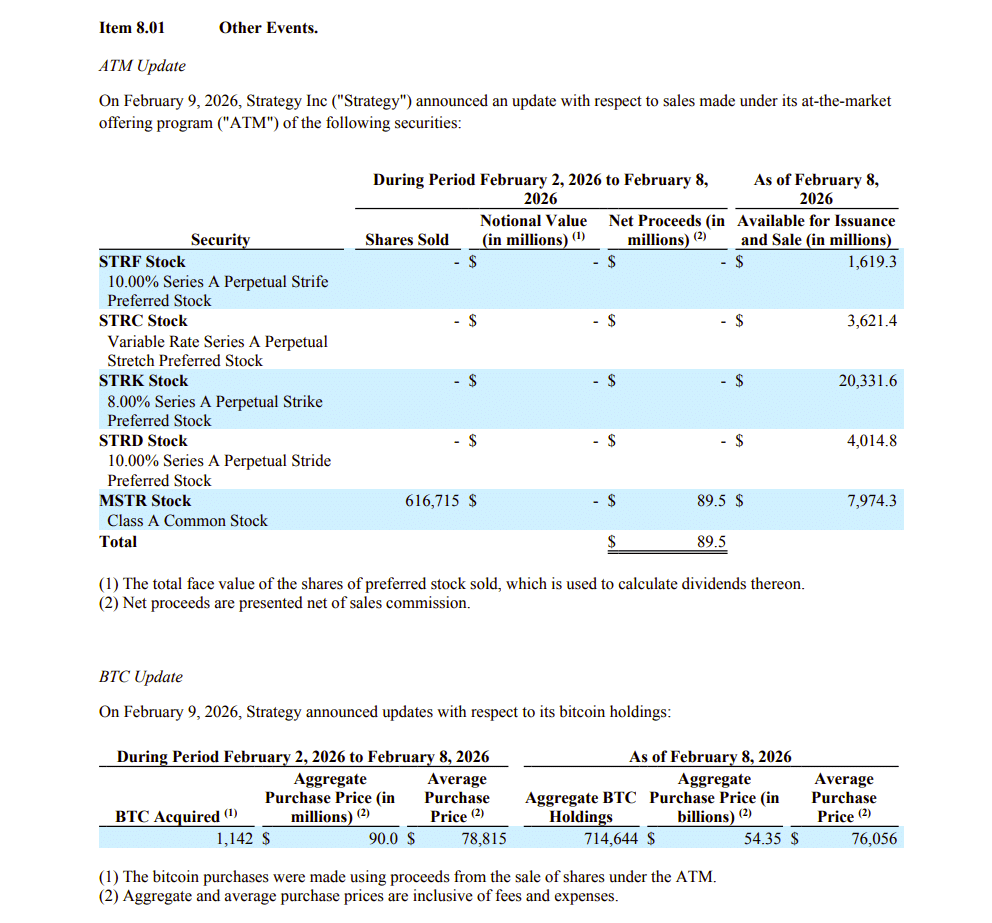

The company revealed today that it spent $90 million on the latest batch of Bitcoin between February 2 and February. 8, acquire the reserve at an average price of $78,815 per piece. The funding came from the sale of MSTR common stock, which generated net proceeds of $89.5 million.

Michael Saylor, founder and executive chairman of Strategy, led the company’s shift toward treating Bitcoin as its primary cash reserve. The average base cost across all titles now stands at $76,056 per token.

The acquisition follows a purchase earlier this month, when Strategy purchased 855 BTC for $75 million. The Company maintains approximately $37.6 billion of remaining capacity under its common and preferred stock ATM programs.

Strategy’s aggressive accumulation strategy has encountered headwinds in recent months. The company reported a net loss of $12.4 billion in the fourth quarter of 2025, largely due to fluctuations in market value.

MSTR fell slightly in premarket trading Monday after closing up 26% last Friday, according to Yahoo Finance.