Strategy, formerly MicroStrategy, is one of Bitcoin’s biggest advocates. For years, the business intelligence company has been buying BTC, adding digital gold to its balance sheet. So far, MicroStrategy is the largest BTC holder with over 687,000 BTC worth over $63 billion.

While their strategy has inspired many other public companies, including MetaPlanet, MicroStrategy faces challenges: the price of Bitcoin has stagnated, or even declined, in recent months. As a result, MSTR stock was under immense selling pressure, falling at a faster rate than Bitcoin itself.

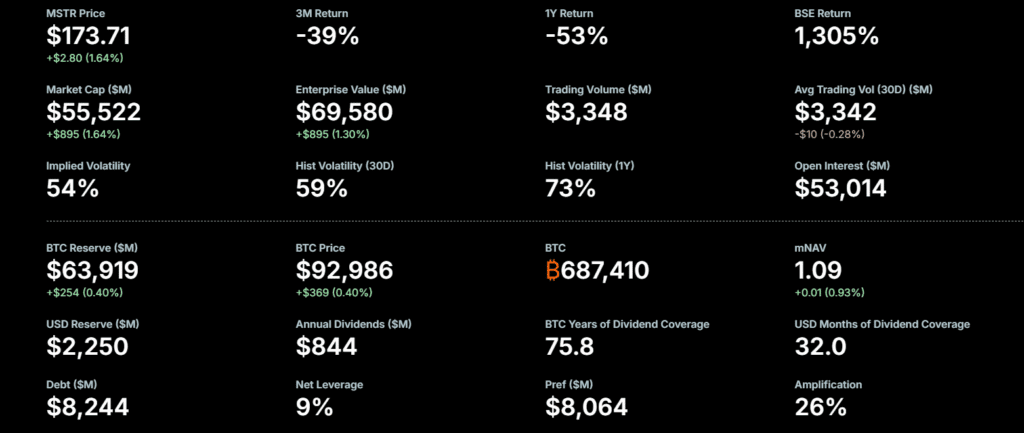

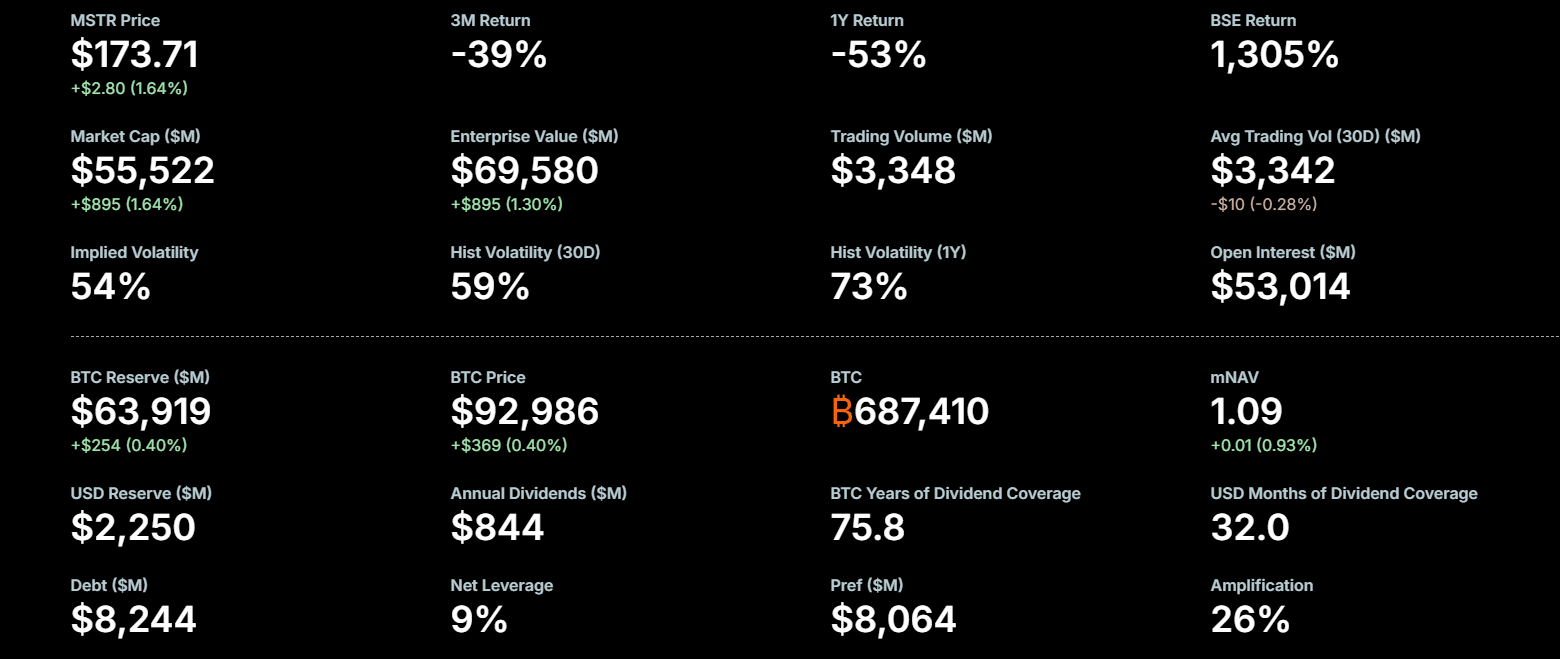

At the time of writing, MicroStrategy stock is changing hands above $173. It is down -53% since the start of the year. Meanwhile, at spot rates, the price of Bitcoin is only down +11% over the past year. Historically, MSTR stock traded at a 2x+ premium to its Bitcoin holdings.

(Source: Strategy)

By mid-January 2026, this the premium has collapsedthe security occasionally trading at a price lower than its net asset value (NAV); a rare event that signals investor fear.

DISCOVER: The best Meme Coin ICOs to invest in 2026

Why is MicroStrategy MSTR stock falling faster than Bitcoin

Given this discrepancy, it’s no surprise that the Bitcoin-focused public company is facing new scrutiny. Interestingly, criticism is heavy on MicroStrategy just as more public companies are actively buying Bitcoin and adding them to their balance sheets.

This pessimism about MicroStrategy is logical. Although it is a business intelligence company, it no longer acts like a normal software company. It operates as a Bitcoin treasury company, meaning it uses stock sales and borrowed money to buy Bitcoin and hold it for the long term. Criticism of their project has intensified due to recent risks that could decimate the company and its Bitcoin strategy.

