The CME group is moving entirely into crypto mode. Starting May 29, 2026, it will offer 24/7 trading for its crypto futures and options contracts. No more weekend interruptions. No more waiting for traditional market times.

The move bridges the gap between Wall Street schedules and the always-on nature of crypto. And this comes as institutional demand continues to reach record levels.

Traditional finance is finally adapting to the speed of crypto.

The crypto market does not sleep. Now your risk management doesn’t have to either.

24/7 trading of cryptocurrency futures and options will take place on May 29*, so you can manage your risk when you need to.

See what changes.

*Awaiting regulatory review pic.twitter.com/i6xjkJVffm

– CME Group (@CMEGroup) February 19, 2026

DISCOVER: Best new cryptocurrencies to invest in in 2026

The end of the weekend

For years there was a strange disconnect.

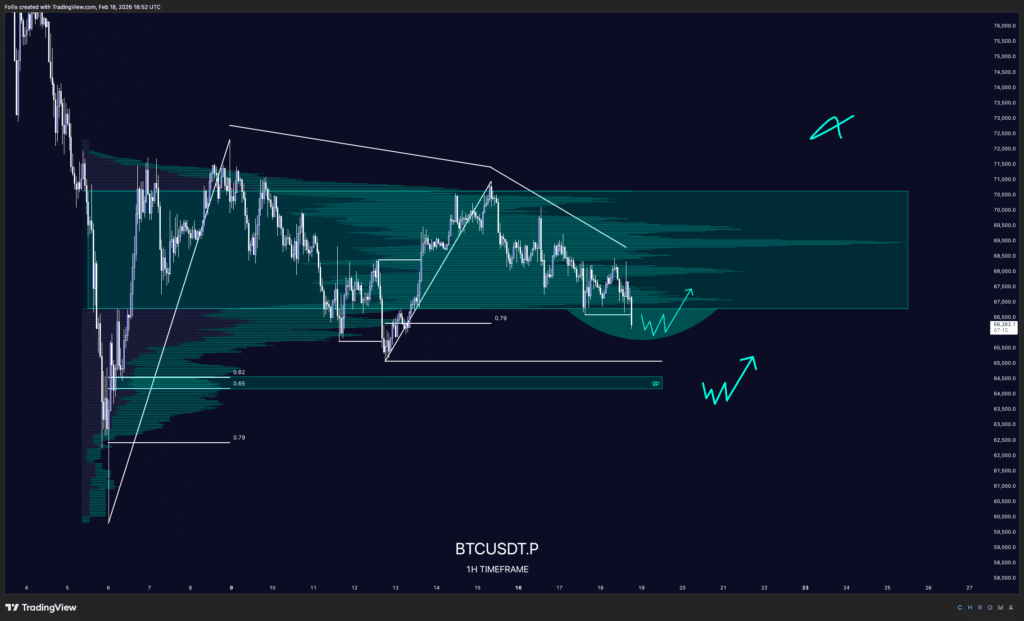

Bitcoin trades 24/7 on spot exchanges. But CME futures would be closed for the weekend. This is how the famous “CME gap” was born. The price would move while Wall Street offices were offline, then reopen with a surge.

More kids from CME gap

-Crypto Kid (@CryptoKid) February 19, 2026

The big players essentially had to watch from the sidelines between Friday and Sunday as crypto continued to move.

This dynamic is about to disappear. With 24/7 futures trading, institutions can hedge risk at any time, just like retail traders do. No more forced pauses while the market turns.

DISCOVER: Top 20 cryptocurrencies to buy in 2026

Institutional appetite reaches record levels

It’s not about convenience. It’s a question of scale.

CME says demand for risk management is at an unprecedented level. In 2025 alone, it processed $3 trillion in volume. This is a serious size.

Daily volume is up 47% year-over-year, averaging over 403,900 contracts. And it’s not just about Bitcoin and Ether. The lineup now includes Solana, XRP, and newer contracts for Cardano, Chainlink, and Stellar.

Retail traders might monitor IBIT options for hype. Institutions monitor open futures contracts. This is where the real leverage lies. Metrics like Cardano’s open interest reveal the level of risk built into the system.

Bitcoin ownership changed dramatically in 2025.

More in next week’s report on Bitcoin adoption. pic.twitter.com/dyIk9e7rWt

– River (@River) February 17, 2026

With 24/7 access, big players no longer have to fear a weekend move they can’t cover. They can manage exposure in real time.

Will this keep Bitcoin price volatility in check?

For regular investors, it goes both ways.

Weekends used to mean limited cash flow. That’s why we had these wild fluctuations and random scams. With CME open 24/7, liquidity is expected to deepen. This could alleviate some of this chaos. Some even argue that this is another step towards a more mature and stable Bitcoin market.

(Source: BTCUSD/TradingView)

But slow down.

If institutions can trade at 3 a.m. on Sunday, they can also react instantly to headlines. This could reduce gaps while speeding up movements. Volatility does not disappear. It just evolves.

If regulators approve, this will go live at the end of May. And it marks a real shift in how Wall Street handles crypto.

DISCOVER: The Best Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X for the latest market updates and subscribe on YouTube for daily market analysis from experts.

The article No more CME gap? CME Group Launch, 24/7 Trading appeared first on 99Bitcoins.