Nano Labs Ltd, an infrastructure provider and web3 -based products based in China, announced today the acquisition of 74,34 315 Binance Coin (Bnb) Tokens via over -the -counter transactions (OTC) at an average price of around $ 672.45 per token, which represents a total investment of around $ 50 million.

The purchase provides total digital asset reserves of the company, encompassing Bitcoin and BNB Holdings, at around 160 million dollars, representing an important step in the BNB strategic accumulation plan of Nano Labs.

According to a press release on July 3, the company listed in Hong Kong plans to acquire up to $ 1 billion in BNB through convertible tickets and private investments during the initial phase.

BNB Holdings of Nano Labs positions it as the first public company to store Binance’s part

In the long term, Nano Labs intends to control between 5% and 10% of the supply of total BNB.

The company had previously concluded a convertible ticket agreement of $ 500 million on June 24 to support BNB accumulation efforts.

At that time, Nano Labs indicated that he would carry out complete assessments of the usefulness of BNB, network security and long -term investment potential.

Today’s acquisition shows that Nano Labs has completed his assessment and has committed to establishing BNB as a strategic reserve asset.

In the early hours of July 3, Nano Labs published a promotional video presenting the operational history of almost eight years from Binance.

Advertising, which declares: “Nano Labs encourages you when approaching the big day. Let us continue to build the future ensemble“, Has led many observers to believe that the company is really convinced of the usefulness and the value of BNB as a reserve ratio, which makes it the first public enterprise to store the ERC-20 token on this scale.

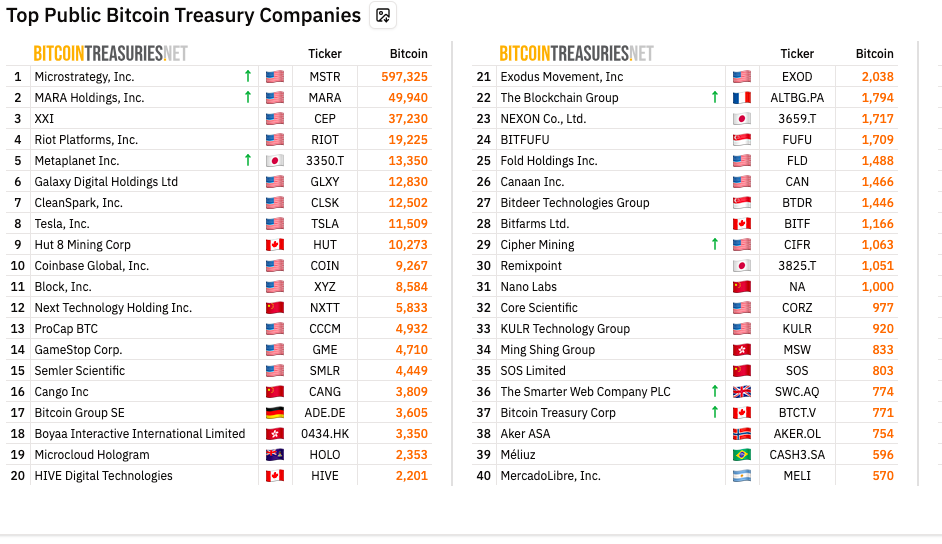

Although the company’s crypto-tresor understands BNB, it also has Bitcoin, which has become a standard reserve asset among public companies.

Nano Labs is currently ranking 31st among public companies by Bitcoin Holdings, now more than 1,000 BTC in his treasure.

On June 27, the founder of Binance, Changpeng Zhao (CZ), was observed engaging with Nano Labs on X when he shared his number of BTC Holdings, by asking for the number of BNB tokens that the dollars equivalent would give.

The company used this interaction to demonstrate its commitment to BNB, responding with “more loading of BNB $”.

BNB Action Price: $ 793 ATH in sight when the adoption of companies increases

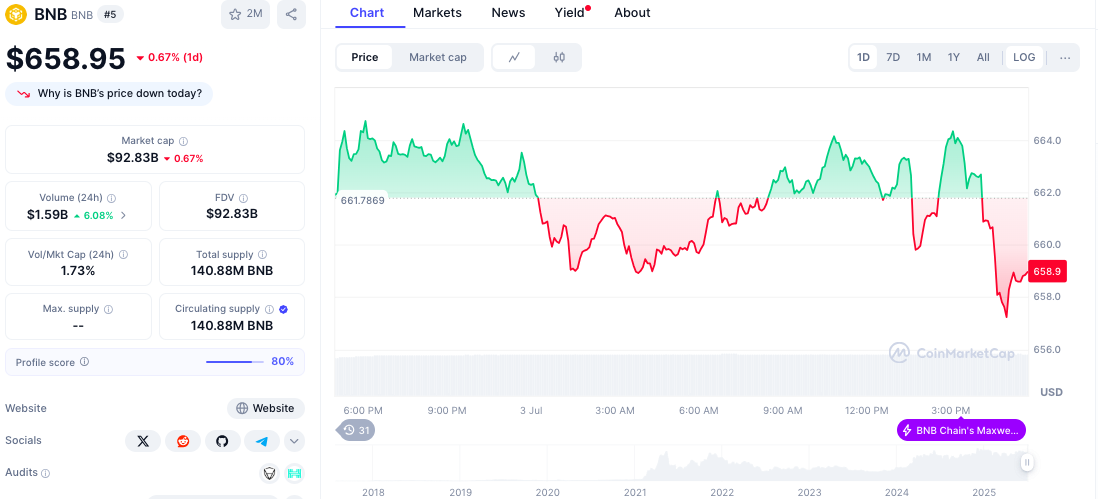

At the time of the press, BNB is traded at $ 658.64, showing a minimum daily movement and publishing only a gain of 2.11% in the last seven days, despite a broader market momentum.

The cryptocurrency maintains its position as a fifth largest digital asset by market capitalization, with a market capitalization exceeding $ 92 billion and an average daily negotiation volume of more than $ 300 million.

While more and more public companies are recognizing the BNB value proposal, the token could potentially exceed the level of resistance of $ 662 and challenge its highest 2024 $ 793.

In January, Gelephu Mindfulness City from Bhutan (GMC) announced its decision to include BNB in its strategic reserves alongside Bitcoin and Ethereum.

However, since the announcement, the country, known for its pro-Crypto initiatives similar to El Salvador, has not revealed any purchase of real BNB.

By holding the BNB, Bhutan could participate directly in the Binance ecosystem, including its sequence of DEFI tools, jealous opportunities and blockchain infrastructure.

The Nano Labs movement contributes to the growing tendency of the adoption of cryptography as a strategic reserve ratio, in particular utility tokens beyond bitcoin.

For example, on June 30, Bitmin Immersion Technologies announced a private investment of $ 250 million entirely dedicated to the accumulation of Ethereum (ETH), marking the first major initiative to establish a treasure of the ETH.

Similarly, on May 28, Upexi, a cash company focused on Solana, added 56,000 soil to its assets, bringing total reserves to 735,692 soil worth more than $ 110 million to current market assessments.

The Post Nano Labs is responsible for BNB – $ 50 million today, a war box of $ 1 billion in sight appeared first on Cryptonews.

Breakup

Breakup

https://t.co/mg8kluuhct

https://t.co/mg8kluuhct BNB (@cz_binance)

BNB (@cz_binance)  Bhutan becomes the first to offer a national cryptographic payment system for tourism thanks to the remuneration of Binance.

Bhutan becomes the first to offer a national cryptographic payment system for tourism thanks to the remuneration of Binance.