Here are some interesting results on the performance of different minors during the first 280,000 blockchain Ethereum blockchain blockchain. For this time, I collected the list of block and uncle Coinbase addresses; Raw data can be found Here for the blocks And Here for unclesAnd from this, we can glean a lot of interesting information, especially on expired rates and how well connected to the various minors and swimming pools.

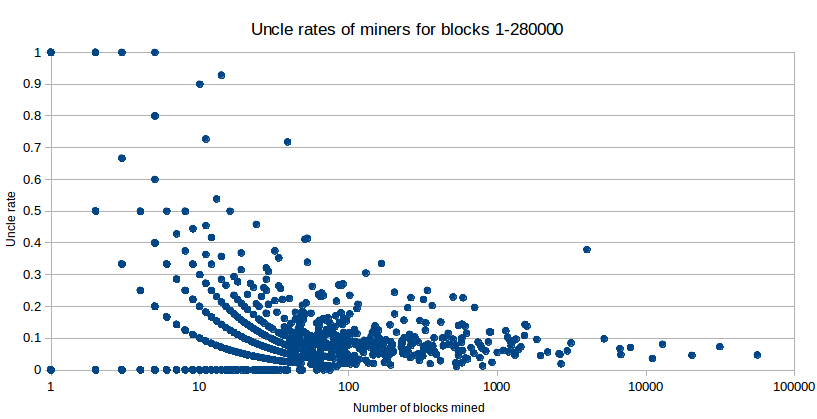

First of all, the dispersion intrigue:

What we clearly see here are some primary trends. First of all, uncle rates are quite low compared to the Olympics; In total, we have seen 2,0750 uncles with 2,80,000 blocks, or an uncle rate of 7.41% (if you calculate it inclusive, that is to say that the percentage uncles of all blocks rather than blocks per block, you get 6.89%)-in short, not much higher than similar figures for Bitcoin even in 2011When its mining ecosystem was more similar to that of Ethereum with CPU and GPU always dominant and with a low volume of transaction. Note that this does not mean that minors obtain only 93.11% of the income they would be if they were infinitely well connected to everyone; Ethereum’s mechanic effectively reduces around 87% of the difference, and therefore the actual “average loss” of poor connectivity is only ~ 0.9%. That said, these losses will increase for two reasons once the network is starting to see more transactions: first, the uncle’s mechanic operates with basic block rewards, and not transaction costs, and second, larger blocks necessarily lead to longer propagation times.

Second, we can see that there is a general trend that the largest minors have lower uncle. It is, of course, to expect, although it is important to dissect (1) why it happens, and (2) to what extent it is in fact a real effect and not simply a statistical artifact of the fact that smaller samples tend to have more extreme results.

Segregation by the size of minors, the statistics are as follows:

| Number of extracted blocks | Average uncle rate |

| <= 10 | 0.127 |

| 10-100 | 0.097 |

| 100-1000 | 0.087 |

| 1000-10000 | 0.089 * |

| > = 10000 | 0.055 |

* This result is undoubtedly strongly biased by a single aberrant value, the probably broken minor which is the point of the graph with 4005 extracted blocks, 0.378 uncle rate; Without this minor, we obtain an average uncle rate of 0.071 Which seems much more in line with the general trend.

There are four main hypotheses that can explain these results:

- Disparity of professionalism: Large minors are professional operations and have more resources to invest in improving their overall connectivity to the network (for example, by buying better wireless, looking more carefully to see if their uncle prices are very under-optimal due to networking problems), and therefore have higher efficiency. Small minors, however, tend to be lovers of their laptops and may not be particularly well connected to the Internet.

- Last block effect: The minor who produced the last block “discovers” the block immediately rather than after waiting for ~ 1 second for it to spread through the network, and thus gains an advantage to find the following block

- Pool efficiency: The very large minors are swimming pools and the pools are for any reason probably linked to networking more efficient than solo minors.

- Time period differences: The pools and other very large minors were not active on the first day of the blockchain, when the block times were very fast and the uncle’s rates were very high.