Recently, MSCI considered whether “digital asset treasury” companies with more than 50% of their assets in crypto as “funds” rather than “operating companies” should be removed. This reclassification will have a direct impact on MicroStrategy. JPMorgan estimated that a removal from the MSCI index could trigger up to $8.8 billion in passive outflows.

What more? To fund its recent purchase of 13,627 BTC in early January, the company issued over $1.1 billion in new shares. As they buy more BTC, the constant emission new shares dilutes existing shareholders. If the price of Bitcoin does not rise faster than the number of shares, the value of “Bitcoin per share” actually falls.

And it’s even worse. In the fourth quarter of 2025, they reported Unrealized loss of $17.44 billion. Today, critics point to the company’s legacy software business, which only generates about $125 million in operating cash flow. This is nowhere near enough to repay the billions in debt used to buy Bitcoin.

DISCOVER: Best new cryptocurrencies to invest in in 2026

What’s next for MicroStrategy?

Despite the obvious criticism and pressure, Saylor remained defiant. In a podcast, he argued that a company losing $10 million in operations is “saved” if its Bitcoin gains $30 million. Additionally, the founder maintains that MicroStrategy is a “Bitcoin development company” and that traditional cash flow metrics are obsolete in a digital asset economy.

As bullish as Saylor is, MicroStrategy’s fortunes are now directly dependent on the price action of Bitcoin and some of the top Solana meme coins. If cryptocurrency prices rise, MSTR stock will start trading at a price higher than its net asset value, which is nothing more than its Bitcoin reserve. Once this premium increases, the “MSTR flywheel” will start spinning again, allowing them to issue shares at a high price to buy Bitcoin at a relative low cost.

