According to the agreement, the reserve pool will adopt a joint care mechanism, the platform and the partners establishing a multi-signature portfolio system. This will be supplemented by chain verification tools and a quarterly audit mechanism to guarantee the transparency, conformity and safety of assets. This system will provide stable support to the platform during market fluctuations and will serve as a fundamental credit anchoring for the future stable emission, the securitization of compliant assets and cross-border compensation.

Multilayer reserve system, creating a risk -resistant ditch

The asset pool will include a three -level reserve structure, in particular:

- · Basic reserve pool: To meet daily market operations and liquidity needs.

- · Emergency reserve pool: To quickly respond to systemic risks and serious market fluctuations.

- · Stability mechanism pool: To support the stability of stable dowels of the platform, chain loans, compensation for payments and other stability scenarios.

Thanks to this mechanism, MSBFund aims to provide an almost-central banking asset trust system for global users and ecosystem developers, advancing digital financial infrastructure in a new phase of stability, compliance and long-term development.

- · Corresponding trading API: Support the correspondence capacities of up to a million transactions per second under large competition.

- · Account and account API: Support for transfers and multi-monnaite asset establishments and cross-accounts.

- · Identity verification and control modules: Support KYC, AML compliance links and the integration of the AI rating model.

- · Reserve verification module: Allowing access to reserve status and chain audit mechanisms.

AI Smart Risk Control 2.0 released, verified through global sandbox

Key characteristics include:

- · Recognition of behavioral profiling: Dynamically monitoring user behavior anomalies via automatic learning models.

- · Risk score: Provide alerts for potential violations, high frequency behavior and money laundering routes.

- · System response mechanism: Synchronized blacklist implementation, freeze for negotiating and marking at risk.

- · High compatibility: Capable of being integrated into various commercial modules, including DAPPs, payment systems and stable compensation paths.

The system is currently applied to the entire MSBFund risk control frame, covering more than 95% of asset routes, considerably improving the levels of platform safety and compliance.

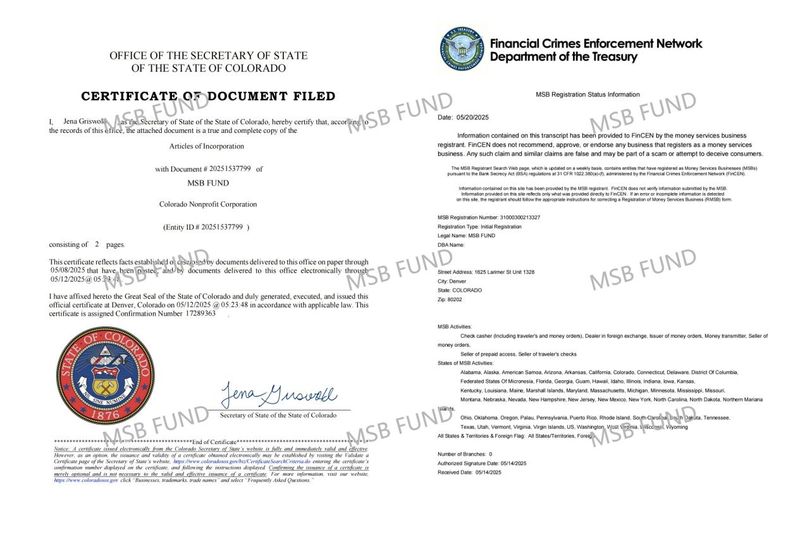

The platform implements a 1: 1 asset reserve system, with all the assets of users held in compliant financial institutions and independent wallet / hot portfolio systems, subject to regular audits of international audit companies to ensure the safety of user funds.

Contact with the media

Company name: MSB funds

Contact: Robert V. Adams

Website: https://msbfund.com

Notice of non-responsibility: The information provided in this press release is not a request for the investment, nor investment advice, financial advice or commercial advice. Investment involves risks, including potential capital loss. It is strongly recommended to practice reasonable diligence, including consultation with a professional financial advisor, before investing or negotiating cryptocurrency and titles. Neither the media platform nor the publisher will be held responsible for any fraudulent activity, false declarations or financial losses resulting from the content of this press release.