The last block effect clearly does not explain the whole history. If it was 100%of the cause, then we would in fact see a linear decrease in efficiency: minors who extracted 1 block could see an uncle rate of 8%, minors who have undermined 28,000 (that is to say 10%of all) would see an uncle rate of 7.2%, minors who have undermined 56,000 blocks would see an uncle rate of 6.4%, etc.; Indeed, minors who extracted 20% of the blocks would have extracted the last block of 20% of the time, and would therefore benefit from an expected uncle rate of 20% of the time, hence the reduction of 20% from 8% to 6.4%. The difference between minors who extracted 1 block and minors who extracted 100 blocks would be negligible. In reality, of course, the decrease in stingy rates with a growing size seems to be almost perfectly logarithmic, a curve that seems much more coherent with a theory of professionalism disparity than anything else. The theory of the difference in time period is also supported by the curve, although it is important to note that only ~ 1600 uncles (that is to say 8% of all uncles and 0.6% of all blocks) were extracted during these first hectic days where uncle’s rates were high and that this can maximum 0.6% of uncle.

The fact that the disparity of professionalism seems to dominate is in a way an encouraging sign, especially since (i) the factor has more to small and medium scales than to medium to large, and (ii) individual minors tend to have counterpart economic factors which prevail over their reduced effectiveness – in particular the fact that they use material that they have already paid.

Now, what about the leap from 7.1% to 1000 to 10,000 blocks to 5.5% for all those above this? The last block effect can represent approximately 40% of the effect, but not everything (rapid mathematics: the average minor in the first cohort has a network share of 1%, in the last cohort of 10%, and the difference of 9% should project a decrease of 7.1 to 7.1% * 0.93 = 6.4%), although the small number of minors is important to note that any conclusion should be considered to be very temporary.

The key characteristic of minors above 10,000 blocks, quite naturally, is that they are pool (or at least three of the five; the other two are solo minors although they are the little ones). Interestingly, the two non-pools have uncle levels of 8.1% and 3.5% respectively, an weighted average of 6.0%, which is not very different from the rate of weighted periods of 5.4% of the three pools; Consequently, in general, it seems that the pools are very slightly more effective than solo minors, but once again, the observation should not be considered statistically significant; Even if the size of the sample in each pool is very large, the size of the swimming pool of the swimming pools is small. In addition, the most effective mining swimming pool is not really the largest (nanopool) – it’s suprnova.

This brings us to an interesting question: where do the efficiency and ineffectiveness of common mines come from? On the one hand, the pools are probably very well connected to the network and do a good job to broadcast their own blocks; They also benefit from a lower version of the last block effect (lower version because there is always the unique round trip from one minor to another at one pool to another). On the other hand, the delay in the work of a pool after having created a block should slightly increase its expired rate: assuming a network latency of 200 ms, by around 1%. It is likely that these forces are widening roughly.

The third key thing to measure is as follows: the quantity of disparities we see is due to a real inequality in the way minors are well connected, and what is the random luck? To check this, we can do a simple statistical test. Here are the deciles of the uncle’s rates of all minors who have produced more than 100 blocks (that is to say the first number is the lowest uncle, the second number is the 10th centile, the third is the 20th centile and so on until the last number is the highest) ::

(0.01125703564727955, 0.03481012658227848, 0.04812518452908179, 0.0582010582010582, 0.06701030927835051, 0.07642487046632124, 0.0847457627118644, 0.09588299024918744, 0.11538461538461539, 0.14803625377643503, 0.3787765293383271)

Here are the deciles generated by a random model where each minor has an expired rate of 7.41% “natural” and all the disparities are due to luck or bad luck:

(0.03, 0.052980132450331126, 0.06140350877192982, 0.06594885598923284, 0.06948640483383686, 0.07207207207207207, 0.07488986784140969, 0.078125, 0.08302752293577982, 0.09230769230769231, 0.12857142857142856)

We therefore obtain about half of the effect. The other half comes in fact real differences in connectivity; In particular, if you make a simple model where the rates of “natural” periods are random variables with normal distribution around an average of 0.09, the standard deviation 0.06 and the minimum hard 0 that you get:

(0, 0.025374105400130124, 0.05084745762711865, 0.06557377049180328, 0.07669616519174041, 0.09032875837855091, 0.10062893081761007, 0.11311861743912019, 0.13307984790874525, 0.16252390057361377, 0.21085858585858586)

This is quite close, although it is too fast on the low side and slowly on the upper side; In reality, it seems that the “natural outdated rate distribution” positive asymmetryTo which we expect given the yields decreased in increasing effort expenses to make ourselves more and more well connected to the network. Overall, the effects are not very important; Especially when they are divided by 8 after the uncle’s mechanism is taken into account, the disparities are much smaller than the disparities in electricity costs. Consequently, the best approaches to improve decentralization in the future are undoubtedly highly concentrated to find more decentralized alternatives to mining pools; Maybe mining pools implementing something like Meni Rosenfeld Multi-PS Can be a medium -term solution.