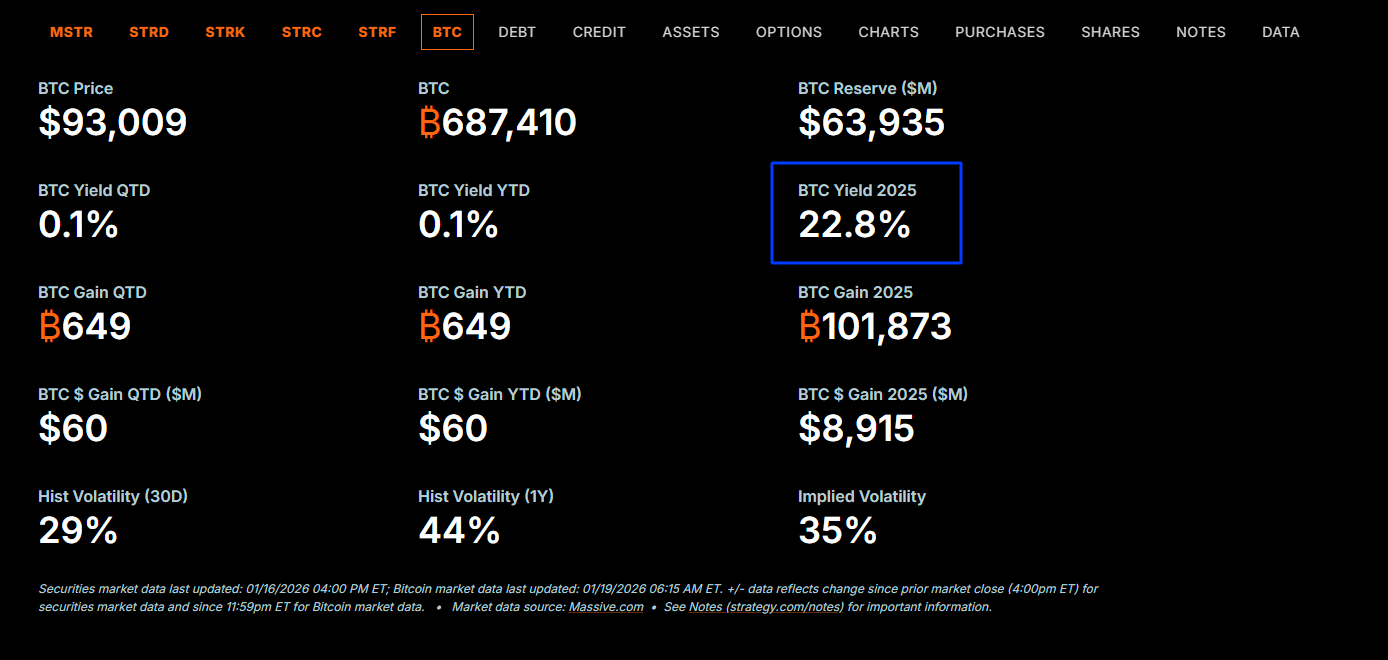

The higher premium could also allow MicroStrategy to return to using low-interest convertible debt instead of outright issuing stock. When this happens, the dilution issues will ease, increasing their “Bitcoin yield. By the end of 2025, the yield stood at over +22%.

(Source: Strategy)

Beyond pricing, MSCI is set to officially confirm that “digital asset treasury companies” like MicroStrategy will be part of the index. Once this is done, MicroStrategy will find relief and the threat of over $9 billion in forced sales will be removed, thereby stabilizing the MSTR stock price.

DISCOVER:

- 16+ New and Upcoming Binance Announcements in 2026

- 99Bitcoins State of the Crypto Market Report for Q4 2025

Follow 99Bitcoins on X For the latest market updates and subscribe on YouTube for daily market analysis from experts.

The post Michael Saylor’s Bitcoin Bet Faces Reality Check as Strategy Slips appeared first on 99Bitcoins.