Bitcoin finally began to change its correlation with American actions, signaling a potential change in market dynamics. Analysts call an aggressive increase if BTC manages to maintain the current levels and continue to push higher. The bulls feel more and more confident after Bitcoin pushed above the critical bar of $ 90,000 – a pivot area which had previously acted as a strong resistance during the months of consolidation and sales pressure.

While the bulls are now in short -term control, the risks of net slowdown remain high. Global commercial instability, fueled by current tensions between the United States and China, continues to threaten broader financial markets. Fear and volatility have dominated the landscape since US President Donald Trump obtained a re -election in November 2024, creating an unpredictable macroeconomic backdrop.

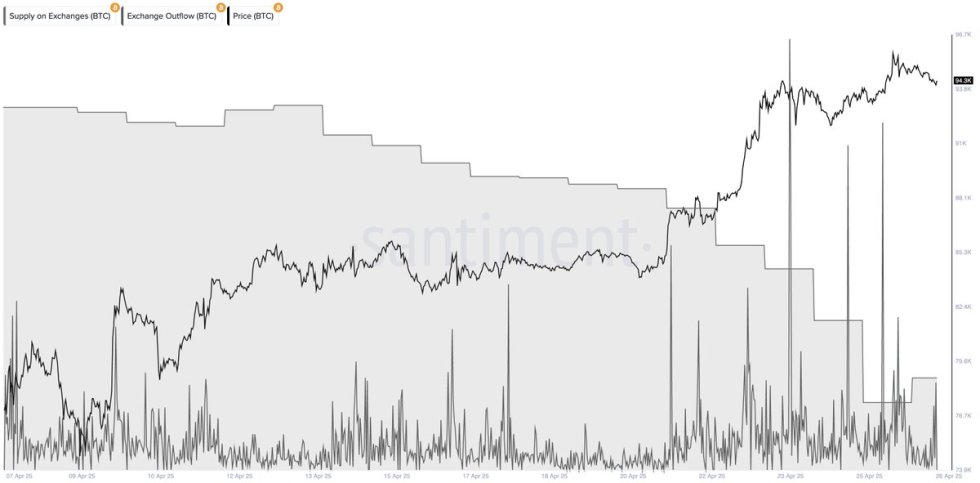

Despite these opposite winds, chain measures paint a bullish table. According to recent data, more than 40,000 bitcoins have been removed from exchanges during last week, reporting a strong accumulation trend. This movement suggests that investors opt more and more for self -sufficiency, reducing the available offer on trading platforms – a dynamic that historically supports higher prices. While the market is heading for a critical phase, Bitcoin behavior in the coming days could define the next major trend.

Bitcoin faces a decisive moment while the bulls have a short -term control

Bitcoin now enters a critical phase where prices action in the coming weeks could shape market management for the coming months. The bulls are currently in short-term control, following a strong increase which prompted BTC firmly above the bar of $ 90,000. However, despite this amount of movement, the high risks of a reversal remain while the instability of world trade continues to dominate macroeconomic narratives.

Tensions between the United States and China persist, with growing prices and fractured supply chains threatening world markets. Although some analysts are optimistic, calling on Bitcoin to rally to new heights of all time (ATH) in the coming weeks, others remain cautious, arguing that recent force can be a temporary reaction rather than the beginning of a sustained escape.

A key signal supporting upward vision is an increasing accumulation of investors. High -level analyst Ali Martinez shared relevant data revealing that more than 40,000 BTCs have been removed from exchanges during last week. This strong outing trend suggests that investors are increasingly moving their BTC in cold storage, reducing the available offer and strengthening the basics of a potential price wave.

While Bitcoin hovers at critical resistance levels, the coming days and weeks will be essential. A continuous increase could confirm the start of a new bull phase, while non-compliance with key support areas could cause volatility renewal.

Updating BTC prices: bulls are due as critical levels are held

Bitcoin is currently negotiated at $ 93,900, now a strong position after an impressive rally of several weeks. However, while the bullish momentum persists, it seems that a clear push above the resistance zone from $ 95,000 to $ 96,000 can take additional time. This range is a critical obstacle, and many analysts expect a certain consolidation before any decisive break occurred.

For the moment, the bulls must focus on the defense of key support levels to maintain the intact recovery structure. Holding above $ 88,700 – almost aligned with the 200 -day mobile average – would be a major sign of force. This level has become an important pivot point, helping to confirm whether the rally can maintain upward pressure.

If Bitcoin does not hold above $ 88,700, it could trigger a deeper correction, the next significant support area is around $ 84,000. A downward descent into this area would always integrate into a wider bullish structure, but would delay attempts to definition new peaks of all time.

Overall, the level of $ 88,700 remains the key battlefield. The bulls must continue to defend it when preparing a new potential test of the bar of $ 95,000 in future sessions. Patience and stability are essential because volatility remains high between the financial markets.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.