Bitcoin briefly fell above $ 100,000 this month, growing nearly $ 108,000 before a new decline. The movement seems strong on the surface. But on the basis of Glassnod’s reports, a large part of this overvoltage came from traders using borrowed funds, not fresh buyers that accumulate.

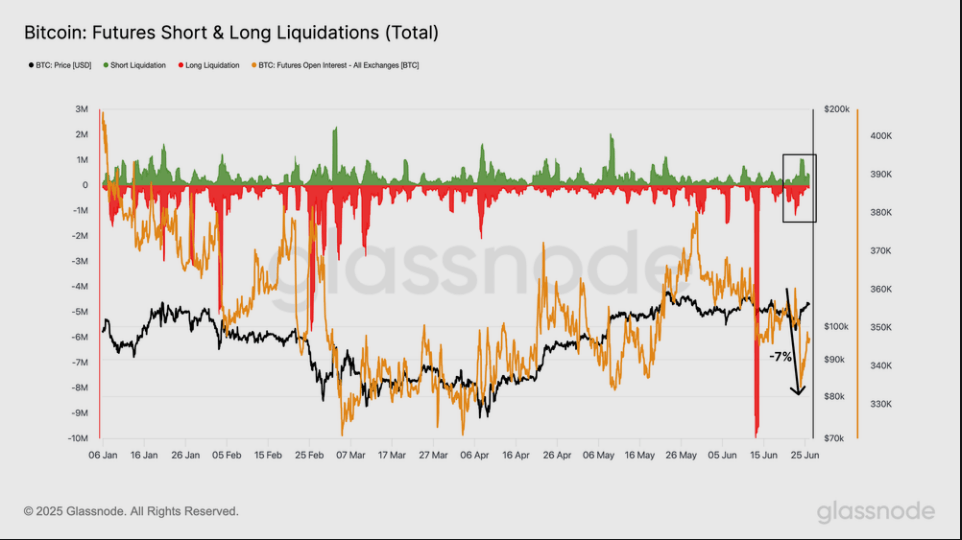

Speculative bets feed the recent rally

According to data on the chain, the volume of the end of June on Bitcoin term contracts remained high while prices exploded. Paris merchants on short -term gains have led the market, even if the excitement behind the rally is up. Funding rates and the three -month -long base both moved, reporting a less optimistic conviction. In other words, fewer people made big bets on Bitcoin these days.

The cash market remains silent

Trading to the point has not followed the boom of term contracts. At its top of $ 111,910 in May, the volume of daily punctuals oscillated approximately $ 7.65 billion. It is below the summits of the previous cycle, which exceeded $ 20 billion on certain days. Based on the reports, new species of retail shops or long -term holders have been on the sidelines instead of flooding.

Institutional buyers always adding

Large companies have continued to buy. This week has seen Michael Saylor, Metaplanet and Procap BTC together pick up around $ 1 billion in Bitcoin. At the same time, the Bitcoin ETF classified by the United States bought more than $ 1.5 billion in new power supplies. These regular purchases suggest a real interest in institutions, even if short -term traders have recently gave the pace.

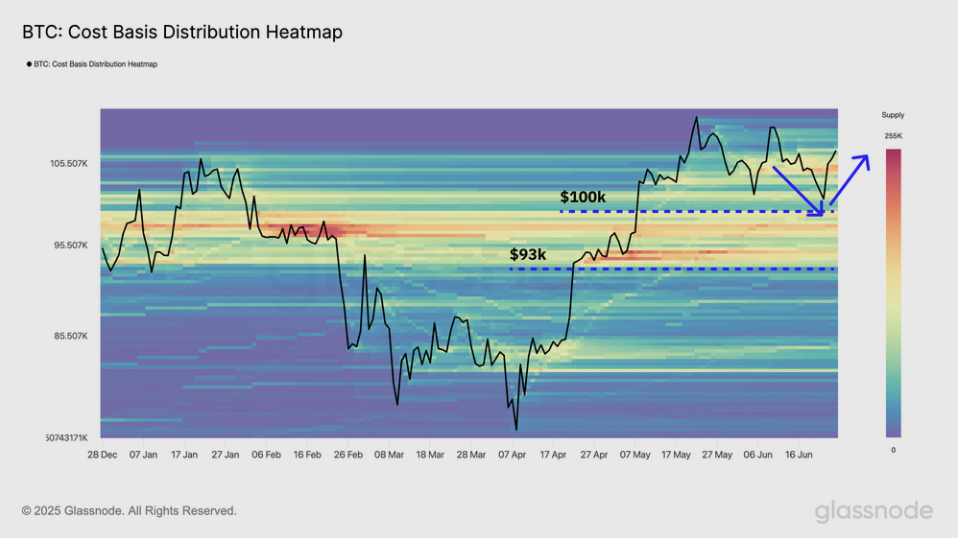

The tightness of the offer could generate prices

Glassnode now only shows 7 million BTCs left freely available on exchanges. About 14 million BTCs have been held by people who have not moved their parts for ages. This supply pressure could support prices if the request maintains. But that also means that any sudden sale could strike hard when the exchange portfolios are low.

Which then comes for Bitcoin

Overall, the recent jump above $ 100,000 looks more like a sprint by margin players than a marathon powered by new believers. Corrections often follow rallies driven by a strong margin activity. However, the purchase in progress by large companies and FNB offers a stamp. If they continue, Bitcoin may need a break now but could rally later.

As of June 28, Bitcoin exchanged $ 106,500, down 0.85% over the day. Market observers will seek a return of demand for fresh points or stabilization of the bets in the long term before declaring the upward trend on solid land.

Felash star image, tradingView graphic